Kraft 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

acceptances of over 90% of Cadbury shares, we are in the process of acquiring the remaining Cadbury ordinary shares that are not tendered in

the offer, including those represented by Cadbury ADSs, through a compulsory acquisition procedure under the United Kingdom Companies Act of

2006, as amended. Additionally, as a condition of the EU Commission’s approval of the Cadbury acquisition, we are required to divest

confectionary operations in Poland and Romania. As part of our acquisition of Cadbury, we expensed approximately $40 million in transaction

related fees in 2009 as we incurred them, and we also incurred $40 million in financing fees in 2009 related to the acquisition.

Pizza Divestiture:

On January 4, 2010, we entered into an agreement to sell the assets of our North American frozen pizza business (“Frozen Pizza”) to Nestlé USA,

Inc. (“Nestlé”) for total consideration of $3.7 billion. Our Frozen Pizza business is a component of our U.S. Convenient Meals and Canada & N.A.

Foodservice segments. The sale, which is subject to customary conditions, including regulatory clearances, includes the DiGiorno, Tombstone and

Jack’s brands in the U.S., the Delissio brand in Canada and the California Pizza Kitchen trademark license. It also includes two Wisconsin

manufacturing facilities (Medford and Little Chute) and the leases for the pizza depots and delivery trucks. It is estimated that approximately 3,400

of our employees will transfer with the business to Nestlé. We anticipate that the transaction will close in the first quarter of 2010.

Post Cereals Split-off:

On August 4, 2008, we completed the split-off of the Post cereals business into Ralcorp Holdings, Inc., after an exchange with our shareholders.

Accordingly, the Post cereals business prior period results were reflected as discontinued operations on the consolidated statement of earnings.

The exchange was expected to be tax-free to participating shareholders for U.S. federal income tax purposes.

In this split-off transaction, approximately 46.1 million shares of Kraft Foods Common Stock were tendered for $1,644 million. Our shareholders

had the option to exchange some or all of their shares of Kraft Foods Common Stock and receive shares of common stock of Cable Holdco, Inc.

(“Cable Holdco”). Cable Holdco was our wholly owned subsidiary that owned certain assets and liabilities of the Post cereals business. In

exchange for the contribution of the Post cereals business, Cable Holdco issued approximately $665 million in debt securities, issued shares of its

common stock and assumed a $300 million credit facility. Upon closing, we used the cash equivalent net proceeds, approximately $960 million, to

repay debt. As a result of the split-off, we recorded a gain on discontinued operations of $926 million, or $0.61 per diluted share, in 2008.

LU Biscuit Acquisition:

On November 30, 2007, we acquired the Groupe Danone S.A. global LU biscuit business (“LU Biscuit”) for €5.1 billion (approximately $7.6 billion)

in cash. The acquisition included 32 manufacturing facilities and approximately 14,000 employees. LU Biscuit reports results from operations on a

one month lag; accordingly, there was no effect on our 2007 operating results. On a proforma basis, LU Biscuit would have contributed net

revenues of $2.8 billion during 2007, and LU Biscuit’s contribution to net earnings would have been insignificant to Kraft Foods.

See Note 2, Acquisitions and Divestitures, to our consolidated financial statements for additional information on these transactions.

Customers

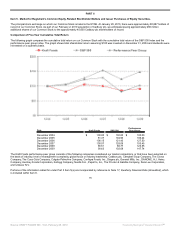

Our five largest customers accounted for approximately 27% of our net revenues in 2009 compared with 27% in 2008 and 29% in 2007. Our ten

largest customers accounted for approximately 36% of our net revenues in 2009 compared with 36% in 2008 and 40% in 2007. One of our

customers, Wal-Mart Stores, Inc., accounted for approximately 16% of our net revenues in 2009 compared with 16% in 2008 and 15% in 2007.

Seasonality

Demand for some of our products may be influenced by holidays, changes in seasons or other annual events. However, overall sales of our

products are generally evenly balanced throughout the year due to the offsetting nature of demands for our diversified product portfolio.

5

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠