MoneyGram 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

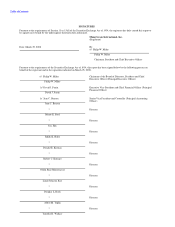

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with GAAP requires estimates and assumptions that affect the reported amounts of

assets and liabilities, revenues and expenses, and related disclosures of contingent assets and liabilities in the Consolidated Financial

Statements. Actual results could differ from those estimates. On a regular basis, management reviews the accounting policies,

assumptions and estimates to ensure that our financial statements are presented fairly and in accordance with GAAP.

Critical accounting policies are those policies that management believes are most important to the portrayal of a company's financial

position and results of operations, and that require management to make estimates that are difficult, subjective or complex. Based on

these criteria, management has identified and discussed with the Audit Committee the following critical accounting policies and

estimates, and the methodology and disclosures related to those estimates:

Fair Value of Investment Securities — The Company holds investment securities classified as trading and available-for-sale in

accordance with SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities. Trading securities, which consist

solely of auction rate securities for all periods presented, are recorded at fair value with unrealized gains and losses reported in the

Consolidated Statements of (Loss) Income. Securities classified as available-for-sale are recorded at fair value with unrealized gains and

losses recorded net of tax as a separate component of stockholders' equity. The fair value of an investment security is the amount that

would be received from the sale of the security in an orderly transaction at the measurement date, other than in a forced or liquidation

sale. This definition of fair value is commonly referred to as the "exit price" of a security.

The degree of management judgment involved in determining the fair value of an investment is dependent upon the availability of quoted

market prices or observable market parameters. Fair value for the majority of our investments is estimated using quoted market prices in

active markets, broker-dealer quotes or through the use of industry-standard models that utilize independently sourced market parameters.

These independently sourced market parameters are observable in the marketplace, can be derived from observable data or are supported

by observable levels at which transactions for similar securities are executed in the marketplace. Examples of such parameters include,

but are not limited to, interest rate yield curves, reported trades, broker or dealer quotes, issuer spreads, benchmark securities, bids, offers

and reference data.

The Company receives prices from an independent pricing service for a majority of our investments. We verify these prices through

periodic internal valuations, as well as through comparison to comparable securities, any broker-dealer quotes received and liquidation

prices. The independent pricing service will only provide a price for an investment if there is sufficient observable market information to

obtain objective pricing. The Company receives prices from an independent pricing service for investments classified as obligations of

states and political subdivisions, commercial mortgage-backed securities, residential mortgage-backed securities, U.S. government

agencies, corporate debt securities, preferred and common stock and other asset-backed securities with direct exposure to sub-prime

mortgages.

For investments that are not actively traded, or for which there is not sufficient observable market information, the Company estimates

fair value using broker-dealer quotes when available. When such quotes are not available, and to verify broker-dealer quotes received, the

Company estimates fair value using industry-standard pricing models, discount margins for comparable securities adjusted for differences

in the Company's security, risk and liquidity premiums observed in the market place, default rates, prepayment speeds, loss severity and

information specific to the underlying collateral to the investment. The Company maximizes the use of market observable information to

the extent possible and makes its best estimate of the assumptions that a similar market participant would make. Investments which are

primarily valued through the use of broker-dealer quotes or internal valuations include those classified as other asset-backed securities,

excluding those with direct exposure to sub-prime mortgages, and certain commercial mortgage-backed securities.

The use of different market assumptions or valuation methodologies may have a material effect on the estimated fair value amounts. Due

to the subjective nature of these assumptions, the estimates determined may not be indicative of the actual exit price if the investment was

sold at the measurement date. In the current market, the most subjective assumptions include the default rate of collateral securities and

loss severity, particularly as it relates to the

55