Kraft 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On May 22, 2008, we issued $2.0 billion of senior unsecured notes and used the net proceeds ($1,967 million) for general corporate purposes,

including the repayment of borrowings under the 364-day bridge facility agreement we used to acquire LU Biscuit and other short-term borrowings.

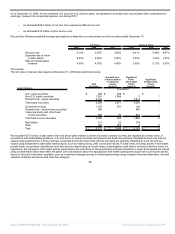

The general terms of the $2.0 billion notes are:

• $1,250 million total principal notes due August 23, 2018 at a fixed, annual interest rate of 6.125%. Interest is payable semiannually,

and began February 23, 2009.

• $750 million total principal notes due January 26, 2039 at a fixed, annual interest rate of 6.875%. Interest is payable semiannually, and

began on January 26, 2009.

On March 20, 2008, we issued €2.85 billion (approximately $4.5 billion) of senior unsecured notes and used the net proceeds (approximately

$4,470 million) to repay a portion of the 364-day bridge facility agreement we used to acquire LU Biscuit. The general terms of the €2.85 billion

notes are:

• €2.0 billion (approximately $3.2 billion) total principal notes due March 20, 2012 at a fixed, annual interest rate of 5.750%. Interest is

payable annually, and began March 20, 2009.

• €850 million (approximately $1.3 billion) total principal notes due March 20, 2015 at a fixed, annual interest rate of 6.250%. Interest is

payable annually, and began March 20, 2009.

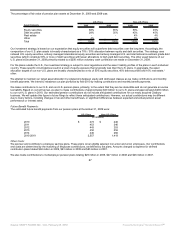

The notes from the above issuances include covenants that restrict our ability to incur debt secured by liens above a certain threshold. We are

also required to offer to purchase these notes at a price equal to 101% of the aggregate principal amount, plus accrued and unpaid interest to the

date of repurchase, if we experience both of the following:

(i) a “change of control” triggering event, and

(ii) a downgrade of these notes below an investment grade rating by each of Moody’s, Standard & Poor’s and Fitch within a specified

period.

We expect to continue to comply with our long-term debt covenants.

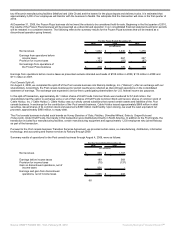

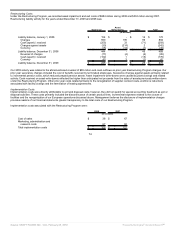

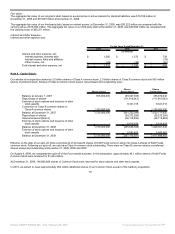

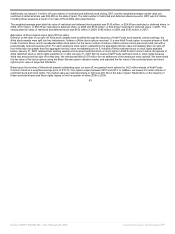

At December 31, 2009 and 2008, our long-term debt consisted of (interest rates were as of December 31, 2009):

2009 2008

(in millions)

Notes, 0.77% to 7.55% (average effective rate 6.23%), due through 2039 $ 14,395 $ 15,130

Euro notes, 5.75% to 6.25% (average effective rate 5.98%), due through 2015 4,072 3,970

7% Debenture (effective rate 11.32%), $200 million face amount, due 2011 - 182

Other foreign currency obligations 5 11

Capital leases and other 65 61

Total long-term debt 18,537 19,354

Less current portion of long term debt (513) (765)

Long-term debt $ 18,024 $ 18,589

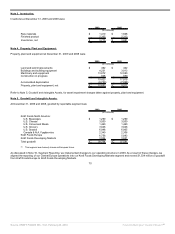

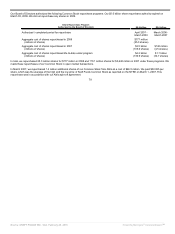

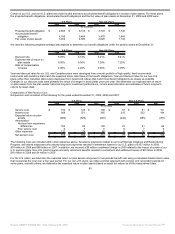

As of December 31, 2009, aggregate maturities of long-term debt were (in millions):

2010 $ 513

2011 2,014

2012 4,373

2013 1,556

2014 506

Thereafter 9,640

On September 3, 2009, we redeemed our November 2011, 7% $200 million debenture at par value. Upon redemption, we recorded a loss of $14

million within interest and other expense, net which represented the write-off of the remaining discount. On November 12, 2009, we repaid $750

million in notes, and on October 1, 2008, we repaid $700 million in notes. These repayments were primarily financed from commercial paper

issuances.

77

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠