Kraft 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

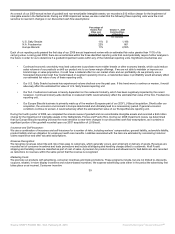

Venezuela - In the fourth quarter of 2009, the Venezuelan economy was classified as highly inflationary under accounting principles generally

accepted in the United States of America (“U.S. GAAP”). Effective January 1, 2010, our Venezuelan subsidiary is being accounted for under highly

inflationary accounting rules, which principally means all transactions are recorded in U.S. dollars. Venezuela has three exchange rates: the

official rate, the consumer staples rate and the secondary (or parallel) rate. We have historically used and will continue to use the official rate to

translate our Venezuelan operations. However, prior to this change in accounting, cash that we had exchanged into U.S. dollars using the

secondary market was carried at that rate. Upon the change to highly inflationary accounting, we were required to translate our U.S. dollars on

hand using the official rate. Additionally, on January 8, 2010, the Venezuelan government devalued its currency. Accordingly, we were required to

revalue our net assets in Venezuela and we recorded an insignificant loss, which will be reflected in our first quarter 2010 results. We expect our

2010 operating results to be negatively impacted by $75 million to $100 million as a result of the aforementioned devaluation. This disclosure does

not reflect the impacts of our recent acquisition activity.

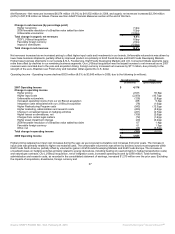

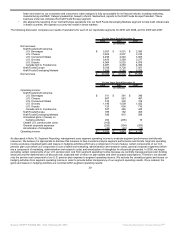

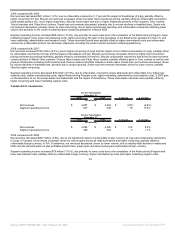

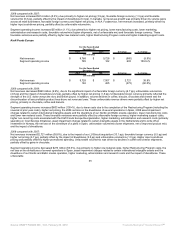

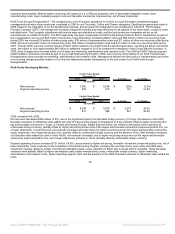

2008 compared with 2007:

Net revenues increased $2,273 million (38.0%), due primarily to the impact of our LU Biscuit acquisition (15.9 pp), higher net pricing (11.0 pp),

favorable volume/mix (5.4 pp), favorable foreign currency (4.7 pp) and the favorable resolution of a Brazilian value added tax claim (1.1 pp). In

Central & Eastern Europe, Middle East & Africa, net revenues increased, driven by higher net pricing across the region, volume growth in

chocolate, biscuits and coffee categories, our LU Biscuit acquisition and favorable foreign currency. In Latin America, net revenues increased,

driven by favorable foreign currency, higher net pricing, the favorable resolution of a value added tax claim and favorable volume/mix in Brazil;

higher net pricing and improved product mix in Argentina; and higher net pricing and favorable volume/mix in Venezuela. In Asia Pacific, net

revenues increased due primarily to our LU Biscuit acquisition, higher net pricing across the region and favorable foreign currency.

Segment operating income increased $227 million (38.6%) due to higher net pricing, favorable volume/mix, the impact of our LU Biscuit acquisition

(net of associated integration costs), the favorable resolution of a Brazilian value added tax claim, and favorable foreign currency. These favorable

variances were partially offset by higher raw material costs, higher manufacturing costs, higher marketing, administration and research costs,

higher Restructuring Program costs, higher marketing support costs, 2008 asset impairment charges related to certain international intangible

assets, a juice operation in Brazil and a cheese plant in Australia and a 2007 gain on the divestiture of our sugar confectionery assets in Romania

and related trademarks.

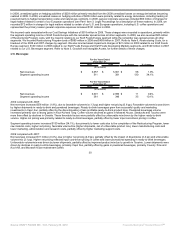

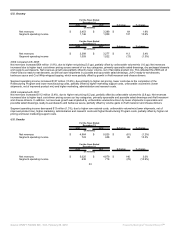

Critical Accounting Policies

Note 1, Summary of Significant Accounting Policies, to the consolidated financial statements includes a summary of the significant accounting

policies we used to prepare our consolidated financial statements. We have discussed the selection and disclosure of our critical accounting

policies and estimates with our Audit Committee. The following is a review of the more significant assumptions and estimates, as well as the

accounting policies we used to prepare our consolidated financial statements.

Principles of Consolidation:

The consolidated financial statements include Kraft Foods, as well as our wholly owned and majority owned subsidiaries. Our domestic operating

subsidiaries report year-end results as of the last Saturday of the year, and our international operating subsidiaries generally report year-end

results two weeks prior to the last Saturday of the year.

We account for investments in which we exercise significant influence (20% - 50% ownership interest) under the equity method of accounting. We

use the cost method of accounting for investments in which we have an ownership interest of less than 20% and in which we do not exercise

significant influence. Noncontrolling interest in subsidiaries consists of the equity interest of noncontrolling investors in consolidated subsidiaries of

Kraft Foods. All intercompany transactions are eliminated.

Use of Estimates:

We prepare our financial statements in accordance with U.S. GAAP, which requires us to make estimates and assumptions that affect a number of

amounts in our financial statements. Significant accounting policy elections, estimates and assumptions include, among others, pension and

benefit plan assumptions, lives and valuation assumptions of goodwill and intangible assets, marketing programs and income taxes. We base our

estimates on

37

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠