MoneyGram 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

We have various resources available to us for purposes of managing liquidity and capital needs, including our cash, cash equivalents,

investments, credit facilities, reverse repurchase agreements and letters of credit. For purposes of this discussion, we use the term

"investments" to refer to our long-term investment portfolio, while the term "cash equivalents" refers to our short-term investment

portfolio. Short-term investments are included in "Cash and cash equivalents" in the Consolidated Balance Sheets and are used in

managing our daily operating liquidity needs. Long-term investments are classified as trading or available-for-sale as explained in

Note 1 — Description of the Business of the Notes to Consolidated Financial Statements and are used in managing our capital needs.

Liquidity

We utilize our cash, cash equivalents and reverse repurchase agreements as the main tools to manage our daily operating liquidity needs.

Our operating liquidity needs relate to the monies required to settle our payment instruments on a daily basis and fund the routine

operating activities of the business. On a daily basis, we move on average over $1.0 billion to settle our payment instruments and make

related settlements with our agents and financial institutions. We receive a similar amount on a daily basis from our agents and financial

institutions for the face amount and related fees of our payment instruments sold. We have agreements with 13 clearing banks that

provide clearing and processing functions for official checks, money orders and share drafts. For the clearing of money orders, we rely

primarily on one clearing bank. In addition, we maintain contractual relationships with a variety of domestic and international cash

management banks for ACH and wire transfer services to move customer funds and make agent payments. The relationships with these

clearing banks and cash management banks are a critical component of the Company's ability to move monies on a global and timely

basis.

We rely on the funds from on-going sales of payment instruments and portfolio cash flows to settle our payment service obligations

("PSO") as they are presented. Our daily net cash settlements tend to follow a pattern whereby certain days of the week are typically net

cash inflow days, while other days are typically net cash outflow days. On the days with a net cash outflow, we have historically utilized

our cash equivalents, as well as repurchase agreements, to fund the shortfall. On the next cash inflow day, excess cash is used to repay

any amounts outstanding under the repurchase agreements, with the remaining excess cash reinvested in cash equivalents. The repurchase

agreements are uncommitted facilities with various banks and require specific securities to be designated as collateral for borrowings

under the agreements. The acceptance of securities as collateral is at the discretion of our counterparty. Beginning in the third quarter of

2007, we began investing more heavily in cash equivalents to enhance our liquidity. This shift was accomplished by reinvesting proceeds

from normal maturities of our long-term investments into cash equivalents. As a result of this enhanced liquidity, we have reduced our

use of repurchase agreements. At December 31, 2007, we had no amounts outstanding under repurchase agreements.

For certain of our financial institution customers, we established individual SPEs upon the origination of our relationship. Along with

operational processes and certain financial covenants, these SPEs provide the financial institutions with additional assurance of our ability

to clear their official checks. Under these relationships, the cash, cash equivalents, investments and PSO related to the financial institution

customer are all held by the SPE. In most cases, the fair value of the cash, cash equivalents and investments must be maintained in excess

of the PSO. As the financial institution customer sells our payment service instruments, the face amount of the instrument and any fees

are paid into the SPE. As payment service instruments issued by the financial institution customer are presented for payment, the cash

and cash equivalents within the SPE are used to settle the instrument. As a result, cash and cash equivalents within SPEs are generally not

available for use outside of the SPE. We remain liable to satisfy the obligations, both contractually and under the Uniform Commercial

Code, as the issuer and drawer of the official checks regardless of the existence of the SPEs. Accordingly, we consolidate all of the assets

and liabilities of these SPEs in our Consolidated Balance Sheets, with the individual assets and liabilities of the SPEs classified in a

manner similar to our other assets and liabilities. For further information relating to the SPEs, see Note 2 — Summary of Significant

Accounting Policies of the Notes to Consolidated Financial Statements.

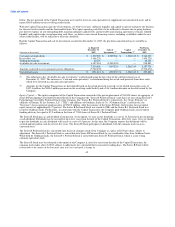

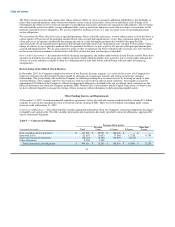

Contractual and Regulatory Capital

We use investments and credit facilities to manage our capital needs deriving from contractual and regulatory requirements. Due to the

continuous nature of the sales and settlement of our payment instruments as described above, we are able to invest in securities with a

longer term than the average life of our payment instruments to

41