MoneyGram 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

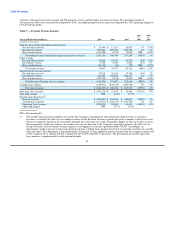

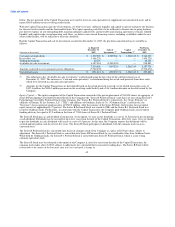

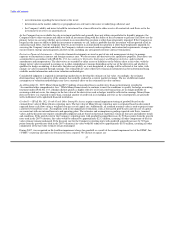

Debt consists of amounts outstanding under the term loan and revolving credit facility at December 31, 2007, as described in Note 9 —

Debt of the Notes to Consolidated Financial Statements, as well as related interest payments, facility fees and annual commitment fees.

As described above, the interest rate on our outstanding debt is based on a floating interest rate indexed to LIBOR. For disclosure

purposes, the interest rate for future periods has been assumed to be 7.58 to 7.66 percent, which are the rates in effect on December 31,

2007. Included in our Consolidated Balance Sheet at December 31, 2007 is $345.0 million of debt and $0.3 million of accrued interest,

which represents amounts owed as of December 31, 2007. The above table reflects the principal and interest that will be paid through the

maturity of the debt using the rates in effect on December 31, 2007. Operating leases consist of various leases for buildings and

equipment used in our business. Derivative financial instruments represent the net payable (receivable) under our interest rate swap

agreements. Other obligations are unfunded capital commitments related to our limited partnership interests included in our investment

portfolio and a $2.3 million indemnity holdback related to the acquisition of Money Express payable on the second anniversary of the

acquisition.

In connection with the acquisition of PropertyBridge, we have an obligation for a potential earn-out payment of up to $10.0 million

contingent on PropertyBridge's performance during 2008. This earn-out payment, which is payable in 2009, is not included in the above

table as the amount is unknown at this time. We anticipate that the ultimate earn-out payment will be less than $10.0 million.

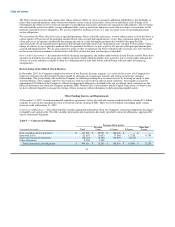

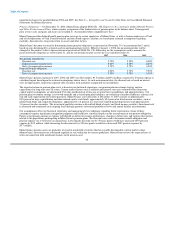

We have funded, noncontributory pension plans. Our funding policy is to contribute at least the minimum contribution required by

applicable regulations. We did not make a contribution to the funded pension plans during 2007. There are no required contributions for

the funded pension plan in 2008; however, we may choose to make contributions. We also have certain pension and postretirement plans

that require benefit payments over extended periods of time. During 2007, we paid benefits totaling $3.8 million related to these

unfunded plans. Benefit payments under these unfunded plans are expected to be $4.3 million in 2008. Expected contributions and benefit

payments under these plans are not included in the table above. See "Critical Accounting Policies — Pension obligations" for further

discussion of these plans. In August 2006, Congress approved the Pension Protection Act of 2006, which requires new funding rules for

defined benefit plans. We have reviewed the funding requirements under this Act and do not anticipate a significant impact on our future

contribution requirements.

As of December 31, 2007, the liability for unrecognized tax benefits is $33.7 million. This amount is not reflected in the table above. As

there is a high degree of uncertainty regarding the timing of potential future cash outflows associated with liabilities relating to Financial

Accounting Standards Board ("FASB") Interpretation ("FIN") No. 48, Accounting for Uncertainty in Income Taxes, we are unable to

make a reasonably reliable estimate of the amount and period in which these liabilities might be paid.

In limited circumstances, we may grant minimum commission guarantees as an incentive to new or renewing agents, for a specified

period of time at a contractually specified amount. Under the guarantees, we will pay to the agent the difference between the

contractually specified minimum commission and the actual commissions earned by the agent. As of December 31, 2007, the minimum

commission guarantees had a maximum payment of $22.9 million over a weighted average remaining term of 2.3 years. The maximum

payment is calculated as the contractually guaranteed minimum commission times the remaining term of the contract and, therefore,

assumes that the agent generates no money transfer transactions during the remainder of its contract. As of December 31, 2007, the

liability for minimum commission guarantees is $4.4 million. Minimum commission guarantees are not reflected in the table above.

Included in the Consolidated Balance Sheets under "Accounts payable and other liabilities" and "Property and equipment" is $0.7 million

of property and equipment received by the Company, but not paid as of December 31, 2007. These amounts were paid in January and

February 2008 and are not reflected in the above table.

48