Kraft 2009 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

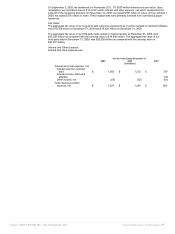

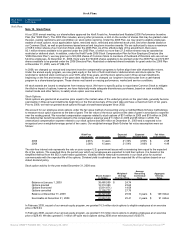

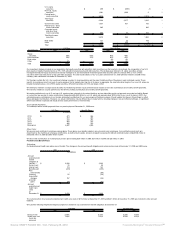

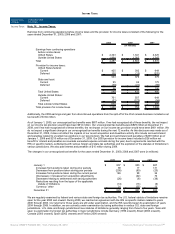

Accumulated benefit

obligation 4,166 5,464 3,478 1,664

Fair value of plan assets 3,932 4,386 2,629 1,144

We used the following weighted-average assumptions to determine our benefit obligations under the pension plans at

December 31:

U.S. Plans Non-U.S. Plans

2009 2008 2009 2008

Discount rate 5.93% 6.10% 5.21% 6.41%

Expected rate of return

on

plan assets 8.00% 8.00% 7.26% 7.25%

Rate of compensation

increase 4.00% 4.00% 3.08% 3.09%

Year-end discount rates for our U.S. and Canadian plans were developed from a model portfolio of high quality, fixed-income

debt instruments with durations that match the expected future cash flows of the benefit obligations. Year-end discount rates

for our non-U.S. plans (other than Canadian plans) were developed from local bond indices that match local benefit

obligations as closely as possible. Changes in our discount rates were primarily the result of changes in bond yields

year-over-year. We determine our expected rate of return on plan assets from the plan assets’ historical long-term investment

performance, current asset allocation and estimates of future long-term returns by asset class.

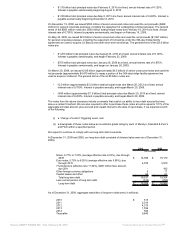

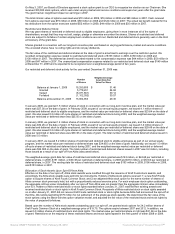

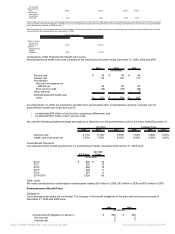

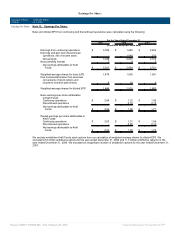

Components of Net Pension Cost:

Net pension cost consisted of the following for the years ended December 31, 2009, 2008 and 2007:

U.S. Plans Non-U.S. Plans

2009 2008 2007 2009 2008 2007

(in millions)

Service cost $ 152 $ 149 $ 159 $ 67 $ 91 $ 101

Interest cost 369 371 365 215 222 194

Expected return on plan

assets (486) (526) (523) (242) (285) (251)

Amortization:

Net loss from

experience

differences 160 85 138 23 31 66

Prior service cost 6 7 5 6 7 9

Other expenses 112 74 68 8 16 4

Net pension cost $ 313 $ 160 $ 212 $ 77 $ 82 $ 123

The following costs are included within other expenses above. Severance payments related to our Cost Savings Initiatives and

Restructuring Program, and retired employees who elected lump-sum payments resulted in settlement losses for our U.S. plans of

$107 million in 2009, $74 million in 2008 and $68 million in 2007. In addition, we incurred a $5 million curtailment charge in 2009

related to the freeze of certain of our U.S. pension plans. Non-U.S. plant closures and early retirement benefits resulted in

curtailment and settlement losses of $8 million in 2009, $16 million in 2008 and $4 million in 2007.

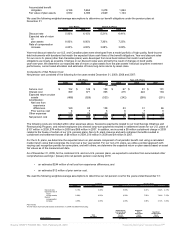

For the U.S. plans, we determine the expected return on plan assets component of net periodic benefit cost using a calculated

market return value that recognizes the cost over a four year period. For our non-U.S. plans, we utilize a similar approach with

varying cost recognition periods for some plans, and with others, we determine the expected return on plan assets based on asset

fair values as of the measurement date.

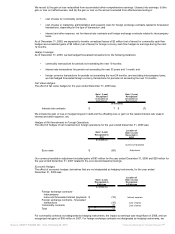

As of December 31, 2009, for the combined U.S. and non-U.S. pension plans, we expected to amortize from accumulated other

comprehensive earnings / (losses) into net periodic pension cost during 2010:

• an estimated $244 million of net loss from experience differences; and

• an estimated $12 million of prior service cost.

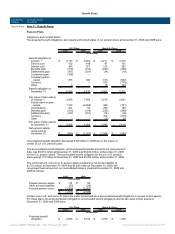

We used the following weighted-average assumptions to determine our net pension cost for the years ended December 31:

U.S. Plans Non-U.S. Plans

2009 2008 2007 2009 2008 2007

Discount rate 6.10% 6.30% 5.90% 6.41% 5.44% 4.67%

Expected rate of

return

on plan assets 8.00% 8.00% 8.00% 7.25% 7.43% 7.53%

Rate of

compensation

increase 4.00% 4.00% 4.00% 3.09% 3.13% 3.00%

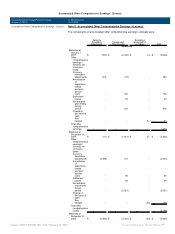

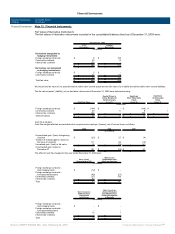

Plan Assets:

The fair value of pension plan assets at December 31, 2009 was determined using:

Asset Category

Total

Fair Value

Quoted Prices

in Active Market

for Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

(in millions)

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠