MoneyGram 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

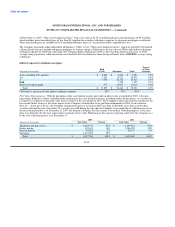

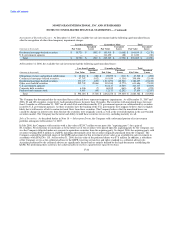

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

three broad categories. The Company adopted SFAS No. 157 on January 1, 2008 with no material impact on its Consolidated Financial

Statements.

In September 2006, the FASB issued SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement

Plans, an amendment of FASB Statements No. 87, 88, 106 and 132. SFAS No. 158 requires the recognition of the funded status of a

pension or postretirement plan in the balance sheet as an asset or liability. Unrecognized prior service cost and gains and losses are

recorded to "Accumulated other comprehensive loss" in the Consolidated Balance Sheets. SFAS No. 158 does not change previous

guidance for income statement recognition. The standard requires the plan assets and benefit obligations to be measured as of the annual

balance sheet date of the Company. Prospective application of SFAS No. 158 is required. The Company adopted the recognition and

disclosure provisions of SFAS No. 158 at December 31, 2006. The change in measurement date is effective for the Company's 2008 year-

end. As of January 1, 2008, the Company adopted the change in measurement date using the transition method of measuring its plan

assets and benefit obligations as of January 1, 2008. Net periodic benefit costs for the period from our current measurement date of

November 30, 2007 through January 1, 2008 will be recognized as a separate adjustment to retained earnings, net of tax, and changes in

the fair value of our plan assets and benefit obligations for this period will be recognized as other comprehensive (loss) income in 2008.

In January 2007, the FASB issued SFAS No. 133 Implementation Issue No. B40, Embedded Derivatives: Application of Paragraph 13(b)

to Securitized Interests in Prepayable Financial Assets ("DIG B40"), which relates to SFAS No. 155. SFAS No. 155 requires the

evaluation of interest in securitized financial assets to identify interests that are derivatives. DIG B40 provides the circumstances in which

a securitized interest in prepayable financial assets would not be subject to the SFAS No. 155 requirement. The Company adopted DIG

B40 on January 1, 2007 with no material impact on its Consolidated Financial Statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities. SFAS No. 159

permits companies to choose to measure certain financial instruments and certain other items at fair value. The election to measure the

financial instrument at fair value is made on an instrument-by-instrument basis for the entire instrument, with few exceptions, and is

irreversible. The Company adopted SFAS No. 159 on January 1, 2008 with no material impact on its Consolidated Financial Statements.

In April 2007, the FASB issued FASB Staff Position ("FSP") FIN No. 48-1, Definition of Settlement in FASB Interpretation No. 48.

FIN No. 48 requires a tax position be measured or recognized based upon the outcomes that could be realized upon "ultimate settlement"

with a tax authority. FSP FIN No. 48-1 amends FIN No. 48 to clarify when a tax position is effectively settled upon examination by a

taxing authority. The Company adopted FSP FIN No. 48-1 as of January 1, 2007 with no material impact to its Consolidated Financial

Statements.

In June 2007, the American Institute of Certified Public Accountants ("AICPA") issued Statement of Position ("SOP") 07-1, Clarification

of the Scope of the Audit and Accounting Guide Investment Companies and Accounting by Parent Companies and Equity Method

Investors for Investments in Investment Companies. SOP 07-1 provides specific guidance for determining whether an entity meets the

definition of an investment company and should follow the AICPA Audit Accounting Guide, Investment Companies (the "Guide").

Entities that meet the definition of an investment Company must apply the provisions of the Guide, which includes a requirement to carry

investments at fair value. The effective date of SOP 07-1 has been indefinitely deferred.

In June 2007, the EITF approved Issue No. 06-11, Accounting for Income Tax Benefits on Dividends on Share-Based Payment. The EITF

reached a final conclusion that a realized income tax benefit from dividends or dividend equivalents that are charged to retained earnings

and are paid to employees for equity classified restricted stock, restricted stock units and stock options should be recognized as an

increase to additional paid-in-capital ("APIC"). Those tax benefits are considered excess tax benefits under SFAS No. 123R. The amount

recognized in APIC for the realized income tax benefit from dividends on those awards should be included in the pool of excess tax

benefits available to absorb tax deficiencies. The guidance of EITF Issue No. 06-11 will be adopted prospectively for the

F-19