Kraft 2009 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

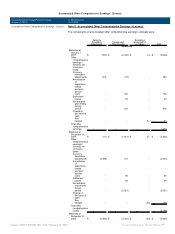

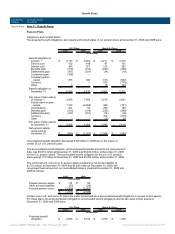

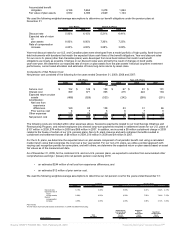

Benefit Plans:

Benefit Plans:

(USD $)

12 Months Ended

12/31/2009

Benefit Plans: Note 11. Benefit Plans:

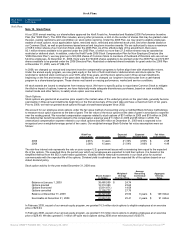

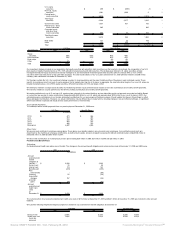

Pension Plans

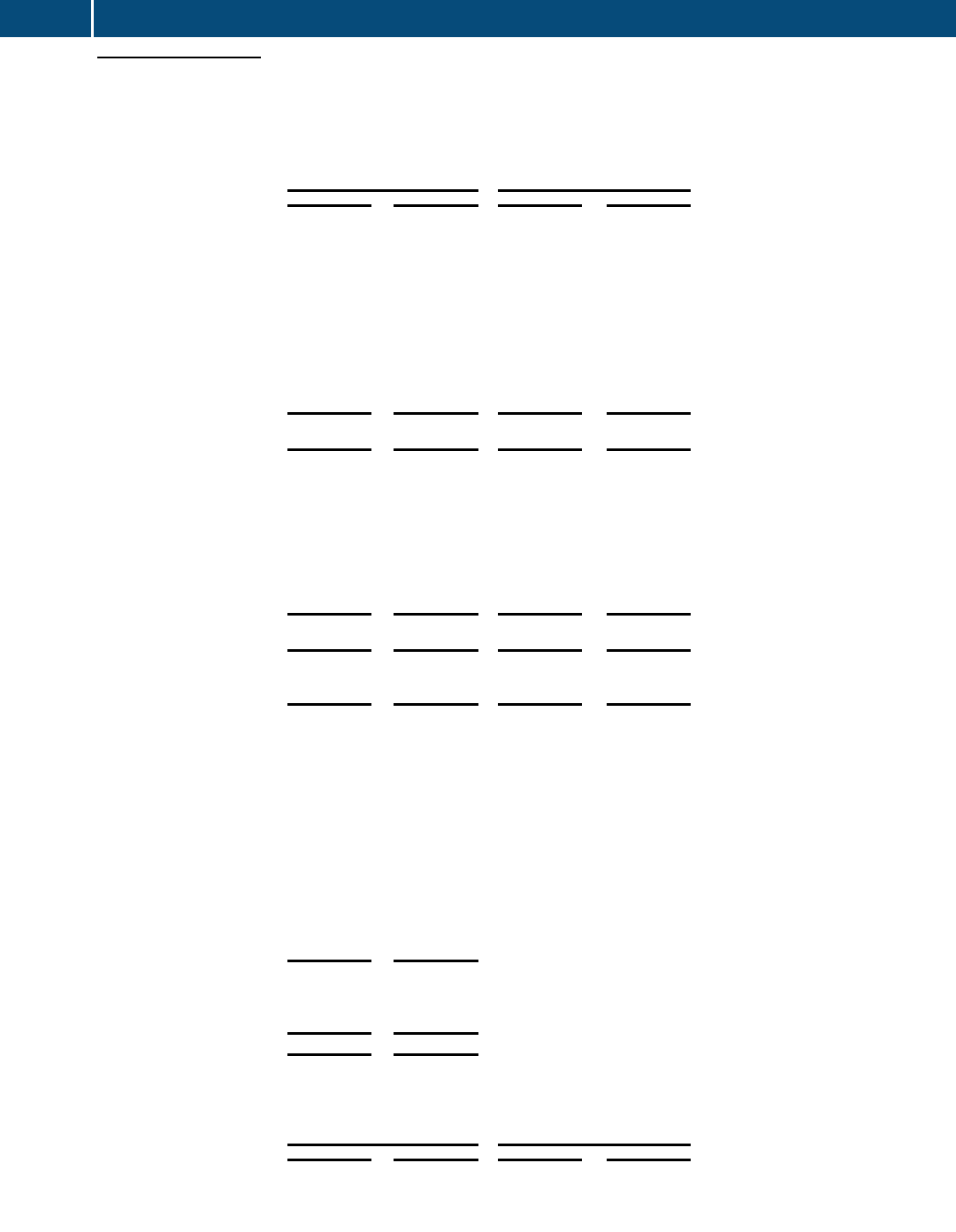

Obligations and Funded Status:

The projected benefit obligations, plan assets and funded status of our pension plans at December 31, 2009 and 2008 were:

U.S. Plans Non-U.S. Plans

2009 2008 2009 2008

(in millions)

Benefit obligation at

January 1 $ 6,133 $ 5,952 $ 3,211 $ 4,275

Service cost 152 149 67 107

Interest cost 369 371 215 257

Benefits paid (310) (314) (225) (269)

Settlements paid (187) (331) (14) (16)

Curtailment gain (168) - - -

Actuarial (gains) /

losses 203 306 619 (542)

Currency - - 510 (710)

Other 3 - 18 109

Benefit obligation at

December 31 6,195 6,133 4,401 3,211

Fair value of plan assets

at January 1 4,386 7,006 2,618 4,041

Actual return on plan

assets 1,180 (2,028) 400 (761)

Contributions 427 53 209 180

Benefits paid (310) (314) (225) (269)

Settlements paid (187) (331) (14) (16)

Currency - - 414 (615)

Other - - (5) 58

Fair value of plan assets

at December 31 5,496 4,386 3,397 2,618

Net pension liability

recognized at

December 31 $ (699) $ (1,747) $ (1,004) $ (593)

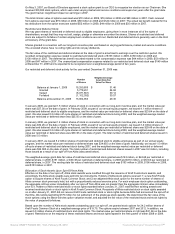

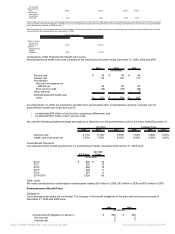

Our projected benefit obligation decreased $168 million in 2009 due to the freeze of

certain of our U.S. pension plans.

The accumulated benefit obligation, which represents benefits earned to the measurement

date, was $5,673 million at December 31, 2009 and $5,464 million at December 31, 2008

for the U.S. pension plans. The accumulated benefit obligation for the non-U.S. pension

plans was $4,115 million at December 31, 2009 and $3,024 million at December 31, 2008.

The combined U.S. and non-U.S. pension plans resulted in a net pension liability of

$1,703 million at December 31, 2009 and $2,340 million at December 31, 2008. We

recognized these amounts in our consolidated balance sheets at December 31, 2009 and

2008 as follows:

2009 2008

(in millions)

Prepaid pension assets $ 115 $ 56

Other accrued liabilities (53) (29)

Accrued pension costs (1,765) (2,367)

$ (1,703) $ (2,340)

Certain of our U.S. and non-U.S. plans are under funded and have accumulated benefit obligations in excess of plan assets.

For these plans, the projected benefit obligations, accumulated benefit obligations and the fair value of plan assets at

December 31, 2009 and 2008 were:

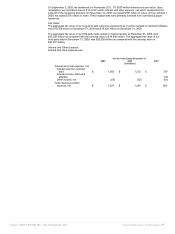

U.S. Plans Non-U.S. Plans

2009 2008 2009 2008

(in millions)

Projected benefit

obligation $ 4,666 $ 6,133 $ 3,703 $ 1,740

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠