Kraft 2009 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

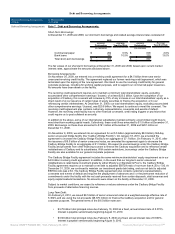

On August 4, 2008, we completed the split-off of the Post cereals business into Ralcorp Holdings, Inc.

(“Ralcorp”), after an exchange with our shareholders. Accordingly, the Post cereals business prior period results

were reflected as discontinued operations on the consolidated statement of earnings. The exchange was

expected to be tax-free to participating shareholders for U.S. federal income tax purposes.

In this split-off transaction, approximately 46.1 million shares of Kraft Foods Common Stock were tendered for

$1,644 million. Our shareholders had the option to exchange some or all of their shares of Kraft Foods Common

Stock and receive shares of common stock of Cable Holdco, Inc. (“Cable Holdco”). Cable Holdco was our wholly

owned subsidiary that owned certain assets and liabilities of the Post cereals business. In exchange for the

contribution of the Post cereals business, Cable Holdco issued approximately $665 million in debt securities,

issued shares of its common stock and assumed a $300 million credit facility. Upon closing, we used the cash

equivalent net proceeds, approximately $960 million, to repay debt.

The Post cereals business included such brands as Honey Bunches of Oats, Pebbles, Shredded Wheat, Selects,

Grape-Nuts and Honeycomb. Under Kraft Foods, the brands in this transaction were distributed primarily in North

America. In addition to the Post brands, the transaction included four manufacturing facilities, certain

manufacturing equipment and approximately 1,230 employees who joined Ralcorp as part of the transaction.

Pursuant to the Post cereals business Transition Services Agreement, we provided certain sales,

co-manufacturing, distribution, information technology, and accounting and finance services to Ralcorp through

2009.

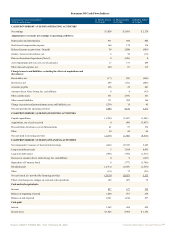

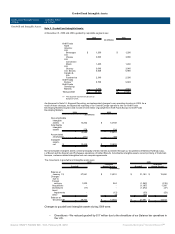

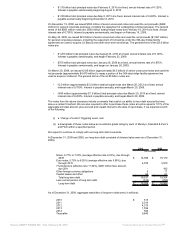

Summary results of operations for the Post cereals business through August 4, 2008, were as follows:

For the Years Ended December 31,

2008 2007

(in millions)

Net revenues $ 666 $ 1,107

Earnings before income taxes 189 369

Provision for income taxes (70) (137)

Gain on discontinued operations, net of

income taxes 926 -

Earnings and gain from discontinued

operations, net of income taxes $ 1,045 $ 232

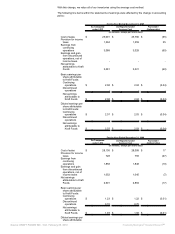

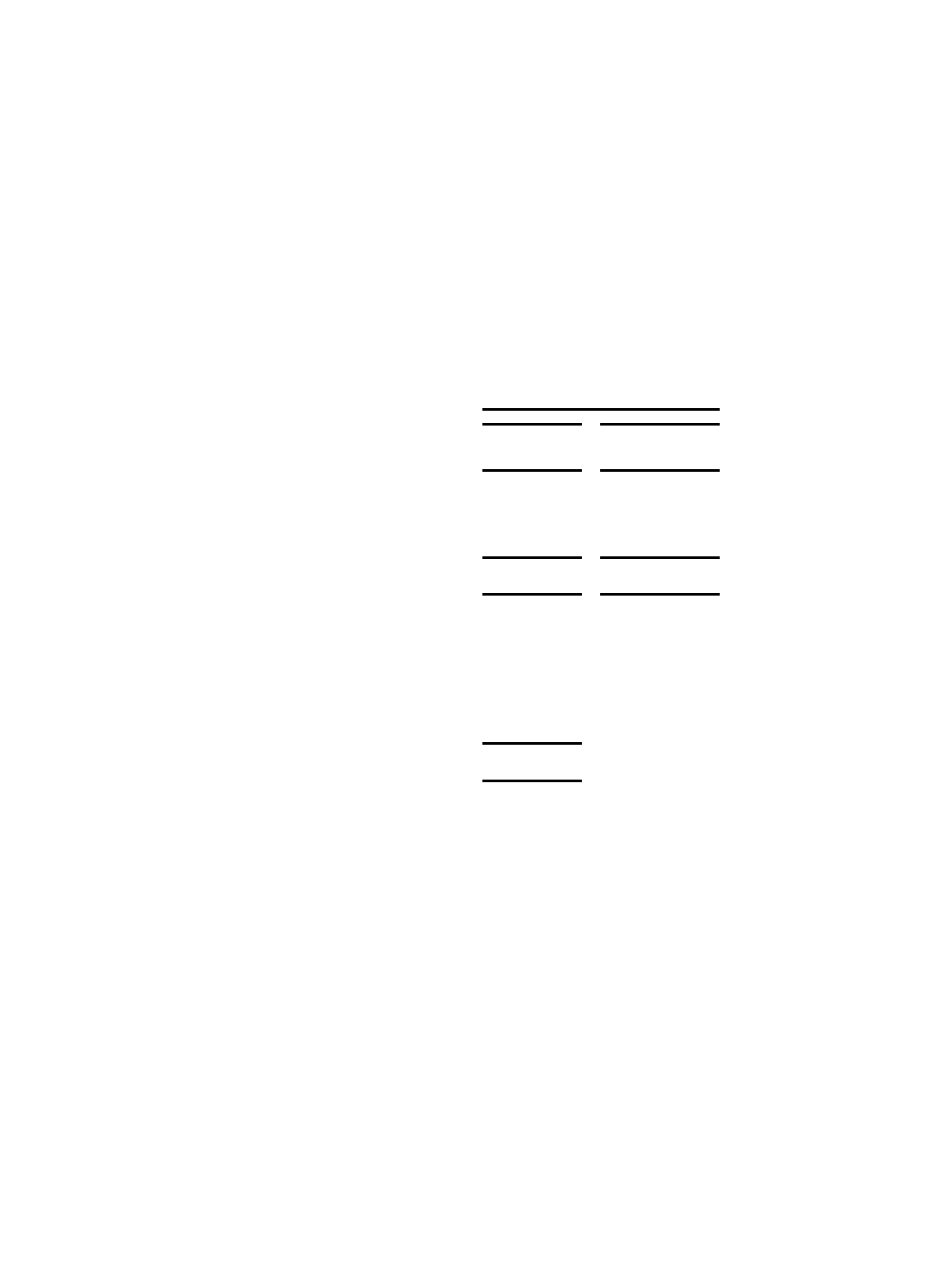

The following assets of the Post cereals business were included in the Post split-off (in

millions):

Inventories, net $ 94

Property, plant and equipment, net 425

Goodwill 1,234

Other assets 11

Other liabilities (3)

Distributed assets of the Post cereals

business $ 1,761

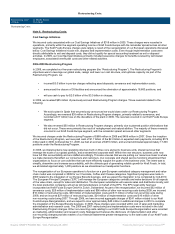

LU Biscuit Acquisition:

On November 30, 2007, we acquired the Groupe Danone S.A. global LU biscuit business (“LU Biscuit”) for €

5.1 billion (approximately $7.6 billion) in cash. The acquisition included 32 manufacturing facilities and approximately

14,000 employees. During 2008, we repaid Groupe Danone S.A. for excess cash received upon the acquisition. LU

Biscuit reports results from operations on a one month lag; accordingly, there was no effect on our 2007 operating

results. On a proforma basis, LU Biscuit would have contributed net revenues of $2.8 billion during 2007, and LU

Biscuit’s contribution to net earnings would have been insignificant to Kraft Foods.

Other Divestitures:

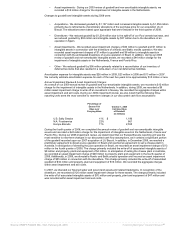

In 2009, we received $41 million in net proceeds and recorded pre-tax losses of $6 million on the divestitures of our

Balance bar operations in the U.S., a juice operation in Brazil and a plant in Spain. We recorded after-tax gains of

$58 million on these divestitures, primarily due to the differing book and tax bases of our Balance bar operations.

In 2008, we received $153 million in net proceeds, and recorded pre-tax losses of $92 million on divestitures,

primarily related to a Nordic and Baltic snacks operation and four operations in Spain. We recorded after-tax losses

of $64 million on these divestitures.

Included in the 2008 divestitures were the following, which were a condition of the EU Commission’s approval of our

LU Biscuit acquisition:

• We divested a biscuit operation in Spain. From this divestiture, we received $86 million in net proceeds and

recorded pre-tax losses of $74 million.

• We divested another biscuit operation in Spain and a trademark in Hungary that we had previously

acquired as part of the LU Biscuit acquisition. As such, the impacts of these divestitures were reflected as

adjustments to the purchase price allocations.

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠