Kraft 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

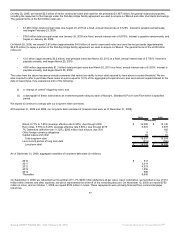

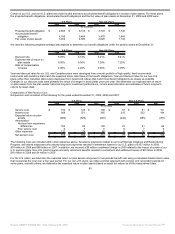

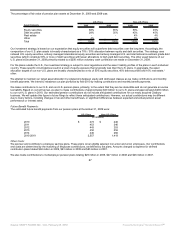

In February 2008, as part of our annual equity program, we granted 13.5 million stock options to eligible employees at an exercise price of $29.49.

We also granted 0.1 million off-cycle stock options during 2008 at an exercise price of $30.78.

On May 3, 2007, our Board of Directors approved a stock option grant to our CEO to recognize her election as our Chairman. She received

300,000 stock options, which vest under varying market and service conditions and expire ten years after the grant date. The grant had an

insignificant impact on earnings in 2007.

The total intrinsic value of options exercised was $72 million in 2009, $76 million in 2008 and $90 million in 2007. Cash received from options

exercised was $79 million in 2009, $80 million in 2008 and $124 million in 2007. The actual tax benefit realized for the tax deductions from the

option exercises totaled $52 million in 2009, $44 million in 2008 and $35 million in 2007.

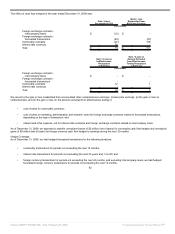

Restricted and Deferred Stock:

We may grant shares of restricted or deferred stock to eligible employees, giving them in most instances all of the rights of shareholders, except

that they may not sell, assign, pledge or otherwise encumber the shares. Shares of restricted and deferred stock are subject to forfeiture if certain

employment conditions are not met. Restricted and deferred stock generally vest on the third anniversary of the grant date.

Shares granted in connection with our long-term incentive plan vest based on varying performance, market and service conditions. The unvested

shares have no voting rights and do not pay dividends.

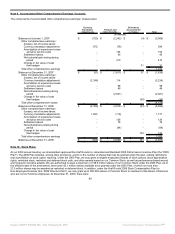

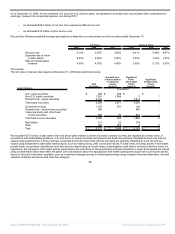

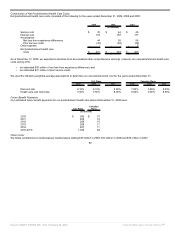

The fair value of the restricted and deferred shares at the date of grant is amortized to earnings over the restriction period. We recorded

compensation expense related to restricted and deferred stock of $133 million in 2009, $160 million in 2008 and $136 million in 2007. The

deferred tax benefit recorded related to this compensation expense was $44 million in 2009, $53 million in 2008 and $47 million in 2007. The

unamortized compensation expense related to our restricted and deferred stock was $149 million at December 31, 2009 and is expected to be

recognized over a weighted-average period of two years.

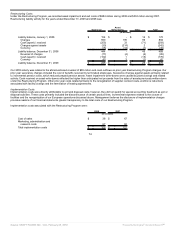

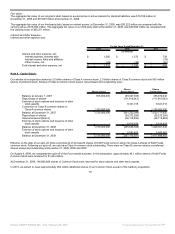

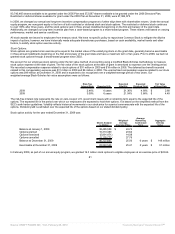

Our restricted and deferred stock activity for the year ended December 31, 2009 was:

Number

of Shares

Weighted-Average

Grant Date Fair

Value Per Share

Balance at January 1, 2009

15,250,805 $ 31.46

Granted 5,778,201 24.68

Vested (6,071,661) 30.12

Forfeited (1,102,392) 30.57

Balance at December 31, 2009 13,854,953 29.30

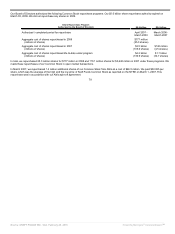

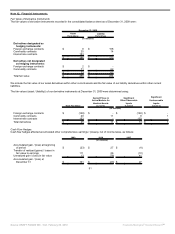

In January 2009, we granted 1.5 million shares of stock in connection with our long-term incentive plan, and the market value per share was

$27.00 on the date of grant. In February 2009, as part of our annual equity program, we issued 4.1 million shares of restricted and deferred stock

to eligible employees, and the market value per restricted or deferred share was $23.64 on the date of grant. We also issued 0.2 million off-cycle

shares of restricted and deferred stock during 2009, and the weighted-average market value per restricted or deferred share was $25.55 on the

date of grant.

In January 2008, we granted 1.4 million shares of stock in connection with our long-term incentive plan, and the market value per share was

$32.26 on the date of grant. In February 2008, as part of our annual equity program, we issued 3.4 million shares of restricted and deferred stock

to eligible employees, and the market value per restricted or deferred share was $29.49 on the date of grant. We also issued 0.2 million off-cycle

shares of restricted and deferred stock during 2008, and the weighted-average market value per restricted or deferred share was $30.38 on the

date of grant. The total number of restricted and deferred shares issued in 2008 was 5.0 million.

In January 2007, we issued 5.2 million shares of restricted and deferred stock to eligible employees as part of our annual equity program, and the

market value per restricted or deferred share was $34.655 on the date of grant.

82

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠