Kraft 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

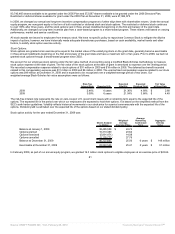

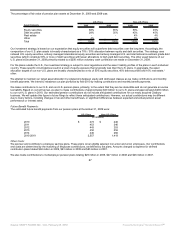

Fair Value:

The aggregate fair value of our long-term debt, based on quoted prices in active markets for identical liabilities, was $19,769 million at

December 31, 2009 and $19,629 million at December 31, 2008.

The aggregate fair value of our third-party debt, based on market quotes, at December 31, 2009, was $20,222 million as compared with the

carrying value of $18,990 million. The aggregate fair value of our third-party debt at December 31, 2008, was $20,526 million as compared with

the carrying value of $20,251 million.

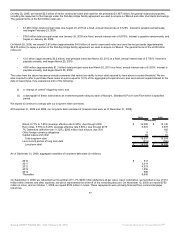

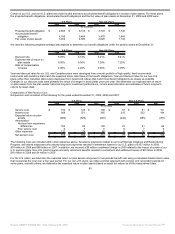

Interest and Other Expense:

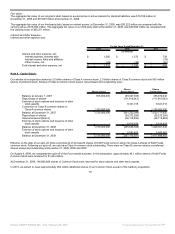

Interest and other expense was:

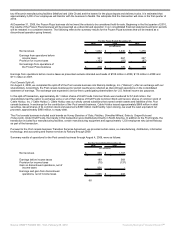

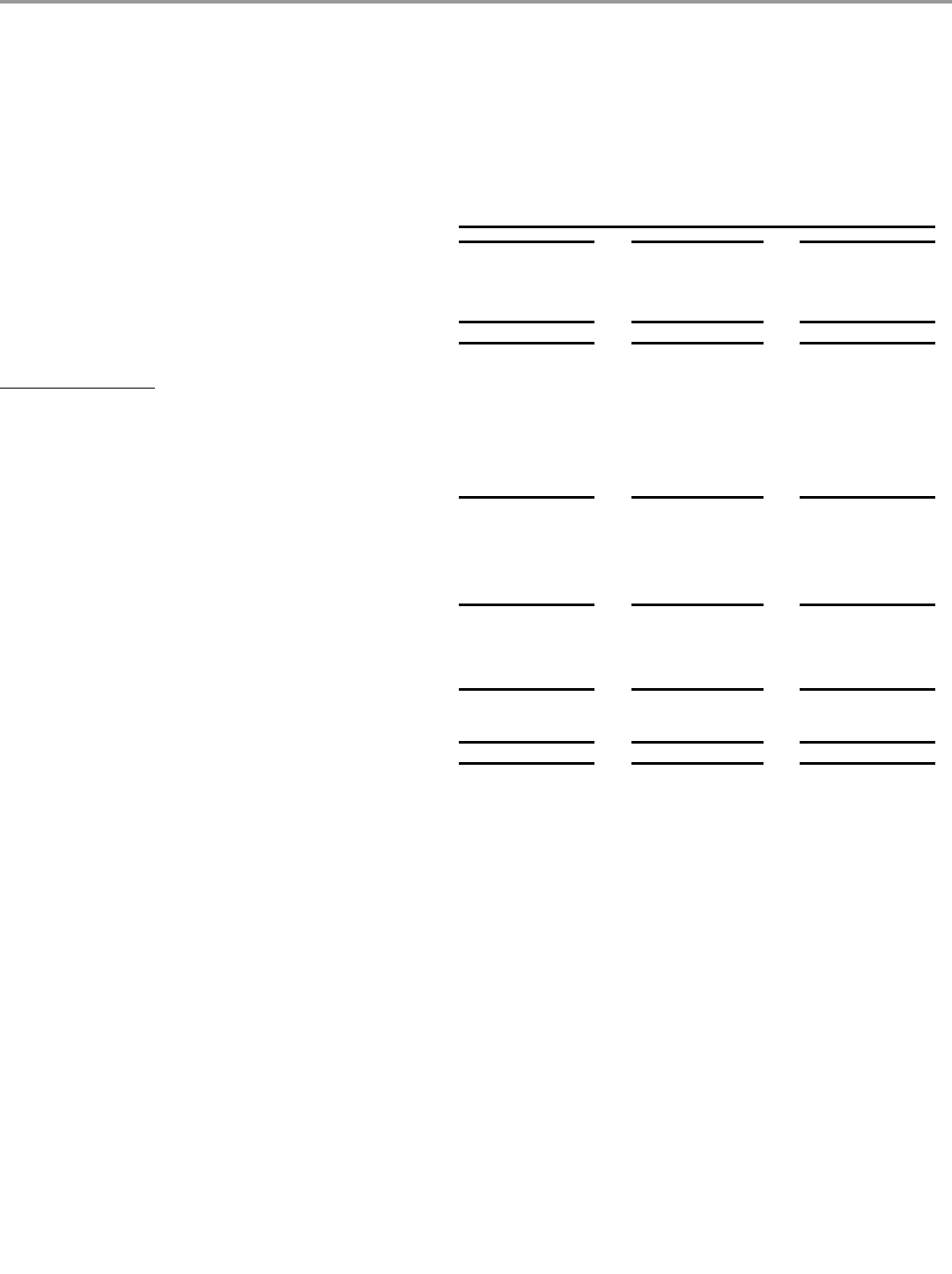

For the Years Ended December 31,

2009 2008 2007

(in millions)

Interest and other expense, net:

Interest expense, external debt $ 1,260 $ 1,272 $ 739

Interest income, Altria and affiliates - - (74)

Other income, net (23) (32) (61)

Total interest and other expense, net $ 1,237 $ 1,240 $ 604

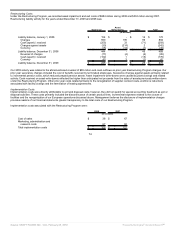

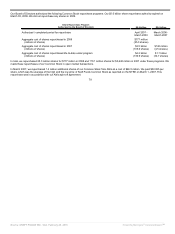

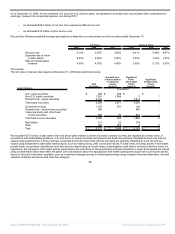

Note 8. Capital Stock:

Our articles of incorporation authorize 3.0 billion shares of Class A common stock, 2.0 billion shares of Class B common stock and 500 million

shares of preferred stock. Shares of Class A common stock issued, repurchased and outstanding were:

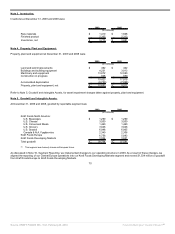

Shares Issued

Shares

Repurchased

Shares

Outstanding

Balance at January 1, 2007 555,000,000 (99,027,355) 455,972,645

Repurchase of shares - (111,516,043) (111,516,043)

Exercise of stock options and issuance of other

stock awards - 9,321,018 9,321,018

Conversion of Class B common shares to

Class A common shares 1,180,000,000 - 1,180,000,000

Balance at December 31, 2007 1,735,000,000 (201,222,380) 1,533,777,620

Repurchase of shares - (25,272,255) (25,272,255)

Shares tendered (Note 2) - (46,119,899) (46,119,899)

Exercise of stock options and issuance of other

stock awards - 6,915,974 6,915,974

Balance at December 31, 2008 1,735,000,000 (265,698,560) 1,469,301,440

Exercise of stock options and issuance of other

stock awards - 8,583,463 8,583,463

Balance at December 31, 2009 1,735,000,000 (257,115,097) 1,477,884,903

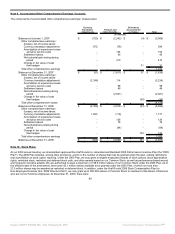

Effective on the date of our spin-off, Altria converted all of its Class B shares of Kraft Foods common stock into Class A shares of Kraft Foods

common stock. Following our spin-off, we only have Class A common stock outstanding. There were no Class B common shares or preferred

shares issued and outstanding at December 31, 2009, 2008 and 2007.

On August 4, 2008, we completed the split-off of the Post cereals business. In this transaction, approximately 46.1 million shares of Kraft Foods

Common Stock were tendered for $1,644 million.

At December 31, 2009, 146,863,809 shares of Common Stock were reserved for stock options and other stock awards.

In 2010, we expect to issue approximately 260 million additional shares of our Common Stock as part of the Cadbury acquisition.

78

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠