Kraft 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

maintain our target asset allocation by rebalancing between equity and debt asset classes as we make contributions and monthly benefit

payments. We intend to rebalance our plan portfolios by mid-2010 by making contributions and monthly benefit payments.

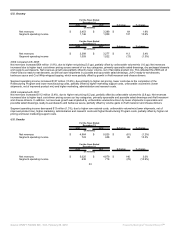

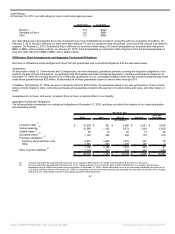

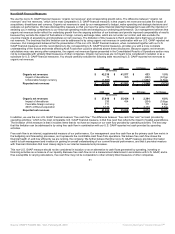

While we do not anticipate further changes in the 2010 assumptions for our U.S. and non-U.S. pension and postretirement health care plans, as a

sensitivity measure, a fifty-basis point change in our discount rate or a fifty-basis point change in the expected rate of return on plan assets would

have the following effects, increase / (decrease) in cost, as of December 31, 2009:

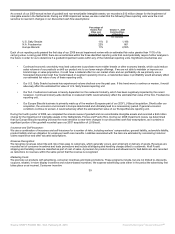

U.S. Plans Non-U.S. Plans

Fifty-Basis-Point Fifty-Basis-Point

Increase Decrease Increase Decrease

(in millions)

Effect of change in discount rate on

pension costs $ (59) $ 59 $ (24) $ 26

Effect of change in expected rate of return

on plan assets on pension costs (30) 30 (18) 18

Effect of change in discount rate on

postretirement health care costs (9) 9 (1) 1

Financial Instruments:

As we operate globally, we use certain financial instruments to manage our foreign currency exchange rate, commodity price and interest rate

risks. We monitor and manage these exposures as part of our overall risk management program. Our risk management program focuses on the

unpredictability of financial markets and seeks to reduce the potentially adverse effects that the volatility of these markets may have on our

operating results. We maintain foreign currency, commodity price and interest rate risk management strategies that seek to reduce significant,

unanticipated earnings fluctuations that may arise from volatility in foreign currency exchange rates, commodity prices and interest rates,

principally through the use of derivative instruments.

Financial instruments qualifying for hedge accounting must maintain a specified level of effectiveness between the hedging instrument and the

item being hedged, both at inception and throughout the hedged period. We formally document the nature of and relationships between the

hedging instruments and hedged items, as well as our risk management objectives, strategies for undertaking the various hedge transactions and

method of assessing hedge effectiveness. Additionally, for hedges of forecasted transactions, the significant characteristics and expected terms of

the forecasted transaction must be specifically identified, and it must be probable that each forecasted transaction will occur. If we deem it

probable that the forecasted transaction will not occur, we recognize the gain or loss in earnings currently.

By using derivatives to hedge exposures to changes in exchange rates and commodity prices, we have exposure on these derivatives to credit

and market risk. We are exposed to credit risk that the counterparty might fail to fulfill its performance obligations under the terms of the derivative

contract. We minimize our credit risk by entering into transactions with high quality counterparties with investment grade credit ratings, limiting the

amount of exposure we have with each counterparty and monitoring the financial condition of our counterparties. In October 2008, one of our

counterparties, Lehman Brothers Commercial Corporation, filed for bankruptcy. Consequently, we wrote off an insignificant asset related to

derivatives held with them. This did not have a significant impact on our foreign currency risk management program. We also maintain a policy of

requiring that all significant, non-exchange traded derivative contracts with a duration greater than one year be governed by an International

Swaps and Derivatives Association master agreement. Market risk is the risk that the value of the financial instrument might be adversely affected

by a change in foreign currency exchange rates, commodity prices, or interest rates. We manage market risk by incorporating monitoring

parameters within our risk management strategy that limit the types of derivative instruments and derivative strategies we use, and the degree of

market risk that may be undertaken by the use of derivative instruments.

We record derivative financial instruments at fair value in our consolidated balance sheets as either current assets or current liabilities. Changes in

the fair value of a derivative that is highly effective and designated as a cash flow hedge, to the extent that the hedge is effective, are recorded

each period either in accumulated other comprehensive earnings / (losses) or in earnings. Gains and losses on derivative instruments reported in

42

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠