Kraft 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

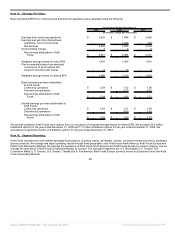

Our 2008 effective tax rate included net tax benefits of $222 million from discrete tax events. Of the total net tax benefits, approximately $50

million related to fourth quarter corrections of state, federal and foreign tax liabilities and a third quarter reconciliation of our inventory of deferred

tax items that resulted in a write-down of our net deferred tax liabilities. The remaining net tax benefits primarily related to the resolution of various

tax audits and the expiration of statutes of limitations in various jurisdictions. Other discrete tax benefits included the impact from divestitures of a

Nordic and Baltic snacks operation and several operations in Spain and the tax benefit from impairment charges taken in 2008. In addition, the

2008 tax rate benefited from foreign earnings taxed below the U.S. federal statutory tax rate and from the expected tax benefit of 2008

restructuring expenses. These benefits were only partially offset by state tax expense and certain foreign costs.

Our 2007 effective tax rate included net tax benefits of $184 million, primarily including the effects of dividend repatriation benefits, foreign joint

venture earnings, and the effect on foreign deferred taxes from lower foreign tax rates enacted in 2007. The 2007 tax rate also benefited from

foreign earnings taxed below the U.S. federal statutory tax rate, an increased domestic manufacturing deduction and the divestiture of our flavored

water and juice brand assets and related trademarks. These benefits were partially offset by state tax expense, tax costs associated with the

divestiture of our hot cereal assets and trademarks and interest income from Altria related to the transfer of our federal tax contingencies

discussed in Note 1, Summary of Significant Accounting Policies.

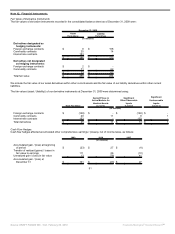

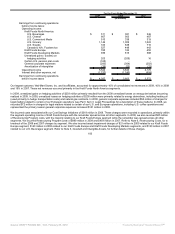

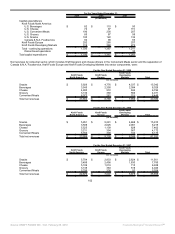

The tax effects of temporary differences that gave rise to deferred income tax assets and liabilities consisted of the following at December 31,

2009 and 2008:

2009 2008

(in millions)

Deferred income tax assets:

Accrued postretirement and post employment benefits $ 1,472 $ 1,467

Accrued pension costs 456 703

Other 1,997 2,324

Total deferred income tax assets 3,925 4,494

Valuation allowance (97) (84)

Net deferred income tax assets $ 3,828 $ 4,410

Deferred income tax liabilities:

Trade names $ (4,431) $ (4,431)

Property, plant and equipment (2,029) (1,862)

Other (1,055) (1,239)

Total deferred income tax liabilities (7,515) (7,532)

Net deferred income tax liabilities $ (3,687) $ (3,122)

97

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠