Kraft 2009 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Debt and Borrowing Arrangements:

Debt and Borrowing Arrangements:

(USD $)

12 Months Ended

12/31/2009

Debt and Borrowing Arrangements: Note 7. Debt and Borrowing Arrangements:

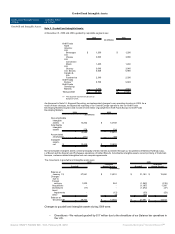

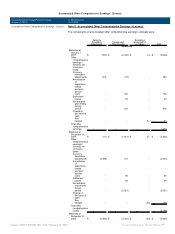

Short-Term Borrowings:

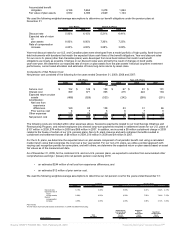

At December 31, 2009 and 2008, our short-term borrowings and related average interest rates consisted of:

2009 2008

Amount

Outstanding

Average

Year-End Rate

Amount

Outstanding

Average

Year-End Rate

(in millions) (in millions)

Commercial paper $ 262 0.5% $ 606 2.6%

Bank loans 191 10.5% 291 13.0%

Total short-term borrowings $ 453 $ 897

The fair values of our short-term borrowings at December 31, 2009 and 2008, based upon current market

interest rates, approximate the amounts disclosed above.

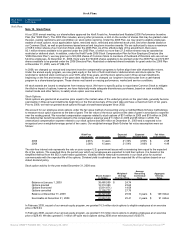

Borrowing Arrangements:

On November 30, 2009, we entered into a revolving credit agreement for a $4.5 billion three-year senior

unsecured revolving credit facility. The agreement replaced our former revolving credit agreement, which was

terminated upon the signing of the new agreement. We intend to use the revolving credit facility for general

corporate purposes, including for working capital purposes, and to support our commercial paper issuances.

No amounts have been drawn on the facility.

The revolving credit agreement requires us to maintain a minimum total shareholders’ equity, excluding

accumulated other comprehensive earnings / (losses), of at least $23.0 billion. Upon the completion of our

acquisition of Cadbury, this covenant will increase by 75% of any increase in our total shareholders’ equity as a

direct result of a) our issuance of certain types of equity securities to finance the acquisition; or b) our

refinancing certain indebtedness. At December 31, 2009, our total shareholders’ equity, excluding accumulated

other comprehensive earnings / (losses), was $29.8 billion. We expect to continue to meet this covenant. The

revolving credit agreement also contains customary representations, covenants and events of default.

However, the revolving credit facility has no other financial covenants, credit rating triggers or provisions that

could require us to post collateral as security.

In addition to the above, some of our international subsidiaries maintain primarily uncommitted credit lines to

meet short-term working capital needs. Collectively, these credit lines amounted to $1.5 billion at December 31,

2009. Borrowings on these lines amounted to $191 million at December 31, 2009 and $291 million at

December 31, 2008.

On November 9, 2009, we entered into an agreement for a £5.5 billion (approximately $8.9 billion) 364-day

senior unsecured bridge facility (the “Cadbury Bridge Facility”). On January 18, 2010, we amended the

agreement to increase the Cadbury Bridge Facility to an aggregate of £7.1 billion. On February 11, 2010, after

the issuance of $9.5 billion of senior unsecured notes, we amended the agreement again to decrease the

Cadbury Bridge Facility to an aggregate of £1.3 billion. We expect to use borrowings under the Cadbury Bridge

Facility and proceeds from other financing sources to finance the Cadbury acquisition and to refinance certain

indebtedness of Cadbury and its subsidiaries. With certain restrictions, borrowings under the Cadbury Bridge

Facility are also available for our general corporate purposes.

The Cadbury Bridge Facility agreement includes the same minimum shareholders’ equity requirement as in our

$4.5 billion revolving credit agreement. In addition, in the event that our long-term senior unsecured

indebtedness is rated below investment grade by either Moody’s or Standard & Poor’s, the Cadbury Bridge

Facility agreement requires us to maintain a net debt to adjusted EBITDA ratio of not more than 4.25 to 1.00. At

December 31, 2009, we continued to maintain our investment grade debt rating, and our net debt to adjusted

EBITDA ratio was 2.64. The Cadbury Bridge Facility agreement also contains customary representations,

covenants and events of default and requires the prepayment of advances and / or the permanent reduction of

commitments under the facility with the net cash proceeds received from certain disposals, debt issuances and

equity capital markets transactions. No amounts were drawn on the facility at December 31, 2009.

Subject to market conditions, we expect to refinance or reduce advances under the Cadbury Bridge Facility

from proceeds of alternative financing sources.

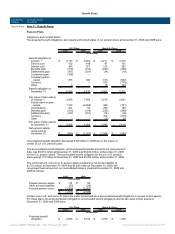

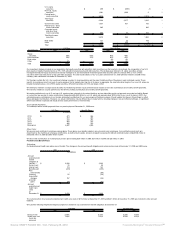

Long-Term Debt:

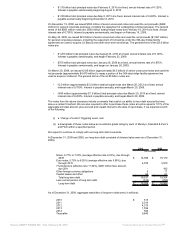

On February 8, 2010, we issued $9.5 billion of senior unsecured notes at a weighted-average effective rate of

5.364% and are using the net proceeds ($9,379 million) to finance the Cadbury acquisition and for general

corporate purposes. The general terms of the $9.5 billion notes are:

• $3.75 billion total principal notes due February 10, 2020 at a fixed, annual interest rate of 5.375%.

Interest is payable semiannually beginning August 10, 2010.

• $3.00 billion total principal notes due February 9, 2040 at a fixed, annual interest rate of 6.500%.

Interest is payable semiannually beginning August 9, 2010.

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠