MoneyGram 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

rate or LIBOR. Consequently, the interest rate risk we were historically exposed to related to investments and payment service

obligations is expected to be negligible going forward. However, we will have some exposure to "basis risk," which is the difference

between the interest rate index of investments (e.g., US treasury rates) and that of the payment service obligations (e.g., LIBOR). In

addition, we have $1.4 billion in notional amounts of swaps that convert a portion of the variable rate commissions to fixed rate

payments. With the portfolio realignment, we will need to re-evaluate the use of the swaps, including possible termination, to better

match our floating rate assets with our floating rate interest-based commission indices. In addition, we will be repricing official check

customers to better align the commission paid to the rates earned on the realigned investment portfolio.

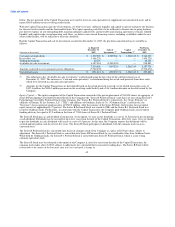

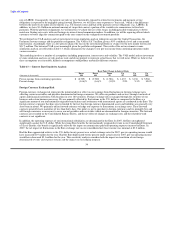

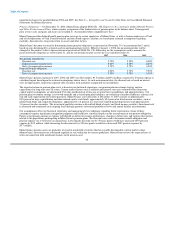

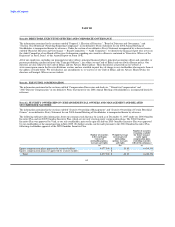

We performed our VAR analysis and net investment revenue simulation analysis taking into account the Capital Transaction, the

Payments Systems strategy and the portfolio realignment. The VAR is $(8.7) million, given a 95% confidence level and a one-month

time horizon. Accordingly, there is a five percent chance the loss on the investment portfolio or swaps over the next month will exceed

$(8.7) million. The historical VAR is not meaningful given the portfolio realignment. The results of the net investment revenue

simulation analysis are reflected in Table 13, which summarizes the changes to our pre-tax income from continuing operations under

various scenarios.

This modeling involves a number of assumptions including prepayments, interest rates and volatility. The VAR model and net investment

revenue simulation analyses are risk analysis tools and do not purport to represent actual losses that we will incur. While we believe that

these assumptions are reasonable, different assumptions could produce materially different estimates.

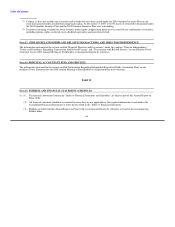

Table 13 — Interest Rate Sensitivity Analysis

Basis Point Change in Interest Rates

Down Down Down Up Up Up

(Amounts in thousands) 200 100 50 50 100 200

Pre-tax income from continuing operations $ (8,705) $ (3,902) $ (1,786) $ 1,637 $ 3,138 $ 5,968

Percent change (14.6)% (6.6)% (3.0)% 2.8% 5.3% 10.0%

Foreign Currency Exchange Risk

Foreign currency exchange risk represents the potential adverse effect on our earnings from fluctuations in foreign exchange rates

affecting certain receivables and payables denominated in foreign currencies. We offer our products and services through a network of

agents and financial institutions with locations in over 180 countries. Foreign exchange risk is managed through the structure of our

business and certain business processes. We are primarily affected by fluctuations in the U.S. dollar as compared to the Euro as a

significant amount of our internationally originated transactions and settlements with international agents are conducted in the Euro. The

foreign currency exposure that does exist is limited by the fact that foreign currency denominated assets and liabilities are generally very

short-term in nature. We primarily utilize forward contracts to hedge our exposure to fluctuations in exchange rates. These forward

contracts generally have maturities of less than thirty days. Our policy is not to speculate in foreign currencies and we promptly buy and

sell foreign currencies as necessary to cover our net payables and receivables which are denominated in foreign currencies. The forward

contracts are recorded on the Consolidated Balance Sheets, and the net effect of changes in exchange rates and the related forward

contracts is not significant.

In addition, the operating expenses of our international subsidiaries are denominated in the Euro. In 2007, the Euro strengthened

significantly against the U.S. dollar. While the strong Euro benefits the internationally originated revenue in our Consolidated Statement

of (Loss) Income, this benefit is significantly offset by the impact on commissions paid and operating expenses incurred in Euros. In

2007, the net impact of fluctuations in the Euro exchange rate on our consolidated net (loss) income was minimal at $3.2 million.

Had the Euro appreciated relative to the U.S. dollar twenty percent over actual exchange rates for 2007, pre-tax operating income would

have increased $1.9 million for the year. Had the Euro depreciated twenty percent under actual rates for 2007, pre-tax operating income

would have decreased $5.1 million for the year. This sensitivity analysis considers both the impact on translation of our foreign

denominated revenue and expense streams and the impact on our hedging program.

54