MoneyGram 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

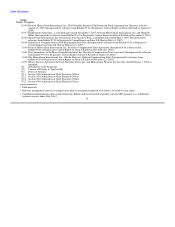

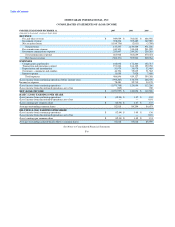

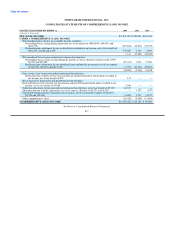

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

AT DECEMBER 31, 2007 2006

(Amounts in thousands, except share data)

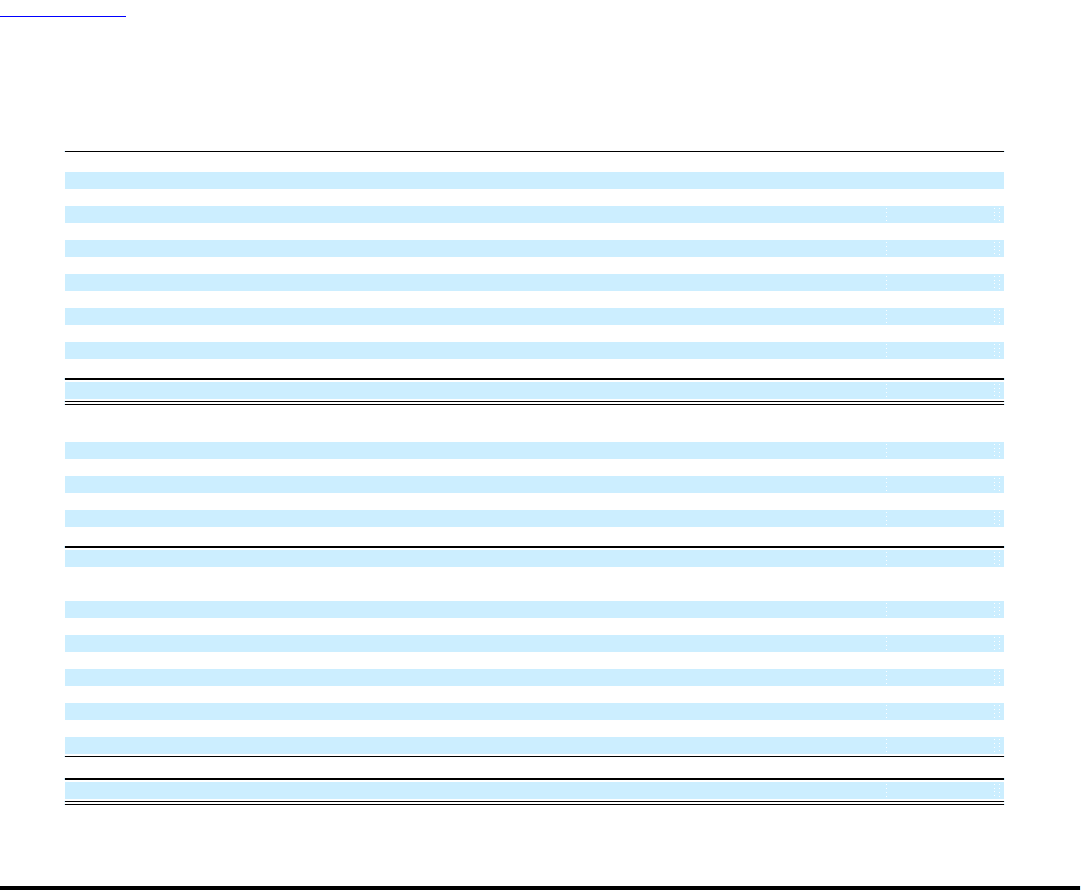

ASSETS

Cash and cash equivalents $ — $ —

Cash and cash equivalents (substantially restricted) 1,552,949 973,931

Receivables, net (substantially restricted) 1,408,220 1,758,682

Trading investments (substantially restricted) 62,105 145,500

Available for sale investments (substantially restricted) 4,187,384 5,690,600

Property and equipment 171,008 148,849

Deferred tax assets — 11,677

Derivative financial instruments 1,647 24,191

Intangible assets 17,605 15,453

Goodwill 438,839 421,316

Other assets 95,254 85,938

Total assets $ 7,935,011 $ 9,276,137

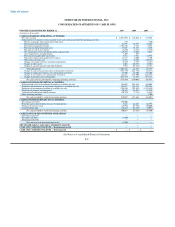

LIABILITIES

Payment service obligations $ 7,762,470 $ 8,209,789

Debt 345,000 150,000

Derivative financial instruments 30,370 3,490

Pension and other postretirement benefits 85,451 103,947

Deferred tax liabilities 11,459 —

Accounts payable and other liabilities 188,778 139,848

Total liabilities 8,423,528 8,607,074

COMMITMENTS AND CONTINGENCIES (Note 14)

STOCKHOLDERS' (DEFICIT) EQUITY

Preferred shares — undesignated, $0.01 par value, 5,000,000 authorized, none issued — —

Preferred shares — junior participating, $0.01 par value, 2,000,000 authorized, none issued — —

Common shares, $0.01 par value, 250,000,000 shares authorized, 88,556,077 shares issued 886 886

Additional paid-in capital 73,077 71,900

Retained (loss) income (387,479) 723,106

Unearned employee benefits (3,280) (17,185)

Accumulated other comprehensive loss (21,715) (6,292)

Treasury stock: 5,910,458 and 4,285,783 shares in 2007 and 2006 (150,006) (103,352)

Total stockholders' (deficit) equity (488,517) 669,063

Total liabilities and stockholders' (deficit) equity $ 7,935,011 $ 9,276,137

See Notes to Consolidated Financial Statements

F-5