MoneyGram 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

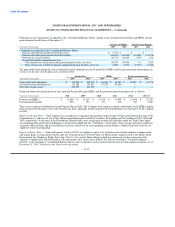

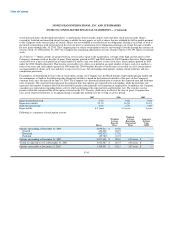

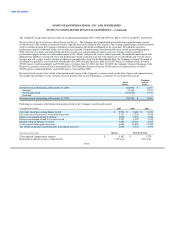

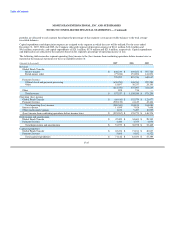

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

control. The Series B Preferred Stock will vote as a class with the common stock of the Company and will have a number of votes equal

to the number of shares of common stock issuable if all outstanding shares of Series B Preferred Stock were converted plus the number of

shares of common stock issuable if all outstanding shares of Series B-1 Preferred Stock were converted into Series B Preferred Stock and

subsequently converted into common stock.

Rights Agreements — As part of the Capital Transaction, the Company amended its Rights Agreement with Wells Fargo Bank, N.A. as

rights agent, to exempt the issuance of securities to the Investors and their affiliates from the Rights Agreement.

Registration Rights — As part of the Capital Transaction, the Company entered into a Registration Rights Agreement with the Investors.

Under the terms of the Registration Rights Agreement, after a specified holding period, the Company must promptly file a shelf

registration statement with the SEC relating to securities held by the Investors. The Company is generally obligated to keep the shelf

registration statement effective for up to 15 years or, if earlier, until all the securities owned by the Investors have been sold. The

Investors are also entitled to five demand registrations and unlimited piggyback registrations.

Senior Credit Facility — As part of the Capital Transaction, the Company's wholly owned subsidiary MoneyGram Payment Systems

Worldwide, Inc. ("Worldwide") entered into a senior credit facility (the "Senior Facility") of $600.0 million with various lenders and

JPMorgan, as Administrative Agent for the lenders. The Senior Facility amended and restated the $350.0 million Amended and Restated

Credit Agreement, dated as of June 29, 2005, among the Company and a group of lenders and includes an additional $250.0 million term

loan. In connection with this transaction, the Company terminated its $150.0 million 364-Day Credit Agreement with JPMorgan.

The Senior Facility includes $350.0 million in two term loan tranches and a $250.0 million revolving credit facility. Tranche A of the

term loans is for $100.0 million and tranche B is for $250.0 million. Tranche B was issued at a discount of 93.5 percent, or $16.3 million.

The interest rate applicable to tranche A and the revolving credit facility is the Eurodollar rate plus 350 basis points. The interest rate

applicable to tranche B is the Eurodollar rate plus 500 basis points. The maturity date of the Senior Facility is March 2013. Fees on the

daily unused availability under the revolving credit facility are 50 basis points.

At March 25, 2008, the Company had outstanding borrowings under the Senior Facility of $495.0 million.

There is a prepayment premium on the tranche B term loan of two percent during the first year and one percent during the second year of

the Senior Facility. Loans under the Senior Facility are secured by substantially all of the Company's non-financial assets and are

guaranteed by the Company's material domestic subsidiaries, with such guarantees secured by the non-financial assets of the subsidiaries.

Borrowings under the Senior Facility are subject to various covenants, including limitations on: use of proceeds from borrowings under

the Senior Facility; additional indebtedness; mergers and consolidations; sales of assets; dividends and other restricted payments;

investments; loans and advances and transactions with affiliates. The Senior Facility also has certain financial covenants, including an

interest coverage ratio and a senior secured debt ratio. Compliance with such financial covenants will not be required until the fiscal

quarter ending March 31, 2009. Under the Senior Facility, the Company must maintain a minimum interest coverage ratio of 1.5:1 from

March 31, 2009 through September 30, 2010, 1.75:1 from December 31, 2010 through September 30, 2012 and 2:1 from December 31,

2012 through maturity. The Company is not permitted to have a senior secured debt ratio in excess of 6.5:1 from March 31, 2009 through

September 30, 2009, 6:1 from December 31, 2009 through September 30, 2010, 5.5:1 from December 31, 2010 through September 30,

2011, 5:1 from December 31, 2011 through September 30, 2012 and 4.5:1 from December 31, 2012 through maturity. The Senior Facility

also contains a financial covenant requiring the Company to maintain at least a 1:1 ratio of certain assets to outstanding payment service

obligations.

Second Lien Notes — As part of the Capital Transaction, Worldwide issued Goldman Sachs $500.0 million of senior secured second lien

notes (the "Notes"), which will mature in March 2018. The interest rate on the Notes is 13.25 percent per year unless interest is

capitalized, in which case the interest rate increases to 15.25 percent. Prior

F-51