MoneyGram 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

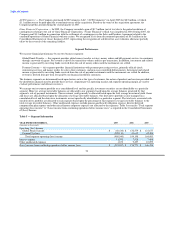

We continue to see a trend among state and federal regulators toward enhanced scrutiny of anti-money laundering compliance. As we

continue to add staff resources and enhancements to our technology systems to address this trend, our transaction expenses will likely

increase. In addition, we anticipate that our transaction expenses will increase due to marketing spend, investment in the agent network

and development of our retail network in Western Europe. We anticipate these expenses will grow at a rate similar to 2007, excluding the

goodwill impairment, based on our assumed agent network growth of 15 to 20 percent. We also will incur significant one-time charges

for costs related to the Capital Transaction and strategic review of the Payment Systems segment. See Note 18 — Subsequent Events of

the Notes to Consolidated Financial Statements for further information.

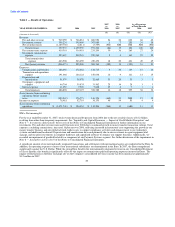

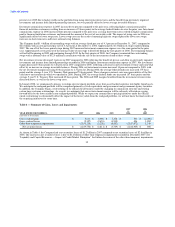

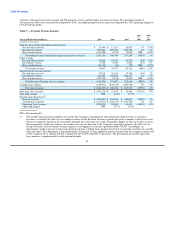

Depreciation and amortization — Depreciation and amortization expense includes depreciation on point of sale equipment, agent

signage, computer hardware and software (including capitalized software development costs), office furniture, equipment and leasehold

improvements and amortization of intangible assets. Depreciation and amortization expense increased $13.0 million, or 33 percent, in

2007 compared to 2006, primarily due to our investment in agent equipment and signage of $5.3 million, amortization of our investment

in computer hardware and capitalized software in prior periods to enhance our support functions, as well as amortization of purchased

software of $5.1 million. Our investments in computer hardware and software helped drive the growth in money transfer product.

Additionally, amortization of acquired intangible assets increased by $1.2 million from 2006, primarily due to the acquisition of

PropertyBridge, Inc ("PropertyBridge") on October 1, 2007. We expect to see a further increase in amortization of intangible assets due

to the intangible assets acquired in the acquisition of PropertyBridge. See further discussion in Note 8 — Intangibles and Goodwill of the

Notes to Consolidated Financial Statements.

Depreciation and amortization expense increased $6.5 million, or 20 percent, in 2006 compared to 2005, primarily due to the

amortization of our investment in computer hardware and capitalized software of $4.4 million to enhance the money transfer platform,

the depreciation of agent equipment of $2.3 million and the amortization of leasehold improvements of $0.5 million (offset by a

corresponding reduction in rent expense of $1.1 million).

The Company is currently implementing a new system to provide improved connections between our agents and our marketing, sales,

customer service and accounting functions. The new system and associated processes are intended to increase the flexibility of our back

office, thereby improving operating efficiencies. In 2007, we capitalized software costs of approximately $3.7 million related to the

enhancements to our financial processing systems that will impact future depreciation and amortization. As we continue our investment

in the infrastructure for future growth, we expect depreciation and amortization expense to increase.

Occupancy, equipment and supplies — Occupancy, equipment and supplies includes facilities rent and maintenance costs, software and

equipment maintenance costs, freight and delivery costs and supplies. Occupancy, equipment and supplies expense increased

$8.9 million, or 25 percent, in 2007 compared to 2006, primarily due to software expense and maintenance, delivery, freight and supplies

expense and office rent. Software expense and maintenance increased $2.8 million due primarily to purchased licenses to support our

growth and compliance initiatives. Delivery, freight and supplies expense increased $2.1 million in connection with the growth in our

agent locations. Office rent increased $1.9 million due to annual rent increases and expanded retail locations.

Occupancy, equipment and supplies expense increased $4.3 million, or 14 percent, in 2006 compared to 2005, primarily due to normal

increases in facilities rent of $1.9 million and higher software maintenance costs of $1.1 million, partially offset by gains on disposal of

equipment of $1.0 million. Software expense and maintenance increases relate primarily to purchased licenses to support our growth and

compliance initiatives, as well as licensing costs which were incurred by Viad prior to the spin-off.

Interest expense — Interest expense increased 39 percent in 2007 compared to 2006, primarily due to higher average interest rates and an

increase in outstanding debt. The increase was partially offset by receipts under our cash flow hedges. During the second half of 2007, we

borrowed an additional $195.0 million under the revolving credit facility. In connection with an amendment to waive certain covenants at

December 31, 2007, the interest rates related to all outstanding balances increased as of January 1, 2008. We expect interest expense to

increase in 2008 due to this increase in interest rates and the additional debt associated with the Capital Transaction. See further

discussion of the credit facility in Note 9 — Debt of the Notes to Consolidated Financial Statements and further discussion of the Capital

Transaction in Note 18 — Subsequent Events of the Notes to Consolidated Financial

34