Kraft 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Non-GAAP Financial Measures

We use the non-U.S. GAAP financial measure “organic net revenues” and corresponding growth ratios. The difference between “organic net

revenues” and “net revenues,” which is the most comparable U.S. GAAP financial measure, is that organic net revenues excludes the impact of

acquisitions, divestitures and currency. Organic net revenues is used by our management to budget, make operating and strategic decisions and

evaluate our performance. We have disclosed this measure so that you have the same financial data that management uses with the intention of

assisting you in making comparisons to our historical operating results and analyzing our underlying performance. Our management believes that

organic net revenues better reflect the underlying growth from the ongoing activities of our business and provide improved comparability of results

because they exclude the impact of fluctuations in foreign currency exchange rates, which are not under our control, and also exclude the

one-time impacts of acquisitions and divestitures on net revenues. The limitation of this measure is that it excludes items that have an impact on

net revenues. The best way that this limitation can be addressed is by using organic net revenues in combination with our U.S. GAAP reported net

revenues. Our management believes that the presentation of this non-U.S. GAAP financial measure, when considered together with our U.S.

GAAP financial measures and the reconciliations to the corresponding U.S. GAAP financial measures, provides you with a more complete

understanding of the factors and trends affecting Kraft Foods than could be obtained absent these disclosures. Because organic net revenues

calculations may vary among other companies, the organic net revenues figures presented in the Consolidated Results of Operations section may

not be comparable with similarly titled measures of other companies. Organic net revenues are not meant to be considered in isolation or as a

substitute for U.S. GAAP financial measures. You should carefully evaluate the following table reconciling U.S. GAAP reported net revenues to

organic net revenues.

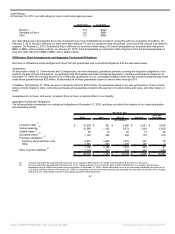

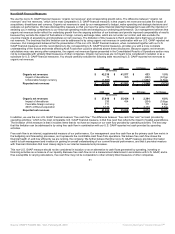

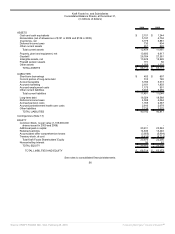

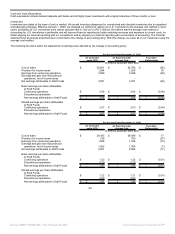

2009 2008 $ Change % Change

(in millions)

Organic net revenues $ 42,210 $ 41,577 $ 633 1.5%

Impact of divestitures 73 355 (282) (0.7)pp

Unfavorable foreign currency (1,897) - (1,897) (4.5)pp

Reported net revenues $ 40,386 $ 41,932 $ (1,546) (3.7%)

2008 2007 $Change % Change

(in millions)

Organic net revenues $ 37,818 $ 35,424 $ 2,394 6.8%

Impact of divestitures 230 434 (204) (0.8)pp

Favorable foreign currency 711 - 711 2.0pp

2007 LU Biscuit acquisition 3,173 - 3,173 8.9pp

Reported net revenues $ 41,932 $ 35,858 $ 6,074 16.9%

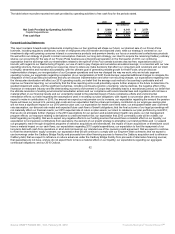

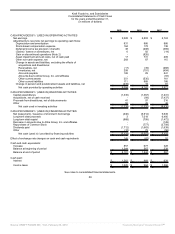

In addition, we use the non-U.S. GAAP financial measure “free cash flow.” The difference between “free cash flow” and “net cash provided by

operating activities,” which is the most comparable U.S. GAAP financial measure, is that free cash flow reflects the impact of capital expenditures.

The limitation of this measure is that it includes items that do not have an impact on our cash flow provided by operating activities. The best way

that this limitation can be addressed is by using free cash flow in combination with our U.S. GAAP reported net cash provided by operating

activities.

Free cash flow is an internal, supplemental measure of our performance. Our management uses free cash flow as the primary cash flow metric in

the budgeting and forecasting processes, as it represents the controllable cash flows from operations. We believe free cash flow shows the

financial health of, and how efficiently we are running, the company. We further believe that this non-U.S. GAAP measure provides information

useful to both management and investors in gaining an overall understanding of our current financial performance, and that it provides investors

with financial information that most closely aligns to our internal measurement processes.

This non-U.S. GAAP measure should not be considered in isolation or as an alternative to cash flows generated by operating, investing or

financing activities as a measure of our liquidity. Because free cash flow is not a measurement determined in accordance with U.S. GAAP, and is

thus susceptible to varying calculations, free cash flow may not be comparable to other similarly titled measures of other companies.

51

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠