MoneyGram 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

ACH Commerce — The Company purchased ACH Commerce, LLC ("ACH Commerce") in April 2005 for $8.5 million, of which

$1.1 million was to be paid upon the second anniversary of the acquisition. Based on the terms of the acquisition agreement, the

Company paid this amount during the second quarter of 2007.

Game Financial Corporation — In 2005, the Company recorded a gain of $0.7 million (net of tax) due to the partial resolution of

contingencies relating to the sale of Game Financial Corporation ("Game Financial"), which was completed in 2004. During 2007, the

Company paid $3.3 million in connection with the settlement of a contingency in the Sales and Purchase Agreement related to the

continued operations of Game Financial with one casino. The Company recognized a loss from discontinued operations of $0.3 million in

the Consolidated Statements of (Loss) Income in 2007, representing the recognition of a deferred tax asset valuation allowance, partially

offset by the reversal of the remaining liability.

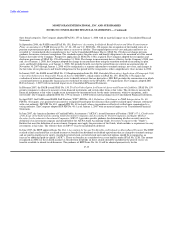

Note 4 — Investments (Substantially Restricted)

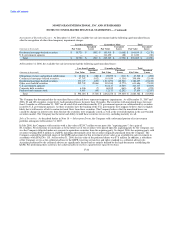

At December 31, 2007 and 2006, no investments were classified as held-to-maturity. Trading investments have contractual maturities in

the year 2049, with auction dates typically 28 days after the date the Company purchases the security. After other-than-temporary

impairment charges, the amortized cost and fair value of available-for-sale investments are as follows at December 31, 2007:

Gross Gross

Amortized Unrealized Unrealized Fair

(Amounts in thousands) Cost Gains Losses Value

Obligations of states and political subdivisions $ 574,124 $ 23,255 $ — $ 597,379

Commercial mortgage-backed securities 250,726 3,097 — 253,823

Residential mortgage-backed securities 1,409,489 4,633 (2,170) 1,411,952

Other asset-backed securities 1,308,699 9,543 — 1,318,242

U.S. government agencies 373,173 1,768 (88) 374,853

Corporate debt securities 215,795 2,572 — 218,367

Preferred and common stock 12,768 — — 12,768

Total $ 4,144,774 $ 44,868 $ (2,258) $ 4,187,384

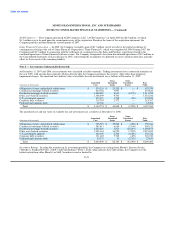

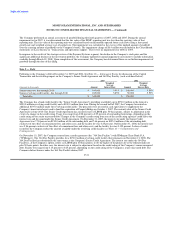

The amortized cost and fair value of available-for-sale investments are as follows at December 31, 2006:

Gross Gross

Amortized Unrealized Unrealized Fair

(Amounts in thousands) Cost Gains Losses Value

Obligations of states and political subdivisions $ 765,525 $ 25,006 $ (490) $ 790,041

Commercial mortgage-backed securities 585,611 6,659 (2,148) 590,122

Residential mortgage-backed securities 1,623,220 3,876 (23,219) 1,603,877

Other asset-backed securities 1,992,164 36,920 (7,839) 2,021,245

U.S. government agencies 342,749 2,564 (6,589) 338,724

Corporate debt securities 311,465 7,745 (470) 318,740

Preferred and common stock 30,175 13 (2,337) 27,851

Total $ 5,650,909 $ 82,783 $ (43,092) $ 5,690,600

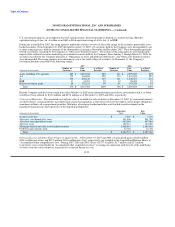

Investment Ratings: In rating the securities in its investment portfolio, the Company uses ratings from Moody's Investor Service

("Moody's), Standard & Poors ("S&P") and Fitch Ratings ("Fitch"). If the rating agencies have split ratings, the Company uses the

highest rating from either Moody's or S&P. Securities issued or backed by

F-21