Kraft 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

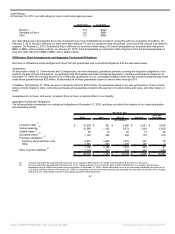

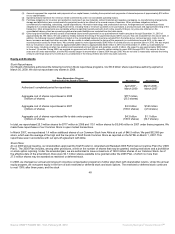

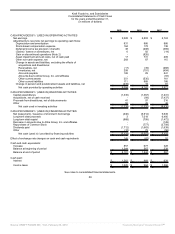

The table below reconciles reported net cash provided by operating activities to free cash flow for the periods stated.

2009 2008 2007

(in millions)

Net Cash Provided by Operating Activities $ 5,084 $ 4,141 $ 3,571

Capital Expenditures (1,330) (1,367) (1,241)

Free cash flow $ 3,754 $ 2,774 $ 2,330

Forward-Looking Statements

This report contains forward-looking statements including how our four priorities will shape our future; our planned sale of our Frozen Pizza

business, including regulatory clearances, number of employees who will transfer and expected close; what our strategy is centered on; our

investments align with growing consumer interest in convenience products and premium brands; our focus on snacks and confectionary products

fits well within our strategy of growth in instant consumption channels; our long-term strategy; our intent to acquire the remaining Cadbury ordinary

shares; our accounting for the sale of our Frozen Pizza business as a discontinued operation in the first quarter of 2010; our continuing

expectation that the exchange with our shareholders related to the split-off of the Post cereals business was tax-free; expectations about LU

biscuits; with regard to our Restructuring Program, our use of cash to pay charges and cumulative annualized savings; in connection with our new

operating structure, that we are putting our resources closer to where we make decisions that affect our consumers and customers and our intent

to simplify, streamline and increase accountability, with the ultimate goal of generating reliable growth for Kraft Foods; why we disclose

implementation charges; our reorganization of our European operations and how we changed the way we work; why we include segment

operating income; our expectation regarding completion of our reorganization of Kraft Foods Europe; expected additional charges to complete the

integration of the Europe Biscuits business and why we disclose implementation and other non-recurring charges; our expectations regarding how

the Venezuelan devaluation will affect our 2010 operating results; our belief that the average cost method of accounting is preferable and will

improve our financial reporting; our uncertainty that the three reporting units could potentially require further analysis in the future to determine if a

goodwill impairment exists, and the significant certainties, including continued economic uncertainty, volume declines, the negative effect of the

recession on restaurant industry and the deteriorating economic environment in Europe that ultimately lead to a recessionary period; our belief that

the ultimate resolution of existing environmental remediation actions and our compliance with environmental laws and regulations will not have a

material effect on our financial results and our uncertainty related to the potential impact of future compliance efforts and environmental

remediation efforts; our belief regarding the assumptions used in recording our plan obligations; with regard to our pension plans, the amount we

expect to make in contributions in 2010, the amount we expect our net pension cost to increase, our expectation regarding the amount the pension

freeze will lower our annual U.S. pension plan costs and our expectation that the enhanced company contribution to our employee savings plan

will not have a significant impact on our 2010 pension plan cost; our expectation for health care trend rates; our anticipated health care cost trend

rate assumption; our discount rate model and expected future cash flows of benefit obligations; that the final outcome of our legal proceedings will

not materially affect our financial results; our 2010 expected rate of return on plan assets; our intent to rebalance our plan portfolios by mid-2010;

that we do not anticipate further changes in the 2010 assumptions for our pension and postretirement health care plans; our risk management

program effects; our exposure relating to derivatives to credit and market risk; our expectation that 2010 commodity costs will be volatile; our

belief regarding our liquidity; that we do expect any negative effects to our funding sources that would have a material effect on our liquidity; our

expectation to fund pension contributions from operations; the element of our growth strategy to strengthen our brand portfolios and / or expand

our geographic reach through disciplined programs of selective acquisitions and divestitures; the impact of future acquisitions or divestitures could

have a material impact on our cash flows; our expectations regarding 2010 capital expenditures; our expectation to fund the repayment of our

long-term debt with cash from operations or short-term borrowings; our intended use of the revolving credit agreement; that we expect to continue

to meet the shareholders’ equity covenant; our expectation that we will continue to comply with our long-term debt covenants; that we expect to

use borrowings under the Cadbury Bridge Facility and proceeds from other financing sources to finance the Cadbury acquisition and to refinance

Cadbury debt; that we expect to refinance or reduce advances under the Cadbury Bridge Facility from proceeds of alternative financing sources;

that guarantees do not have, and we do not expect them to have a material effect on our liquidity; our expectations regarding our aggregate

contractual obligations; and our 2010 Outlook.

52

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠