Kraft 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and trade promotion activities are recorded as a reduction to revenues based on amounts estimated as being due to customers and consumers at

the end of a period. We base these estimates principally on historical utilization and redemption rates. For interim reporting purposes, advertising

and consumer incentive expenses are charged to operations as a percentage of volume, based on estimated volume and related expense for the

full year. We do not defer costs on our year-end consolidated balance sheet and all marketing costs are recorded as an expense in the year

incurred.

Environmental Costs:

We are subject to laws and regulations relating to the protection of the environment. We accrue for environmental remediation obligations on an

undiscounted basis when amounts are probable and can be reasonably estimated. The accruals are adjusted as new information develops or

circumstances change. Recoveries of environmental remediation costs from third parties are recorded as assets when recovery of those costs is

deemed probable. At December 31, 2009, our subsidiaries were involved in 71 active actions in the U.S. under Superfund legislation (and other

similar actions) related to current operations and certain former or divested operations for which we retain liability.

Based on information currently available, we believe that the ultimate resolution of existing environmental remediation actions and our compliance

in general with environmental laws and regulations will not have a material effect on our financial results. However, we cannot quantify with

certainty the potential impact of future compliance efforts and environmental remediation actions.

Employee Benefit Plans:

In September 2006, new guidance was issued surrounding employers’ accounting for defined benefit pension and other postretirement plans. The

new guidance required us to measure plan assets and benefit obligations as of the balance sheet date beginning in 2008. We previously

measured our non-U.S. pension plans (other than certain Canadian and French pension plans) at September 30 of each year. On December 31,

2008, we recorded an after-tax decrease of $8 million to retained earnings using the 15-month approach to proportionally allocate the transition

adjustment required upon adoption of the measurement provision of the new guidance. The plan assets and benefit obligations of our pension

plans and the benefit obligations of our postretirement plans are now all measured at year-end.

We provide a range of benefits to our employees and retired employees. These include pension benefits, postretirement health care benefits and

postemployment benefits, consisting primarily of severance. We record amounts relating to these plans based on calculations specified by U.S.

GAAP. These calculations require the use of various actuarial assumptions, such as discount rates, assumed rates of return on plan assets,

compensation increases, turnover rates and health care cost trend rates. We review our actuarial assumptions on an annual basis and make

modifications to the assumptions based on current rates and trends when appropriate. As permitted by U.S. GAAP, we generally amortize any

effect of the modifications over future periods. We believe that the assumptions used in recording our plan obligations are reasonable based on

our experience and advice from our actuaries. Refer to Note 11, Benefit Plans, to the consolidated financial statements for a discussion of the

assumptions used.

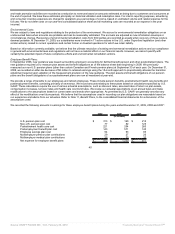

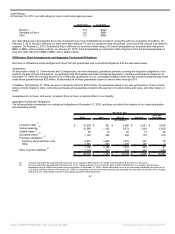

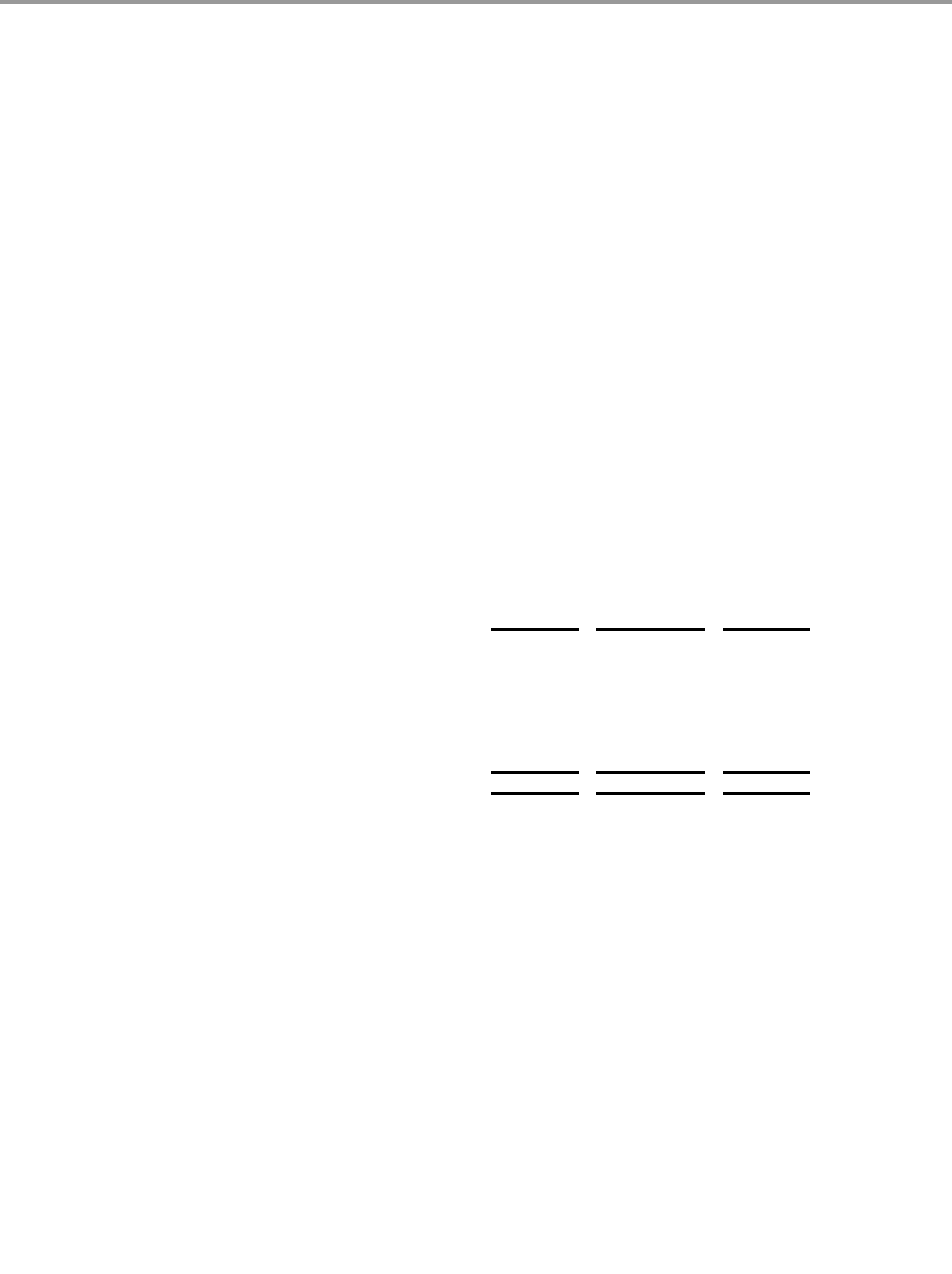

We recorded the following amounts in earnings for these employee benefit plans during the years ended December 31, 2009, 2008 and 2007:

2009 2008 2007

(in millions)

U.S. pension plan cost $ 313 $ 160 $ 212

Non-U.S. pension plan cost 77 82 123

Postretirement health care cost 221 254 260

Postemployment benefit plan cost 143 571 140

Employee savings plan cost 94 93 83

Multiemployer pension plan contributions 29 27 26

Multiemployer medical plan contributions 35 33 33

Net expense for employee benefit plans $ 912 $ 1,220 $ 877

40

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠