MoneyGram 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

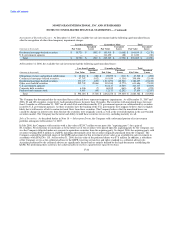

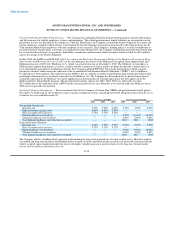

The Company performed an annual assessment of goodwill during the fourth quarters of 2007, 2006 and 2005. During the annual

impairment test in 2007, it was determined that the fair value of the FSMC reporting unit was less than the carrying value of that

reporting unit. The fair value of the reporting unit was calculated based on discounted expected future cash flows using a forecasted

growth rate and weighted average cost of capital rate. The impairment was calculated as the excess of the implied amount of goodwill

over the carrying amount of goodwill on the Company's books. The impairment charge of $6.4 million was included in the Consolidated

Statements of (Loss) Income in "Transactions and operations support." There were no impairments for 2006 or 2005.

In response to the results of the strategic review of the Payment Systems segment, the decline in the Company's stock price and the

significant additional declines in the investment portfolio, the Company updated its annual impairment assessment to include information

available through March 18, 2008. Upon completion of this assessment, the Company has determined there are no further impairments of

goodwill through the date of this filing.

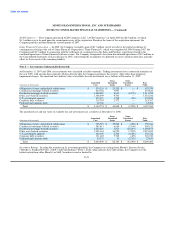

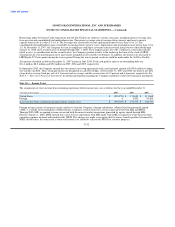

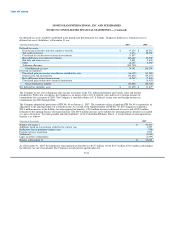

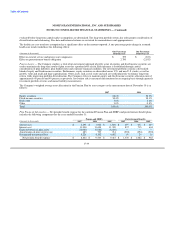

Note 9 — Debt

Following is the Company's debt at December 31, 2007 and 2006. See Note 18 — Subsequent Events for discussion of the Capital

Transaction and the resulting impact on the Company's Senior Credit Agreement and 364 Day Facility (each as defined below).

2007 2006

Weighted Weighted

Average Average

(Amounts in thousands) Amount Interest Rate Amount Interest Rate

Senior term note, due through 2010 $ 100,000 5.91% $ 100,000 5.59%

Senior revolving credit facility, due through 2010 245,000 5.85% 50,000 5.59%

Total debt $ 345,000 $ 150,000

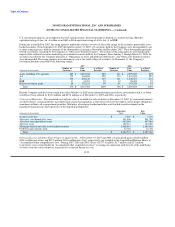

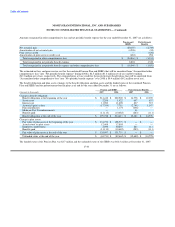

The Company has a bank credit facility (the "Senior Credit Agreement") providing availability up to $350.0 million in the form of a

$250.0 million revolving credit facility and a $100.0 million term loan. During the second half of 2007, the Company borrowed an

additional $195.0 million under the revolving credit facility. The proceeds were invested in cash equivalents to supplement the

Company's unrestricted assets and to fund the acquisition of PropertyBridge on October 1, 2007. The maturity date of the Senior Credit

Agreement is June 2010. The Senior Credit Agreement has an interest rate of LIBOR plus 50 basis points, subject to adjustment in the

event of a change in the credit rating. Usage fees range from 0.08 percent to 0.25 percent of outstanding borrowings, depending on the

credit rating of our senior unsecured debt. Changes in the Company's credit rating from any of the credit rating agencies could affect the

interest rate and fees paid under the Senior Credit Agreement. On December 31, 2007, the interest rate under the Senior Credit

Agreement was 7.58 percent on $150.0 million of the outstanding debt and 7.66 percent on $195.0 million of the outstanding debt,

exclusive of the effect of commitment fees and other costs, and the facility fee was 0.25 percent. On December 31, 2006, the interest rate

was 5.86 percent exclusive of the effect of commitment fees and other costs, and the facility fee was 0.125 percent. Letters of credit

issued for the Company reduce the amount available under the revolving credit facility (see Note 14 — Commitments and

Contingencies).

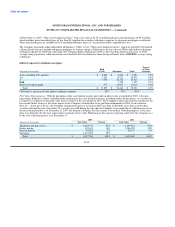

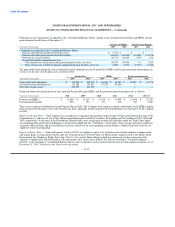

On November 15, 2007, the Company entered into a credit agreement (the "364 Day Facility") with JPMorgan Chase Bank N.A.

("JPMorgan"). The 364 Day Facility provides for a $150.0 million revolving credit facility that terminates on November 13, 2008. The

364 Day Facility has substantially the same terms as the Company's Senior Credit Agreement. The interest rate under the 364 Day

Facility is, at the Company's option, either: (a) LIBOR plus 60 basis points; or (b) the higher of the prime rate or the federal funds rate

plus 50 basis points. In either case, the interest rate is subject to adjustment based on the credit rating of the Company's senior unsecured

debt. Facility fees range from 0.15 percent to 0.25 percent, depending on the credit rating of the Company's senior unsecured debt. The

Company did not borrow under the 364 Day Facility during 2007.

F-31