Kraft 2009 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Asset impairments - During our 2009 review of goodwill and non-amortizable intangible assets, we

recorded a $12 million charge for the impairment of intangible assets in the Netherlands.

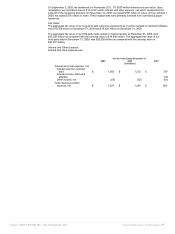

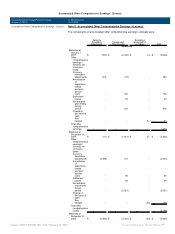

Changes to goodwill and intangible assets during 2008 were:

• Acquisitions - We decreased goodwill by $1,187 million and increased intangible assets by $1,356 million

primarily due to refinements of preliminary allocations of the purchase price for our acquisition of LU

Biscuit. The allocations were based upon appraisals that were finalized in the third quarter of 2008.

• Divestitures - We reduced goodwill by $1,234 million due to the split-off of our Post cereals business, and

we reduced goodwill by $38 million and intangible assets by $37 million due to the divestiture of an

operation in Spain.

• Asset impairments - We recorded asset impairment charges of $34 million to goodwill and $1 million to

intangible assets in connection with the divestiture of a Nordic and Baltic snacks operation. We also

recorded asset impairment charges of $1 million to goodwill and $8 million to intangible assets in

connection with the anticipated divestiture of a juice operation in Brazil. In addition, during our 2008

review of goodwill and non-amortizable intangible assets, we recorded a $44 million charge for the

impairment of intangible assets in the Netherlands, France and Puerto Rico.

• Other - We reduced goodwill by $56 million primarily related to a reconciliation of our inventory of

deferred tax items that also resulted in a write-down of our net deferred tax liabilities.

Amortization expense for intangible assets was $26 million in 2009, $23 million in 2008 and $13 million in 2007.

We currently estimate amortization expense for each of the next five years to be approximately $15 million or less.

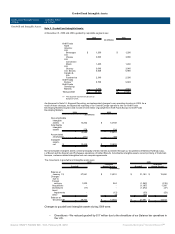

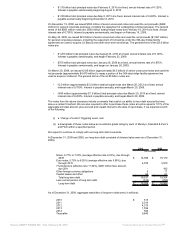

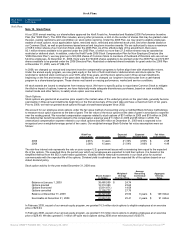

Annual Impairment Review & Asset Impairment Charges:

As a result of our 2009 annual review of goodwill and non-amortizable intangible assets, we recorded a $12 million

charge for the impairment of intangible assets in the Netherlands. In addition, during 2009, we recorded a $9

million asset impairment charge to write off an investment in Norway. We recorded the aggregate charges within

asset impairment and exit costs. During our 2009 impairment review, we also noted that the following three

reporting units were the most sensitive to near-term changes in our discounted cash flow assumptions:

Percentage of

Excess Fair

Value over

Carrying Value

October 1, 2009

Carrying Value

of Goodwill

(in millions)

U.S. Salty Snacks 11% $ 1,186

N.A. Foodservice 22% 861

Europe Biscuits 11% 2,555

During the fourth quarter of 2008, we completed the annual review of goodwill and non-amortizable intangible

assets and recorded a $44 million charge for the impairment of intangible assets in the Netherlands, France and

Puerto Rico. During our 2008 impairment review, we determined that our Europe Biscuits reporting unit was the

most sensitive to near-term changes in our discounted cash flow assumptions, as it contains a significant portion

of the goodwill recorded upon our 2007 acquisition of LU Biscuit. In addition, in December 2008, we reached a

preliminary agreement to divest a juice operation in Brazil and reached an agreement to sell a cheese plant in

Australia. In anticipation of divesting the juice operation in Brazil, we recorded an asset impairment charge of $13

million in the fourth quarter of 2008. The charge primarily included the write-off of associated intangible assets of

$8 million and property, plant and equipment of $4 million. In anticipation of selling the cheese plant in Australia,

we recorded an asset impairment charge of $28 million to property, plant and equipment in the fourth quarter of

2008. Additionally, in 2008, we divested a Nordic and Baltic snacks operation and incurred an asset impairment

charge of $55 million in connection with the divestiture. This charge primarily included the write-off of associated

goodwill of $34 million and property, plant and equipment of $16 million. We recorded the aggregate charges

within asset impairment and exit costs.

In 2007, we divested our flavored water and juice brand assets and related trademarks. In recognition of the

divestiture, we recorded a $120 million asset impairment charge for these assets. The charge primarily included

the write-off of associated intangible assets of $70 million and property, plant and equipment of $47 million and

was recorded within asset impairment and exit costs.

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠