Kraft 2009 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

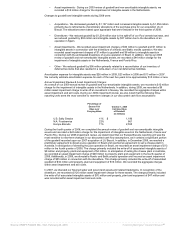

taxes. This amount was reflected as a component of the change in other current assets within the net

cash provided by operating activities section of the consolidated statement of cash flows.

In July 2006, new guidance was issued which addressed accounting for the uncertainty in income

taxes. We adopted the guidance effective January 1, 2007. The guidance clarified when tax benefits

should be recorded in the financial statements and provided measurement criteria for valuing such

benefits. In order for us to recognize benefits, our tax position must be more likely than not to be

sustained upon audit. The amount we recognize is measured as the largest amount of benefit that is

greater than 50 percent likely of being realized upon ultimate settlement. Before the implementation of

the guidance, we established additional provisions for certain positions that were likely to be

challenged even though we believe that those existing tax positions were fully supportable. The

adoption of this guidance resulted in an increase to equity as of January 1, 2007 of $213 million.

We recognize deferred tax assets for deductible temporary differences, operating loss carryforwards

and tax credit carryforwards. Deferred tax assets are reduced by a valuation allowance if it is more

likely than not that some portion, or all, of the deferred tax assets will not be realized.

Reclassification:

In 2009, we separately disclosed other non-cash expense, net within the net cash provided by

operating activities section of the consolidated statement of cash flows and made conforming changes

to the presentation in prior years. This change did not have an impact on cash provided by operating

activities for any of the periods presented. In 2009, we also changed our cost assignment methodology

for headquarter functional costs across our operating structure. As a result, we reclassified $188

million in 2008 and $83 million in 2007 from marketing, administration and research costs to cost of

sales. This change did not have an impact on net earnings for any of the periods presented.

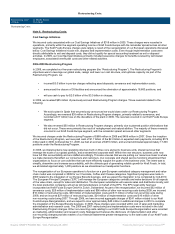

New Accounting Pronouncements:

In September 2006, new guidance was issued on fair value measurements. The guidance defines fair

value, establishes a framework for measuring fair value and expands disclosures about fair value

measurements. The effective date of the guidance for items recognized or disclosed at fair value on an

annual or more frequently recurring basis was January 1, 2008. The effective date of the guidance for

all other nonfinancial assets and liabilities was January 1, 2009. As such, we partially adopted the

guidance effective January 1, 2008. The partial adoption of this guidance did not have a material

impact on our financial statements. We adopted the remaining provisions effective January 1, 2009.

This adoption affects the way that we calculate fair value for our annual impairment review of goodwill

and non-amortizable intangible assets, and when conditions exist that require us to calculate the fair

value of long-lived assets; however, this adoption did not have a material impact on our financial

statements.

In December 2007, new guidance was issued on business combinations. We adopted the guidance

effective January 1, 2009. The guidance requires the acquiring entity in a business combination to

recognize all assets acquired and liabilities assumed in the transaction; establishes the

acquisition-date fair value as the measurement objective for all assets acquired and liabilities

assumed; and requires the acquirer to disclose all information needed by investors to understand the

nature and financial effect of the business combination. The adoption of this guidance did not have a

material impact on our financial statements.

In December 2007, new guidance was also issued on noncontrolling interests in consolidated financial

statements. We adopted the guidance effective January 1, 2009. The guidance requires us to classify

noncontrolling interests in subsidiaries as a separate component of equity instead of within other

liabilities. Additionally, transactions between an entity and noncontrolling interests must be treated as

equity transactions. Therefore, they no longer are removed from net income, but rather are accounted

for as equity. The adoption of this guidance did not have a material impact on our financial statements.

In June 2008, new guidance was issued to assist in determining whether instruments granted in

share-based payment transactions are participating securities. We adopted the guidance effective

January 1, 2009. The guidance considers unvested share-based payment awards with the right to

receive nonforfeitable dividends, or their equivalents, participating securities that should be included in

the calculation of EPS under the two-class method. Accordingly, our restricted and deferred stock

awards are now considered participating units in our calculation of EPS. The adoption of this guidance

did not have a material impact on our financial statements.

In May 2009, new guidance was issued on subsequent events that requires management to evaluate

subsequent events through the date the financial statements are either issued or available to be

issued, depending on the company’s expectation of whether it will widely distribute its financial

statements to its shareholders and other financial statement users. Companies are required to disclose

the date through which subsequent events have been evaluated. We adopted the guidance effective

June 30, 2009.

In June 2009, new guidance was issued on the consolidation of variable interest entities. The

provisions are effective for Kraft Foods as of January 1, 2010. This guidance improves the financial

reporting by enterprises involved with variable interest entities. We do not expect the adoption of this

guidance to have a material impact on our financial statements.

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠