Kraft 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012. In addition, we issued 3.0 million shares of restricted stock and stock rights. The market value per restricted share or right was $31.66 on

the date of grant. Restrictions on the majority of these restricted shares and stock rights lapsed in either the first quarter of 2008 or 2009.

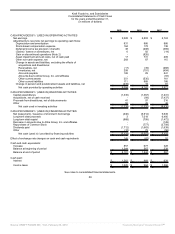

Dividends:

We paid dividends of $1,712 million in 2009, $1,663 million in 2008 and $1,638 million in 2007. The increases of 2.9% in 2009 and 1.5% in 2008

reflect higher dividend rates, partially offset by fewer shares outstanding resulting from the split-off of the Post cereals business and share

repurchases. The present annualized dividend rate is $1.16 per common share. The declaration of dividends is subject to the discretion of our

Board of Directors and depends on various factors, including our net earnings, financial condition, cash requirements, future prospects and other

factors that our Board of Directors deems relevant to its analysis and decision making.

2010 Outlook

We expect the strong operating and financial momentum of our base business to carry forward into coming years. In the near term, we continue to

target organic net revenue growth of 4 percent or more and the high end of our 7 to 9 percent long-term EPS growth objective on our base

business.

We expect to deliver this performance while:

• investing incrementally in product quality, marketing and innovation;

• raising productivity as a percentage of cost of goods sold to greater than 4 percent by 2011;

• leveraging overhead costs by reducing overhead as a percentage of net revenue to approximately 12.5 percent by 2011; and

• restoring operating income margins to industry benchmarks in the mid-teens by 2011.

In addition, our consolidated results will include Cadbury from February 2, 2010, onwards. The combination of Kraft Foods and Cadbury is

expected to provide the potential for meaningful revenue synergies over time from investments in distribution, marketing and product development.

As a result, the combined company is targeting long-term organic net revenue growth of 5 percent or more.

Opportunities for significant synergies from the combination have also been identified. On a combined basis, we continue to expect that pre-tax

cost savings of at least $675 million annually can be realized by the end of 2012. Total one-time implementation cash costs of approximately $1.3

billion are expected to be incurred through the end of 2012.

On a combined basis, we are targeting accretion to earnings per share in 2011 of approximately $0.05 on a cash basis, which excludes one-time

expenses to achieve cost savings, expenses related to the transaction and the impact of incremental non-cash items such as the amortization of

intangibles related to the acquisition. Over the long-term, the combined company is targeting EPS growth of 9 to 11 percent.

Our results will also be affected by the sale of the assets of our Frozen Pizza business, which is expected to close in the first quarter of 2010. We

also expect earnings to be reduced by approximately $0.05 per diluted share on an annual basis as a result of the Frozen Pizza business

transaction. This assumes the proceeds will be used for a combination of debt reduction and share repurchases.

New Accounting Standards

See Note 1, Summary of Significant Accounting Policies, to the consolidated financial statements for a discussion of new accounting standards.

Contingencies

See Note 13, Commitments and Contingencies, to the consolidated financial statements and Part I Item 3. Legal Proceedings for a discussion of

contingencies.

50

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠