MoneyGram 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

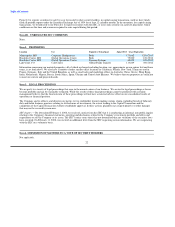

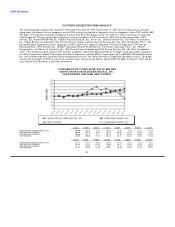

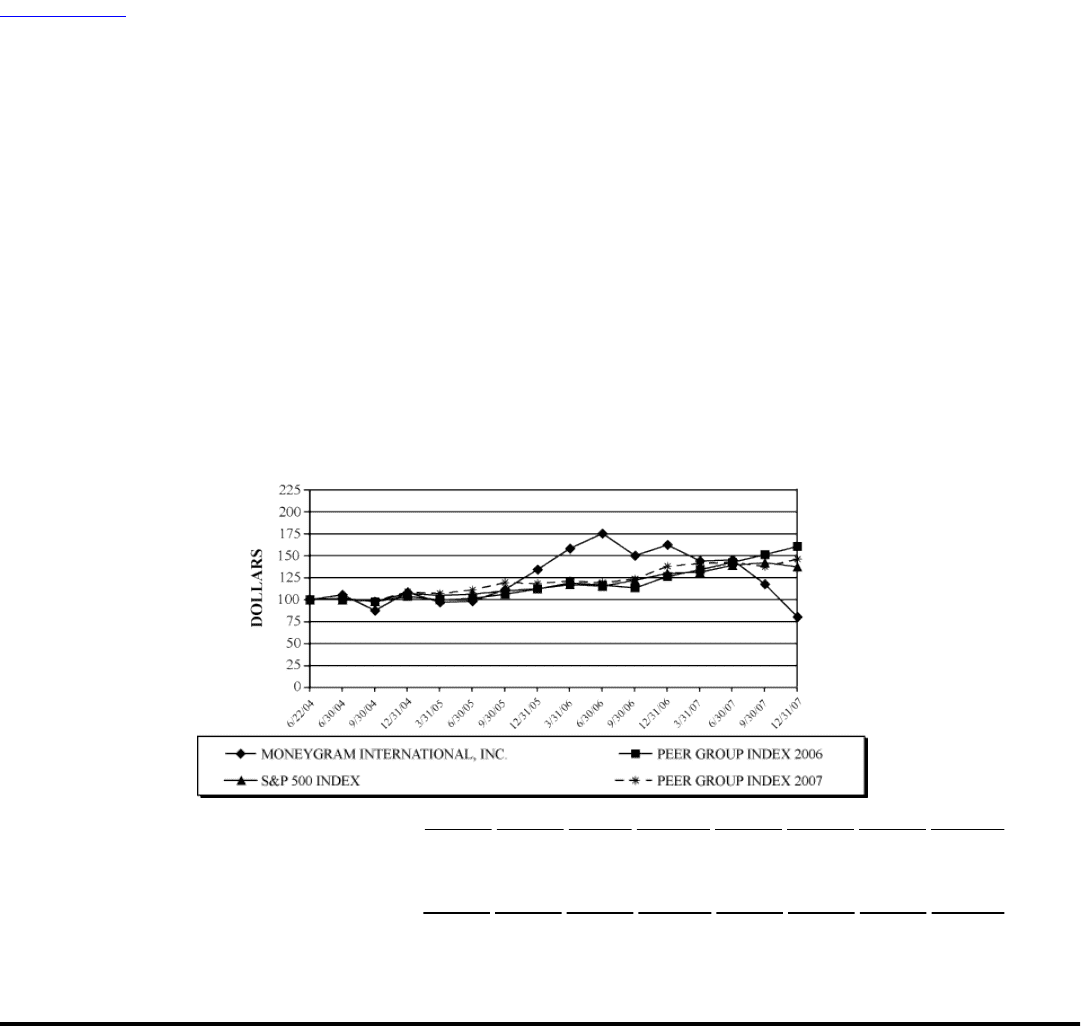

STOCKHOLDER RETURN PERFORMANCE

The following graph compares the cumulative total return from June 22, 2004 to December 31, 2007 for our common stock, our peer

group index of payment services companies used in 2006, our peer group index of payment services companies used in 2007 and the S&P

500 Index. Our common stock began trading on the New York Stock Exchange on June 22, 2004 on a when-issued basis in connection

with the spin-off. The peer group index of payment services companies in 2007 consists of: CSG Systems International Inc., DST

Systems, Inc., Euronet Worldwide Inc., Fidelity National Financial, Inc., Fiserv, Inc., Global Payments Inc., Jack Henry & Associates,

Inc., Online Resources Corporation, The Western Union Company and Total System Services, Inc. (the "Peer Group Index 2007"). The

peer group index of payment services companies in 2006 consists of: Ceridian Corporation, CheckFree Corporation, CSG Systems

International Inc., DST Systems, Inc., eFunds Corporation, Euronet Worldwide Inc., First Data Corporation, Fiserv, Inc., Global

Payments Inc., Jack Henry & Associates, Inc., The Western Union Company and Total System Services, Inc. (the "Peer Group Index

2006"). We changed our peer group in 2007 to delete companies which were purchased and are no longer stand alone public companies

(Ceridian Corporation, eFunds Corporation, First Data Corporation, and CheckFree Corporation) and to add Fidelity National Financial,

Inc. (title insurance/specialty insurance/claims management services) and Online Resources Corporation (payment services). The graph

assumes the investment of $100 in each of our common stock, our peer group indexes and the S&P 500 Index on June 22, 2004, and the

reinvestment of all dividends as and when distributed.

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG MONEYGRAM INTERNATIONAL, INC.,

S&P 500 INDEX AND PEER GROUP INDEX

6/22/04 6/30/04 9/30/04 12/31/04 3/31/05 6/30/05 9/30/05 12/31/05

MONEYGRAM INTERNATIONAL, INC 100.00 105.64 87.64 108.53 97.02 98.25 111.62 134.28

2007 PEER GROUP INDEX 100.00 101.44 98.48 108.97 107.09 111.14 119.39 118.37

2006 PEER GROUP INDEX 100.00 101.47 97.63 103.74 99.80 101.46 106.24 112.06

S&P 500 INDEX 100.00 100.00 98.13 107.19 104.89 106.32 110.16 112.46

3/31/06 6/30/06 9/30/06 12/31/06 3/31/07 6/30/07 9/30/07 12/31/07

MONEYGRAM INTERNATIONAL, INC 158.39 175.27 150.21 162.35 143.98 145.22 117.65 80.32

2007 PEER GROUP INDEX 121.40 119.29 123.67 138.05 141.27 142.58 137.62 146.18

2006 PEER GROUP INDEX 119.13 116.68 113.30 126.33 134.16 142.47 151.30 160.68

S&P 500 INDEX 117.19 115.50 122.04 130.22 131.05 139.28 142.11 137.37

24