MoneyGram 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

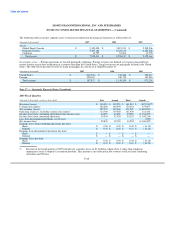

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

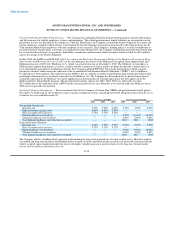

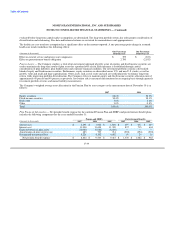

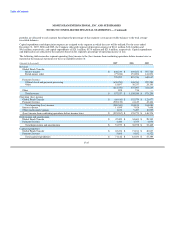

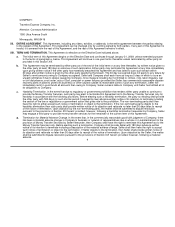

portfolio are allocated to each segment based upon the percentage of that segment's average investable balances to the total average

investable balances.

Capital expenditures and depreciation expense are assigned to the segment in which the asset will be utilized. For the years ended

December 31, 2007, 2006 and 2005, the Company allocated corporate depreciation expense of $16.1 million, $12.4 million and

$9.6 million, respectively, and capital expenditures of $25.1 million, $33.6 million and $23.6 million, respectively. Capital expenditures

and depreciation are allocated to the segments based on the segment's percentage of operating income or loss.

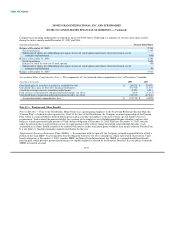

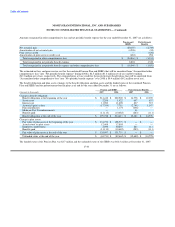

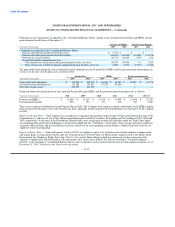

The following table reconciles segment operating (loss) income to the (loss) income from continuing operations before income taxes as

reported in the financial statements for the year ended December 31:

(Amounts in thousands) 2007 2006 2005

Revenue

Global Funds Transfer:

Money transfer $ 848,219 $ 669,852 $ 507,726

Retail money order (77,224) 151,894 141,891

770,995 821,746 649,617

Payment Systems:

Official check and payment processing (630,253) 306,760 297,289

Other 15,897 30,337 24,330

(614,356) 337,097 321,619

Other 898 716 —

Total revenue $ 157,537 $ 1,159,559 $ 971,236

Operating (loss) income

Global Funds Transfer $ (60,410) $ 152,579 $ 121,677

Payment Systems (920,130) 41,619 42,406

Total operating (loss) income (980,540) 194,198 164,083

Interest expense 11,055 7,928 7,608

Other unallocated expenses 1,672 9,497 10,099

(Loss) income from continuing operations before income taxes $ (993,267) $ 176,773 $ 146,376

Depreciation and amortization

Global Funds Transfer $ 47,499 $ 34,603 $ 28,395

Payment Systems 4,480 4,375 4,070

Total depreciation and amortization $ 51,979 $ 38,978 $ 32,465

Capital expenditures

Global Funds Transfer $ 65,474 $ 71,181 $ 40,837

Payment Systems 5,668 9,852 6,522

Total capital expenditures $ 71,142 $ 81,033 $ 47,359

F-47