Kraft 2009 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Income Taxes:

Income Taxes:

(USD $)

12 Months Ended

12/31/2009

Income Taxes: Note 14. Income Taxes:

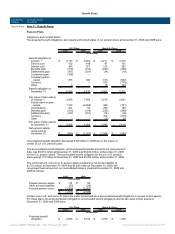

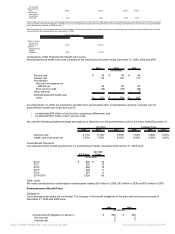

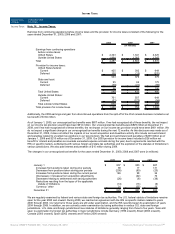

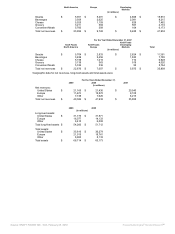

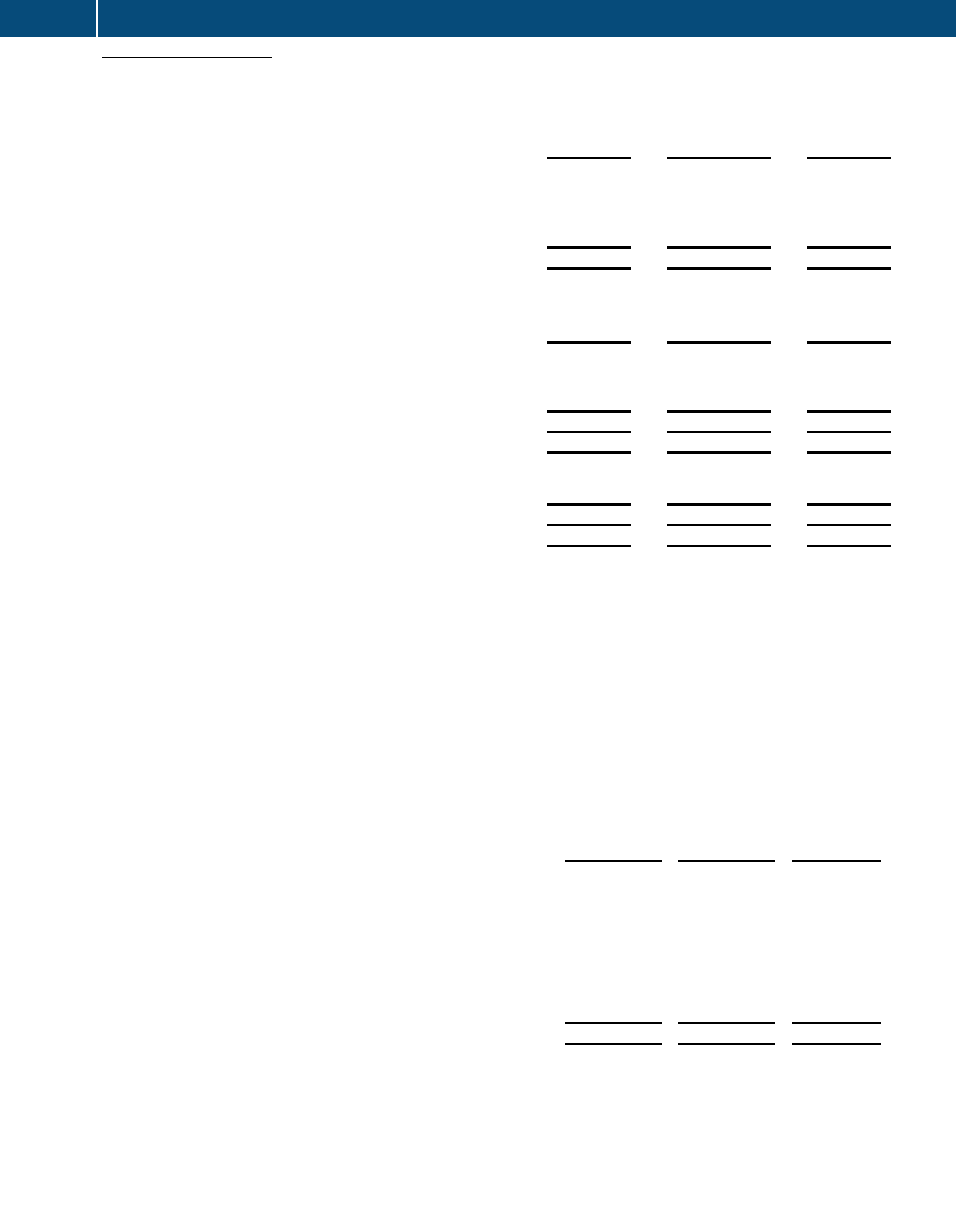

Earnings from continuing operations before income taxes and the provision for income taxes consisted of the following for the

years ended December 31, 2009, 2008 and 2007:

2009 2008 2007

(in millions)

Earnings from continuing operations

before income taxes:

United States $ 2,323 $ 1,341 $ 2,325

Outside United States 1,964 1,262 1,247

Total $ 4,287 $ 2,603 $ 3,572

Provision for income taxes:

United States federal:

Current $ 425 $ 392 $ 649

Deferred 108 (13) (270)

533 379 379

State and local:

Current 95 62 175

Deferred (39) (21) (69)

56 41 106

Total United States 589 420 485

Outside United States:

Current 701 507 649

Deferred (31) (172) (54)

Total outside United States 670 335 595

Total provision for income taxes $ 1,259 $ 755 $ 1,080

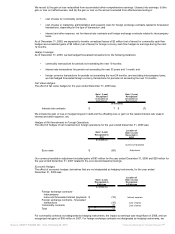

Additionally, the 2008 earnings and gain from discontinued operations from the split-off of the Post cereals business included a net

tax benefit of $104 million.

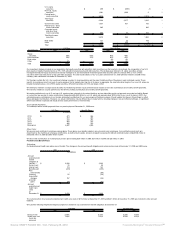

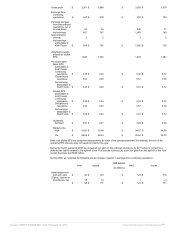

As of January 1, 2009, our unrecognized tax benefits were $807 million. If we had recognized all of these benefits, the net impact

on our income tax provision would have been $612 million. Our unrecognized tax benefits were $829 million at December 31,

2009, and if we had recognized all of these benefits, the net impact on our income tax provision would have been $661 million. We

do not expect a significant change in our unrecognized tax benefits during the next 12 months. As this disclosure was made as of

December 31, 2009, it does not reflect the impacts of our recent acquisition and divestiture activity. We include accrued interest

and penalties related to uncertain tax positions in our tax provision. We had accrued interest and penalties of $239 million as of

January 1, 2009 and $210 million as of December 31, 2009. Our 2009 provision for income taxes included a $26 million net

benefit for interest and penalties as reversals exceeded expense accruals during the year, due to agreements reached with the

IRS on specific matters, settlements with various foreign and state tax authorities and the expiration of the statutes of limitations in

various jurisdictions. We also paid interest and penalties of $10 million during 2009.

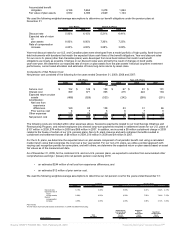

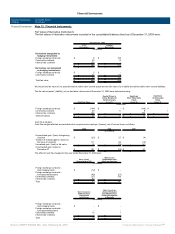

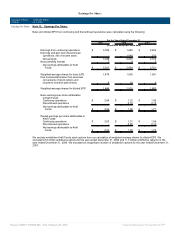

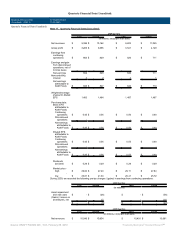

The changes in our unrecognized tax benefits for the years ended December 31, 2009, 2008 and 2007 were (in millions):

2009 2008 2007

January 1 $ 807 $ 850 $ 667

Increases from positions taken during prior periods 90 17 131

Decreases from positions taken during prior periods (205) (90) (23)

Increases from positions taken during the current period 146 98 34

(Decreases) / increases from acquisition adjustments - (22) 72

Decreases relating to settlements with taxing authorities (26) (8) (38)

Reductions resulting from the lapse of the applicable

statute of limitations (14) (13) (6)

Currency / other 31 (25) 13

December 31 $ 829 $ 807 $ 850

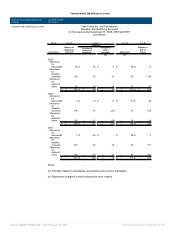

We are regularly examined by federal and various state and foreign tax authorities. The U.S. federal statute of limitations remains

open for the year 2000 and onward. During 2009, we reached an agreement with the IRS on specific matters related to years

2000 through 2003. Our returns for those years are still under examination, and the IRS recently began its examination of years

2004 through 2006. In addition, we are currently under examination by taxing authorities in various U.S. state and foreign

jurisdictions. U.S. state and foreign jurisdictions have statutes of limitations generally ranging from three to five years. Years still

open to examination by foreign tax authorities in major jurisdictions include Germany (1999 onward), Brazil (2003 onward),

Canada (2003 onward), Spain (2002 onward) and France (2006 onward).

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠