Kraft 2009 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

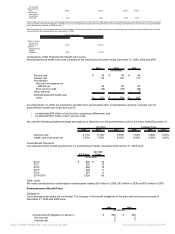

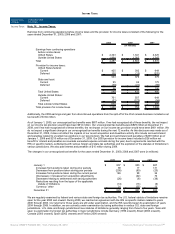

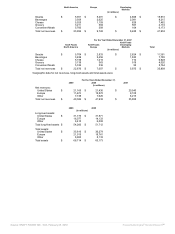

Canada & N.A. Foodservice 527 448 443

Kraft Foods Europe 785 182 455

Kraft Foods Developing Markets 936 815 588

Unrealized gains / (losses) on

hedging activities 203 (205) 16

Certain U.S. pension plan costs (165) - -

General corporate expenses (293) (304) (203)

Amortization of intangibles (26) (23) (13)

Operating income 5,524 3,843 4,176

Interest and other expense, net (1,237) (1,240) (604)

Earnings from continuing operations

before income taxes $ 4,287 $ 2,603 $ 3,572

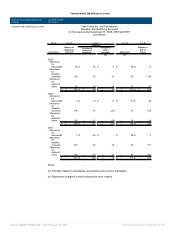

Our largest customer, Wal-Mart Stores, Inc. and its affiliates, accounted for approximately 16% of consolidated net revenues

in 2009, 16% in 2008 and 15% in 2007. These net revenues occurred primarily in the Kraft Foods North America segments.

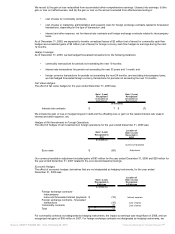

In 2009, unrealized gains on hedging activities of $203 million primarily resulted from the 2008 unrealized losses on energy

derivatives becoming realized in 2009. In 2008, unrealized losses on hedging activities of $205 million were primarily related

to energy derivatives, including heating oil (used primarily to hedge transportation costs) and natural gas contracts. In 2009,

general corporate expenses included $50 million of charges for legal matters related to certain of our European operations

(see Part I Item 3. Legal Proceedings for a description of these matters). In 2008, we recorded $72 million in charges for legal

matters related to certain of our U.S. and European operations, including U.S. coffee operations and represented the primary

reason general corporate expenses increased $101 million in 2008.

We incurred costs associated with our Cost Savings Initiatives of $318 million in 2009. These charges were recorded in

operations, primarily within the segment operating income of Kraft Foods Europe with the remainder spread across all other

segments. In 2009, we also reversed $85 million of Restructuring Program costs, with the majority relating to our Kraft Foods

Europe segment while the remainder was spread across all other segments. We incurred Restructuring Program costs of

$989 million in 2008 and $459 million in 2007. Refer to Note 6, Restructuring Costs, for a breakout of the 2008 and 2007

charges by segment. We also incurred asset impairment charges of $21 million in 2009 related to our Kraft Foods Europe

segment, $140 million in 2008 related to our Kraft Foods Europe and Kraft Foods Developing Markets segments, and $120

million in 2007 related to our U.S. Beverages segment. Refer to Note 5, Goodwill and Intangible Assets, for further details of

these charges.

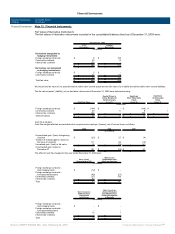

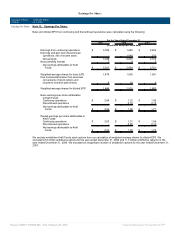

As described in Note 2, Acquisitions and Divestitures, we divested several operations, and recorded net gains / (losses) on

these divestitures in segment operating income as follows:

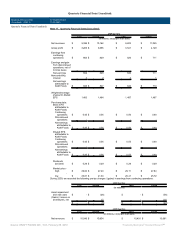

For the Years Ended December 31,

2009 2008 2007

(in millions)

Kraft Foods North

America:

U.S. Beverages $ - $ (1) $ (6)

U.S. Cheese - - -

U.S. Convenient

Meals - - -

U.S. Grocery - - -

U.S. Snacks 11 - 12

Canada & N.A.

Foodservice - - -

Kraft Foods Europe (17) (91) -

Kraft Foods

Developing Markets - - 8

Gains / (losses) on

divestitures, net $ (6) $ (92) $ 14

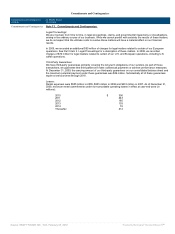

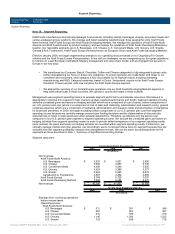

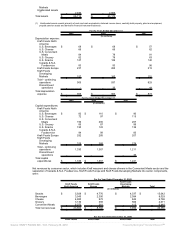

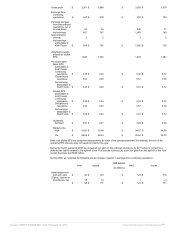

Total assets, depreciation expense and capital expenditures by segment were:

2009 2008

(in millions)

Total assets:

Kraft Foods North

America:

U.S. Beverages $ 2,382 $ 2,257

U.S. Cheese 4,589 4,599

U.S. Convenient

Meals 3,063 2,857

U.S. Grocery 5,565 5,500

U.S. Snacks 16,418 16,384

Canada & N.A.

Foodservice 5,051 4,888

Kraft Foods Europe 16,073 14,346

Kraft Foods

Developing

11,087 9,487

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠