Kraft 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

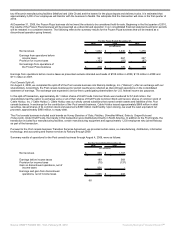

two Wisconsin manufacturing facilities (Medford and Little Chute) and the leases for the pizza depots and delivery trucks. It is estimated that

approximately 3,400 of our employees will transfer with the business to Nestlé. We anticipate that the transaction will close in the first quarter of

2010.

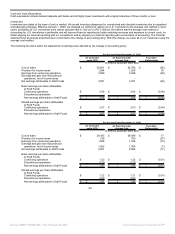

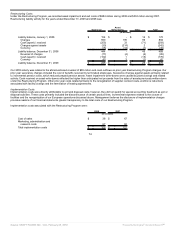

At December 31, 2009, the Frozen Pizza business did not meet the criteria to be considered held-for-sale. Beginning in the first quarter of 2010,

the results of the Frozen Pizza business will be presented as a discontinued operation in our consolidated financial statements and prior periods

will be restated in a consistent manner. The following reflects the summary results for the Frozen Pizza business that will be treated as a

discontinued operation going forward:

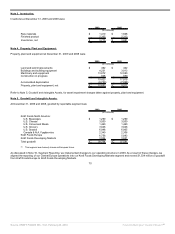

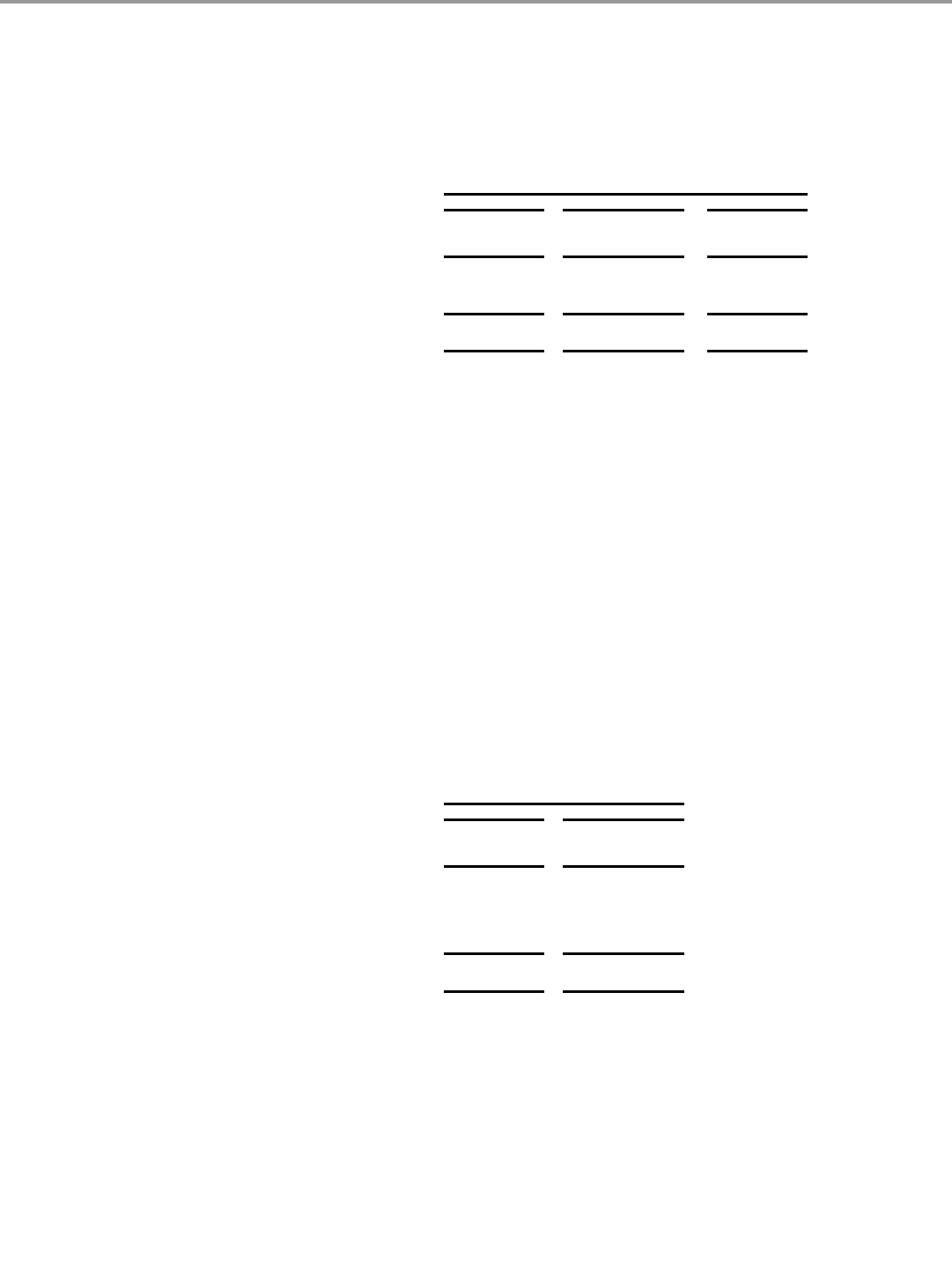

For the Years Ended December 31,

2009 2008 2007

(in millions)

Net revenues $ 1,632 $ 1,440 $ 1,278

Earnings from operations before

income taxes 341 267 237

Provision for income taxes (123) (97) (87)

Net earnings from operations of

the Frozen Pizza business $ 218 $ 170 $ 150

Earnings from operations before income taxes as presented exclude stranded overheads of $108 million in 2009, $112 million in 2008 and

$111 million in 2007.

Post Cereals Split-off:

On August 4, 2008, we completed the split-off of the Post cereals business into Ralcorp Holdings, Inc. (“Ralcorp”), after an exchange with our

shareholders. Accordingly, the Post cereals business prior period results were reflected as discontinued operations on the consolidated

statement of earnings. The exchange was expected to be tax-free to participating shareholders for U.S. federal income tax purposes.

In this split-off transaction, approximately 46.1 million shares of Kraft Foods Common Stock were tendered for $1,644 million. Our

shareholders had the option to exchange some or all of their shares of Kraft Foods Common Stock and receive shares of common stock of

Cable Holdco, Inc. (“Cable Holdco”). Cable Holdco was our wholly owned subsidiary that owned certain assets and liabilities of the Post

cereals business. In exchange for the contribution of the Post cereals business, Cable Holdco issued approximately $665 million in debt

securities, issued shares of its common stock and assumed a $300 million credit facility. Upon closing, we used the cash equivalent net

proceeds, approximately $960 million, to repay debt.

The Post cereals business included such brands as Honey Bunches of Oats, Pebbles, Shredded Wheat, Selects, Grape-Nuts and

Honeycomb. Under Kraft Foods, the brands in this transaction were distributed primarily in North America. In addition to the Post brands, the

transaction included four manufacturing facilities, certain manufacturing equipment and approximately 1,230 employees who joined Ralcorp

as part of the transaction.

Pursuant to the Post cereals business Transition Services Agreement, we provided certain sales, co-manufacturing, distribution, information

technology, and accounting and finance services to Ralcorp through 2009.

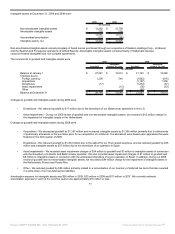

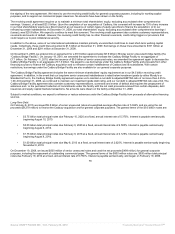

Summary results of operations for the Post cereals business through August 4, 2008, were as follows:

For the Years Ended December 31,

2008 2007

(in millions)

Net revenues $ 666 $ 1,107

Earnings before income taxes 189 369

Provision for income taxes (70) (137)

Gain on discontinued operations, net of

income taxes 926 -

Earnings and gain from discontinued

operations, net of income taxes $ 1,045 $ 232

68

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠