MoneyGram 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

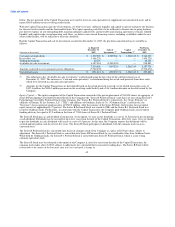

below. The net proceeds of the Capital Transaction were used to invest in cash equivalents to supplement our unrestricted assets and to

repay $100.0 million on our revolving credit facility.

With the Capital Transaction and sale of investments, we believe we have sufficient liquidity and capital to operate and grow our business

for the next twelve months and the foreseeable future. We expect operating cash flows to be sufficient to finance our on-going business,

pay interest expense on our outstanding debt, maintain adequate capital levels and meet debt and clearing agreement covenants. Should

liquidity and capital needs exceed operating cash flows, we believe our external financing sources, including availability under the new

senior credit facility, will be sufficient to meet any shortfalls.

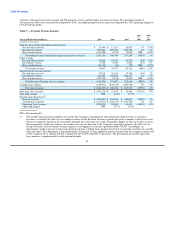

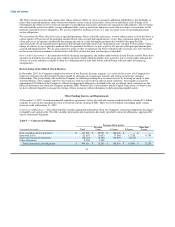

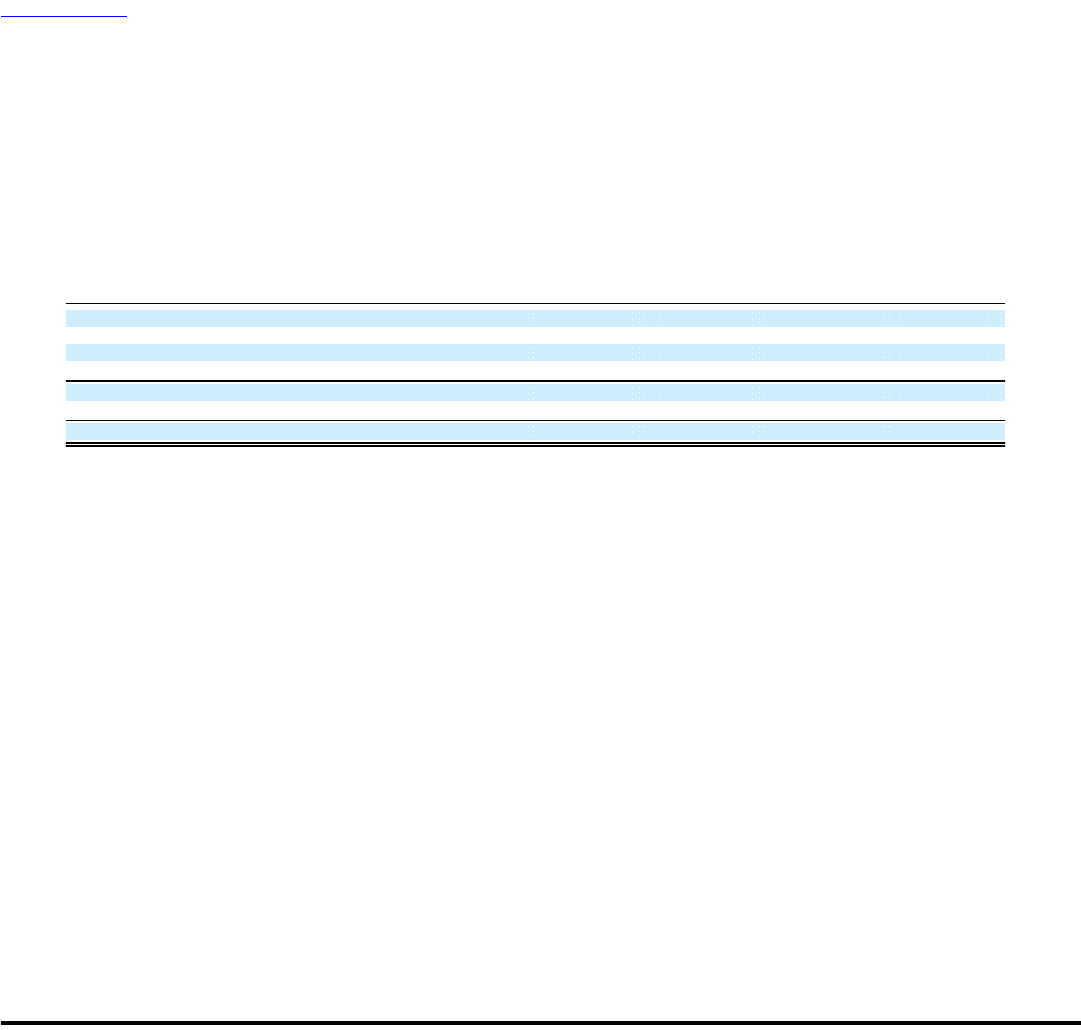

Had the Capital Transaction and sale of investments occurred on December 31, 2007, the pro forma unrestricted assets would be as

follows:

As Reported Pro Forma

December 31, Sales of Capital December 31,

(Amounts in thousands) 2007 Investments (1) Transactions (2) 2007

Cash and cash equivalents $ 1,552,949 $ 2,909,268 $ 1,286,315 $ 5,748,532

Receivables, net 1,408,220 — — 1,408,220

Trading investments 62,105 — — 62,105

Available-for-sale investments 4,187,384 (3,248,503) — 938,881

7,210,658 (339,235) 1,286,315 8,157,738

Amounts restricted to cover payment service obligations (7,762,470) — — (7,762,470)

Unrestricted assets $ (551,812) $ (339,235) $ 1,286,315 $ 395,268

(1) The reduction to the "Available-for-sale investments" is determined using the fair value of the sold investments as of

December 31, 2007. The increase in "Cash and cash equivalents" is determined using the actual cash proceeds from these sales,

which were invested in cash and cash equivalents.

(2) Amounts for the Capital Transactions are determined based on the actual proceeds received, net of related transaction costs of

$107.4 million, the $100.0 million payment on the revolving credit facility and a $16.3 million discount on the debt issued by the

Company.

Equity Capital — The equity component of the Capital Transaction consisted of the private placement of 760,000 shares, in aggregate, of

Series B Participating Convertible Preferred Stock of the Company (the "Series B Preferred Stock") and shares of non-voting Series B-1

Participating Convertible Preferred Stock of the Company (the "Series B-1 Preferred Stock") (collectively, the "Series B Stock") to

affiliates of Thomas H. Lee Partners, L.P. ("THL") and affiliates of Goldman, Sachs & Co. ("Goldman Sachs") (collectively, the

"Investors") for an aggregate purchase price of $760.0 million. After the issuance of the Series B Stock, the Investors have an initial

equity interest of approximately 79 percent. The Series B Preferred Stock was issued to THL and the Series B-1 Preferred Stock was

issued to Goldman Sachs. Furthermore, in connection with the Capital Transaction, the Company paid Goldman Sachs an investment

banking advisory fee equal to $7.5 million in the form of 7,500 shares of Series B-1 Preferred Stock.

The Series B Stock pays a cash dividend of ten percent. At our option, we may accrue dividends at a rate of 12.5 percent in lieu of paying

a cash dividend. Dividends may be accrued for up to five years from the date of the Capital Transaction. After five years, if we are unable

to pay the dividends in cash, dividends will accrue at a rate of 15 percent. At this time, the Company expects that dividends will be

accrued and not paid in cash for at least five years. The Series B Stock participates in dividends with the common stock on an as-

converted basis.

The Series B Preferred Stock is convertible into shares of common stock of the Company at a price of $2.50 per share, subject to

adjustment. The Series B-1 Preferred Stock is convertible into Series B Preferred Stock by any stockholder other than Goldman Sachs.

While held by Goldman Sachs, the Series B-1 Preferred Stock is convertible into Series D Preferred Stock, which is a non-voting

common equivalent stock.

The Series B Stock may be redeemed at the option of the Company if, after five years from the date of the Capital Transaction, the

common stock trades above $15.00, subject to adjustment, for a period of thirty consecutive trading days. The Series B Stock will be

redeemable at the option of the Investors after ten years and upon a change in

45