MoneyGram 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

correspondence and various other communications whether verbal or written, from Company to Seller.

5. TRANSFER RECEIVE TRANSACTIONS. Seller shall follow the computerized or telephonic authorization procedures specified by

Company prior to disbursement of the Transfer Amount. Seller shall maintain the ability to disburse at least $900 in cash for each Transfer

Receive. If a Transfer Receive involves an amount which exceeds that amount or if the recipient requests disbursement in a form other

than cash, Seller will disburse the transfer amount by issuing a money order to the recipient through use of the System. Seller shall

deposit a Money Order in the amount of each Transfer Receive transaction paid out in cash in order to itself receive reimbursement for

cash disbursed. Seller is fully responsible and unconditionally liable for all amounts which Seller, pursuant to a Transfer Receive,

wrongfully disburses either to a person other than the intended recipient or as a result of paying out an incorrect amount. Seller shall pay

all such wrongful disbursement amounts to Company upon demand, unless such wrongful disbursement was caused by Company or its

employees.

6. COMPENSATION.

a. Base Commission. Company and Seller agree that beginning on February 1, 2005, Seller shall be entitled to Commissions on

Money Transfer transactions (including Transfer Sends, Transfer Receives and Express Payment transactions), in the amount of

[*] of the applicable Consumer Fee. Commissions payable to Seller on any new products will be negotiated.

b. Performance Bonus. In addition to the above Commissions and Extension Payment, Seller shall be entitled to a Performance

Based Bonus, as follows ("Performance Bonus"):

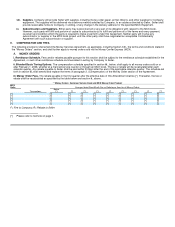

Number of Money Transfer transactions Performance Based Bonus

(per Contract Year) (as a percentage of the applicable Consumer Fee)

[*]

[*]

[*] or more [*]

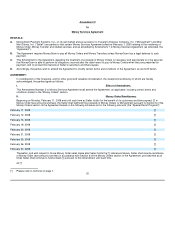

For example, if Seller completes [*] transactions in a Contract Year, Company will pay Seller the applicable Performance Bonus on all

transactions in excess of [*] in such Contract Year (e.g., [*] for transactions [*] — [*]; [*] for transactions [*] — [*], etc.). For the following

Contract Year, Company will continue to pay Seller the same Performance Bonus Seller was entitled to as of the last day of the preceding

year. In the event, at the end of such following Contract Year, Seller's transaction volume for such year did not entitle Seller to the

Performance Bonus paid by Company, Seller will refund the Performance Bonus, or applicable portion thereof, to Company within

30 days following the end of the Contract Year. Seller shall be entitled to a Performance Bonus in the upcoming Contract Year based on

the transaction volume tier reached in the previous Contract Year.

c. Refunds and Hardship Transactions. No Wal-Mart Consumer Fee will be charged and no Commissions or other compensation

will be paid to Seller for processing refunds or hardship transactions.

7. NET SETTLEMENT PROCEDURES. Settlement of funds will be on a daily basis. Amounts owed to Company for the Transfer Amount(s)

and Wal-Mart Consumer Fee(s) relating to Transfer Send and Express Payment transactions initiated by Seller ("Company Amounts")

shall be totaled on a daily basis and Seller shall transfer said amount into a banking account designated by Company by bank wire

transfer on the same day. Commissions due to Seller for Transfer Sends, Transfer Receives and Express Payment transactions shall be

calculated on a daily basis and Company shall initiate the transfer of said amount into a banking account designated by Seller via ACH on

the day following the calculation of the applicable Commissions. Calculation of the daily Commission shall be based on the Commission

rates identified herein. Settlement for transactions occurring on Friday, Saturday, Sunday, and any day as to which federally chartered

banks in the United States are not open for business shall be made on the following business day for Company Amounts and on the

second business day for Commissions.

[*] Please refer to footnote on page 1. 14