Kraft 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

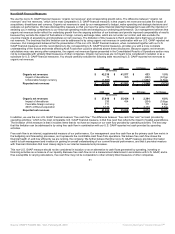

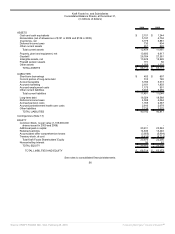

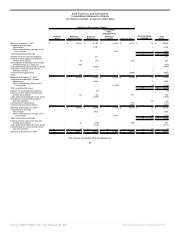

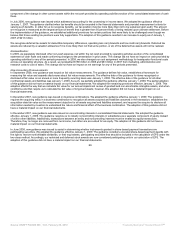

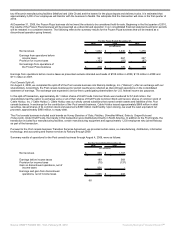

Kraft Foods Inc. and Subsidiaries

Consolidated Statements of Cash Flows

for the years ended December 31,

(in millions of dollars)

2009 2008 2007

CASH PROVIDED BY / (USED IN) OPERATING ACTIVITIES

Net earnings $ 3,028 $ 2,893 $ 2,724

Adjustments to reconcile net earnings to operating cash flows:

Depreciation and amortization 931 986 886

Stock-based compensation expense 164 178 136

Deferred income tax provision / (benefit) 38 (208) (389)

(Gains) / losses on divestitures, net 6 92 (14)

Gain on discontinued operations (Note 2) - (926) -

Asset impairment and exit costs, net of cash paid 17 731 209

Other non-cash expense, net 269 87 115

Change in assets and liabilities, excluding the effects of

acquisitions and divestitures:

Receivables, net (17) (39) (268)

Inventories, net 299 (151) (404)

Accounts payable 126 29 241

Amounts due to Altria Group, Inc. and affiliates - - (93)

Other current assets 351 (535) 161

Other current liabilities 111 985 186

Change in pension and postretirement assets and liabilities, net (239) 19 81

Net cash provided by operating activities 5,084 4,141 3,571

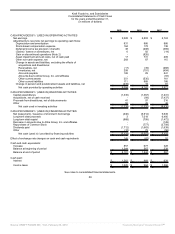

CASH PROVIDED BY / (USED IN) INVESTING ACTIVITIES

Capital expenditures (1,330) (1,367) (1,241)

Acquisitions, net of cash received - (99) (7,437)

Proceeds from divestitures, net of disbursements 41 97 216

Other 50 49 46

Net cash used in investing activities (1,239) (1,320) (8,416)

CASH PROVIDED BY / (USED IN) FINANCING ACTIVITIES

Net (repayment) / issuance of short-term borrowings (446) (5,912) 5,649

Long-term debt proceeds 3 7,018 6,495

Long-term debt repaid (968) (795) (1,472)

Decrease in amounts due to Altria Group, Inc. and affiliates - - (149)

Repurchase of Common Stock - (777) (3,708)

Dividends paid (1,712) (1,663) (1,638)

Other (10) 72 (56)

Net cash (used in) / provided by financing activities (3,133) (2,057) 5,121

Effect of exchange rate changes on cash and cash equivalents 145 (87) 52

Cash and cash equivalents:

Increase 857 677 328

Balance at beginning of period 1,244 567 239

Balance at end of period $ 2,101 $ 1,244 $ 567

Cash paid:

Interest $ 1,262 $ 968 $ 628

Income taxes $ 1,025 $ 964 $ 1,366

See notes to consolidated financial statements.

58

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠