MoneyGram 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

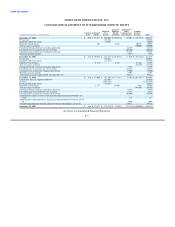

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

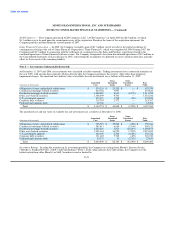

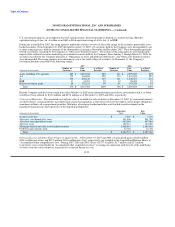

Earnings Per Share — Basic earnings per share are computed based on the weighted-average number of common shares outstanding

during each year. Nonvested restricted stock carries dividends and voting rights and is not included in the weighted average number of

common shares outstanding used to compute basic earnings per share. Diluted earnings per share are based on the weighted-average

number of common shares outstanding plus net incremental shares arising out of employee stock compensation plans. The earnings

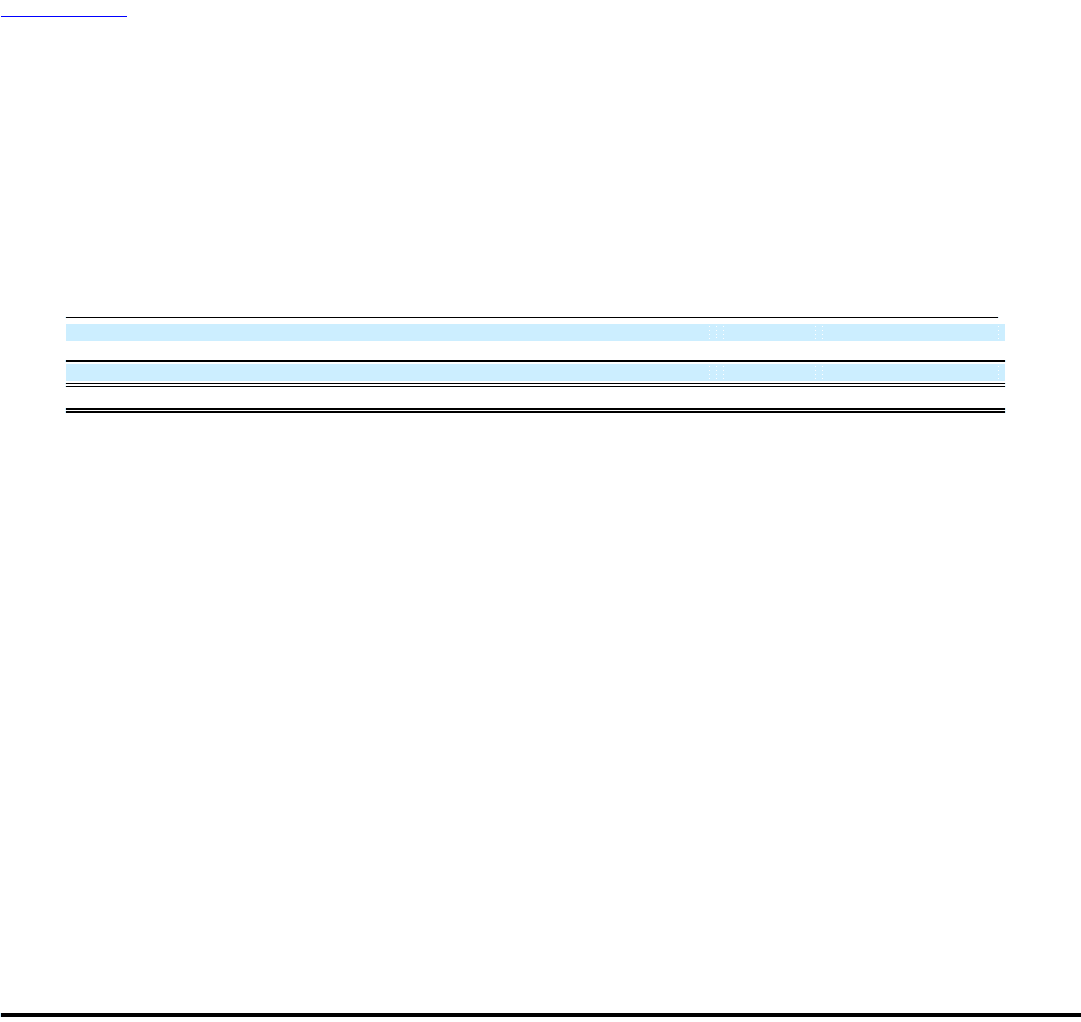

amounts used for per-share calculations are the same for both the basic and diluted methods. The following is a reconciliation of the

weighted-average share amounts used in calculating earnings per share:

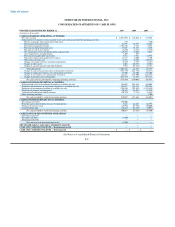

(Amounts in thousands) 2007 2006 2005

Basic common shares outstanding 82,818 84,294 84,675

Incremental shares from stock-based compensation plans — 1,524 1,295

Diluted common shares outstanding 82,818 85,818 85,970

Stock options and other excluded from the computation 1,744 2 403

Stock options and other dilutive instruments are excluded from the dilutive computation either because the Company had a net loss for

the period or because the exercise prices of these instruments were greater than the average market price of the common stock for the

period, both of which would have had an anti-dilutive effect on earnings per share.

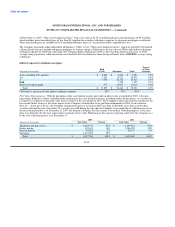

Stock Based Compensation — Effective January 1, 2005, the Company adopted SFAS No. 123 (revised 2004), Share-Based Payment

("SFAS No. 123R"), using the modified prospective method. Under SFAS No. 123R, all share-based compensation awards are measured

at fair value at the date of grant and expensed over their vesting or service periods. Expense is recognized using the straight-line method.

As the Company adopted SFAS No. 123R under the modified prospective method, prior period financial statements are not restated. No

modifications were made to existing share-based awards prior to, or in connection with, the adoption of SFAS No. 123R. The adoption of

SFAS No. 123R reduced income from continuing operations before income taxes by $1.5 million and reduced net income by

$1.1 million, respectively, for 2005. Basic and diluted earnings per share in 2005 were reduced by $0.01. Cash used by operating

activities and cash provided by financing activities during 2005 increased by $1.8 million as a result of the adoption of SFAS No. 123R.

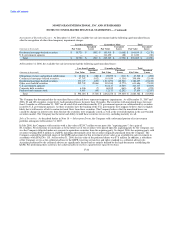

Recent Accounting Pronouncements — In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Instruments —

an amendment of FASB Statements No. 133 and 140. SFAS No. 155 permits companies to measure any hybrid instrument in its entirety

at fair value. Changes in fair value are recorded in income. Previously, hybrid instruments were required to be separated into two

instruments, a derivative and host. Generally, the derivative instrument was recorded at fair value. The election to measure the hybrid

instrument at fair value is made on an instrument-by-instrument basis and is irreversible. SFAS No. 155 also requires that beneficial

interests in securitized financial assets be evaluated for freestanding or embedded derivatives. The Company adopted SFAS No. 155 on

January 1, 2007 with no material impact to its Consolidated Financial Statements.

In July 2006, the FASB issued FIN No. 48, Accounting for Uncertainty in Income Taxes. FIN No. 48 is an interpretation of

SFAS No. 109, Accounting for Income Taxes. FIN No. 48 prescribes a recognition threshold and measurement attribute for the financial

statement recognition and measurement of a tax position taken or expected to be taken in an entity's tax return. This interpretation also

provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition of tax

positions. As discussed in Note 10 — Income Taxes, the Company adopted FIN No. 48 on January 1, 2007.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This statement does not require any new fair value

measurement, but it provides guidance on how to measure fair value under other accounting pronouncements. SFAS No. 157 also

establishes a fair value hierarchy to classify the source of information used in fair value measurements. The hierarchy prioritizes the

inputs to valuation techniques used to measure fair value into

F-18