Kraft 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

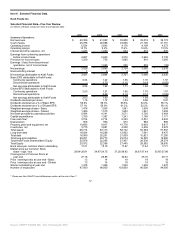

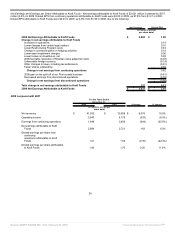

Net Revenues - Net revenues increased $6,074 million (16.9%) to $41,932 million in 2008, and organic net revenues increased $2,394 million

(6.8%) to $37,818 million as follows. Please see Non-GAAP Financial Measures section at the end of this Item.

Change in net revenues (by percentage point)

Higher net pricing 7.4pp

2008 favorable resolution of a Brazilian value added tax claim 0.2pp

Unfavorable volume/mix (0.8)pp

Total change in organic net revenues 6.8%

2007 LU Biscuit acquisition 8.9pp

Favorable foreign currency 2.0pp

Impact of divestitures (0.8)pp

Total change in net revenues 16.9%

Net revenues increased as we increased pricing to offset higher input costs and investments in our brands. Unfavorable volume/mix was driven by

lower base business shipments, partially offset by improved product mix primarily in Kraft Foods Europe and Kraft Foods Developing Markets.

Higher base business shipments in our Canada & N.A. Foodservice, Kraft Foods Developing Markets and U.S. Convenient Meals segments were

more than offset by declines in our remaining business segments. Our LU Biscuit acquisition was the largest increase to net revenues as no 2007

revenues were recorded due to the year-end acquisition timing. Foreign currency increased net revenues by $711 million, due primarily to the

strength of the euro, Brazilian real, Polish zloty and Canadian dollar against the U.S. dollar.

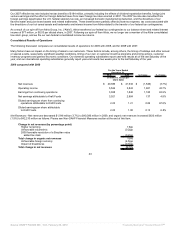

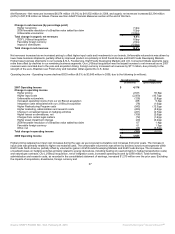

Operating Income - Operating income declined $333 million (8.0%) to $3,843 million in 2008, due to the following (in millions):

Operating Income Change

(in millions) (percentage point)

2007 Operating Income $ 4,176

Change in operating income

Higher pricing 2,633 55.9pp

Higher input costs (2,059) (43.7)pp

Unfavorable volume/mix (128) (2.8)pp

Increased operating income from our LU Biscuit acquisition 438 9.3pp

Integration costs associated with our LU Biscuit acquisition (78) (1.6)pp

Higher Restructuring Program costs (542) (12.3)pp

Higher marketing, administration and research costs (280) (5.9)pp

Change in unrealized losses on hedging activities (221) (4.7)pp

Higher losses on divestitures, net (106) (2.6)pp

Charges from certain legal matters (72) (1.6)pp

Higher asset impairment charges (20) (0.2)pp

2008 favorable resolution of a Brazilian value added tax claim 67 1.4pp

Favorable foreign currency 61 1.3pp

Other, net (26) (0.5)pp

Total change in operating income (333) (8.0)%

2008 Operating Income $ 3,843

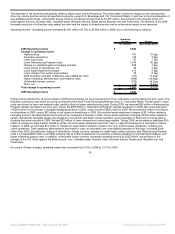

Higher pricing outpaced our input cost increases during the year, as we recovered cumulative cost increases from prior years. The increase in

input costs was primarily related to higher raw material costs. The unfavorable volume/mix was driven by declines across most segments within

Kraft Foods North America, partially offset by volume/mix gains in Kraft Foods Developing Markets and Kraft Foods Europe. The increase in

unrealized losses on hedging activities primarily related to energy derivatives, including heating oil (used primarily to hedge transportation costs)

and natural gas contracts. Our LU Biscuit acquisition, net of integration costs, increased operating income by $360 million. Total marketing,

administration and research costs, as recorded in the consolidated statement of earnings, increased $1,275 million over the prior year. Excluding

the impacts of acquisitions, divestitures, foreign currency and

27

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠