MoneyGram 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

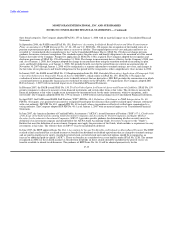

Company as of January 1, 2008. The Company is currently evaluating the impact of EITF Issue No. 06-11 on its Consolidated Financial

Statements.

In December 2007, the FASB issued SFAS No. 141R, Business Combinations. SFAS No. 141R changes how business combinations are

accounted for and disclosed. The adoption of the requirements of SFAS No. 141R applies prospectively to business combinations for

which the acquisition date is on or after fiscal years beginning after December 15, 2008 and may not be early adopted. SFAS No. 141R

will impact financial statements at the acquisition date and in subsequent periods.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements — an amendment of

ARB No. 51. SFAS No. 160 establishes accounting and reporting standards for a non-controlling interest in a subsidiary. The adoption of

the requirements of SFAS No. 160 is effective for fiscal years and interim periods within those fiscal years, beginning after December 15,

2008 and may not be early adopted. The Company is currently evaluating the impact of SFAS No. 160 on its Consolidated Financial

Statements.

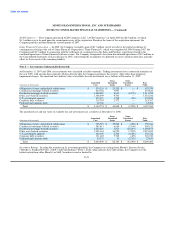

Note 3 — Acquisitions and Discontinued Operations

PropertyBridge, Inc. — On October 1, 2007, the Company acquired PropertyBridge, Inc. ("PropertyBridge") for $28.1 million, plus a

potential earn-out payment of up to $10.0 million contingent on PropertyBridge's performance during 2008. PropertyBridge is a provider

of electronic payment processing services for the real estate management industry. PropertyBridge offers a complete solution to the

resident payment cycle, including the ability to electronically accept deposits and rent payments. Residents can pay rent online, by phone

or in person and set up recurring payments. PropertyBridge is a component of the Company's Global Funds Transfer segment.

In 2007, the Company finalized its purchase price allocation, which included goodwill of $24.1 million, purchased intangible assets of

$6.0 million, consisting primarily of customer lists, developed technology and a noncompetition agreement. The intangible assets will be

amortized over useful lives ranging from three to fifteen years. Goodwill was assigned to the Company's Global Funds Transfer segment.

The acquisition cost includes $0.2 million of transaction costs.

The operating results of PropertyBridge subsequent to October 1, 2007 are included in the Company's Consolidated Statements of (Loss)

Income. The financial impact of the acquisition is not material to the Consolidated Balance Sheets or Consolidated Statements of (Loss)

Income.

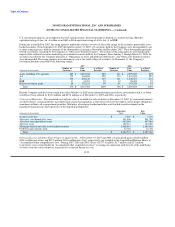

Money Express — On May 31, 2006, MoneyGram completed the acquisition of Money Express S.r.l. ("Money Express"), the Company's

former super agent in Italy, for $15.0 million. In connection with the acquisition, the Company formed MoneyGram Payment Systems

Italy, S.r.l., a wholly-owned subsidiary, to operate the former Money Express agent network. The acquisition provides the Company with

the opportunity for further network expansion and more control of marketing and promotional activities in the region.

In 2007, the Company finalized its purchase price allocation, which resulted in a decrease of $0.3 million to goodwill. Purchased

intangible assets of $7.7 million, consisting primarily of customer lists and a noncompetition agreement, will be amortized over useful

lives ranging from three to five years. Goodwill of $16.7 million was recorded and assigned to the Company's Global Funds Transfer

segment. The acquisition cost includes $1.3 million of transaction costs and the forgiveness of $0.7 million of liabilities.

The operating results of Money Express subsequent to May 31, 2006 are included in the Company's Consolidated Statements of (Loss)

Income. The financial impact of the acquisition is not material to the Consolidated Balance Sheets or Consolidated Statements of (Loss)

Income.

F-20