MoneyGram 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

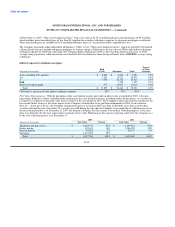

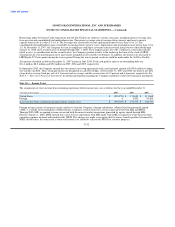

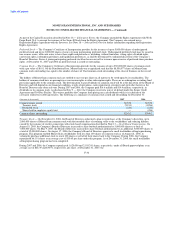

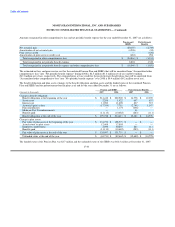

Income tax expense related to continuing operations is as follows for the year ended December 31:

(Amounts in thousands) 2007 2006 2005

Current:

Federal $ 35,445 $ 13,716 $ 27,324

State 3,999 2,968 (1,038)

Foreign 1,400 2,880 5,004

Current income tax expense 40,844 19,564 31,290

Deferred income tax expense 37,637 33,155 2,880

Income tax expense $ 78,481 $ 52,719 $ 34,170

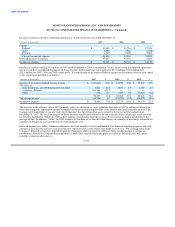

Income tax expense totaling $1.9 million in 2007 and $0.5 million in 2005, is included in "(Loss) income from discontinued operations,

net of tax" in the Consolidated Statements of (Loss) Income. Federal and state taxes paid were $16.0 million, $38.7 million and

$22.9 million for 2007, 2006 and 2005, respectively. A reconciliation of the expected federal income tax at statutory rates for year ended

to the actual taxes provided is as follows:

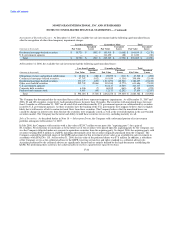

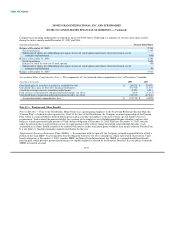

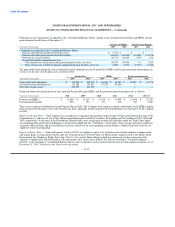

(Amounts in thousands) 2007 % 2006 % 2005 %

Income tax at statutory federal income tax rate $ (347,643) 35.0 $ 61,870 35.0 $ 51,232 35.0

Tax effect of:

State income tax, net of federal income tax effect 3,606 (0.4) 2,647 1.5 2,084 1.4

Valuation allowance 434,446 (43.7) — — — —

Other (152) 0.0 1,445 0.8 (4,673) (3.2)

90,257 (9.1) 65,962 37.3 48,643 33.2

Tax-exempt income (11,776) 1.2 (13,243) (7.5) (14,473) (9.9)

Income tax expense $ 78,481 (7.9) $ 52,719 29.8 $ 34,170 23.3

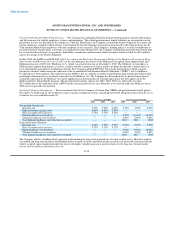

The decrease in the effective rate in 2007 primarily relates to a deferred tax asset valuation allowance of $417.6 million resulting from

other-than-temporary impairment charges recognized in the investment portfolio. Due to the amount and characterization of losses, the

Company determined that it was not "more likely than not" that the deferred tax assets related to the losses will be realized as of

December 31, 2007. We are continuing to evaluate available tax positions related to the net securities losses, which may result in future

tax benefits. Included in "Other" for 2005 is $2.1 million of tax benefits from the reversal of tax reserves no longer needed due to the

passage of time. In addition, "Other" for 2005 includes $3.5 million of tax benefits from changes in estimates to previously estimated tax

amounts resulting from new information received during the year.

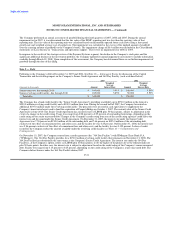

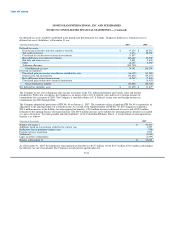

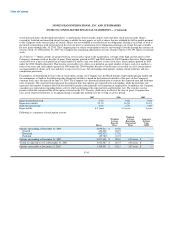

Deferred income taxes reflect temporary differences between amounts of assets and liabilities for financial reporting purposes and such

amounts as measured by tax laws at enacted tax rates expected to be in effect when such differences reverse. The carrying value of the

Company's deferred tax assets is dependent upon the Company's ability to generate sufficient future taxable income in certain tax

jurisdictions. Should the Company determine that it is more likely than not that some portion of all of its deferred assets will not be

realized, a valuation allowance to

F-33