Kraft 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

These forward-looking statements involve risks and uncertainties, and the cautionary statements contained in the “Risk Factors” found in this

Annual Report on Form 10-K identify important factors that could cause actual results to differ materially from those predicted in any such

forward-looking statements. Such factors, include, but are not limited to, continued volatility in commodity costs, pricing actions, increased

competition, our ability to differentiate our products from private label products, increased costs of sales, our indebtedness and our ability to pay

our indebtedness, unexpected safety or manufacturing issues, Food and Drug Administration or other regulatory actions or delays, unanticipated

expenses such as litigation or legal settlement expenses, a shift in our product mix to lower margin offerings, risks from operating globally, our

failure to successfully integrate the Cadbury business and tax law changes. We disclaim and do not undertake any obligation to update or revise

any forward-looking statement in this Form 10-K.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As we operate globally, we use certain financial instruments to manage our foreign currency exchange rate, commodity price and interest rate

risks. We monitor and manage these exposures as part of our overall risk management program. Our risk management program focuses on the

unpredictability of financial markets and seeks to reduce the potentially adverse effects that the volatility of these markets may have on our

operating results. We maintain foreign currency, commodity price and interest rate risk management policies that principally use derivative

instruments to reduce significant, unanticipated earnings fluctuations that may arise from volatility in foreign currency exchange rates, commodity

prices and interest rates. We also sell commodity futures to unprice future purchase commitments, and we occasionally use related futures to

cross-hedge a commodity exposure. We are not a party to leveraged derivatives and, by policy, do not use financial instruments for speculative

purposes. Refer to Note 1, Summary of Significant Accounting Policies, and Note 12, Financial Instruments, to the consolidated financial

statements for further details of our foreign currency, commodity price and interest rate risk management policies and the types of derivative

instruments we use to hedge those exposures.

In October 2008, one of our counterparties, Lehman Brothers Commercial Corporation, filed for bankruptcy. Consequently, we wrote off an

insignificant asset related to derivatives held with them. This did not have a significant impact on our foreign currency risk management program.

Value at Risk:

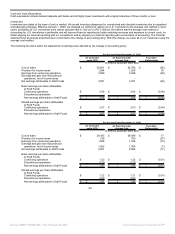

We use a value at risk (“VAR”) computation to estimate: 1) the potential one-day loss in the fair value of our interest rate-sensitive financial

instruments; and 2) the potential one-day loss in pre-tax earnings of our foreign currency and commodity price-sensitive derivative financial

instruments. We included our debt; short-term investments; foreign currency forwards, swaps and options; and commodity futures, forwards and

options in our VAR computation. Anticipated transactions, foreign currency trade payables and receivables, and net investments in foreign

subsidiaries, which the abovementioned instruments are intended to hedge, were excluded from the computation.

We made the VAR estimates assuming normal market conditions, using a 95% confidence interval. We used a “variance / co-variance” model to

determine the observed interrelationships between movements in interest rates and various currencies. These interrelationships were determined

by observing interest rate and forward currency rate movements over the prior quarter for the calculation of VAR amounts at December 31, 2009

and 2008, and over each of the four prior quarters for the calculation of average VAR amounts during each year. The values of foreign currency

and commodity options do not change on a one-to-one basis with the underlying currency or commodity, and were valued accordingly in the VAR

computation.

53

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠