Kraft 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

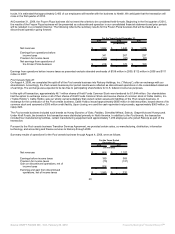

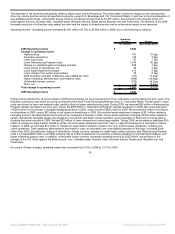

The following assets of the Post cereals business were included in the split-off (in millions):

Inventories, net $ 94

Property, plant and equipment, net 425

Goodwill 1,234

Other assets 11

Other liabilities (3)

Distributed assets of the Post cereals

business $ 1,761

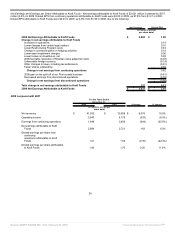

LU Biscuit Acquisition:

On November 30, 2007, we acquired the Groupe Danone S.A. global LU biscuit business (“LU Biscuit”) for € 5.1 billion (approximately $7.6 billion)

in cash. The acquisition included 32 manufacturing facilities and approximately 14,000 employees. We used borrowings of €5.1 billion to finance

this acquisition. Interest incurred on these borrowings was the primary driver of the $533 million increase in interest expense from 2007 to 2008.

LU Biscuit reports results from operations on a one month lag; accordingly, there was no effect on our 2007 operating results. On a proforma

basis, LU Biscuit would have contributed net revenues of $2.8 billion during 2007, and LU Biscuit’s contribution to net earnings would have been

insignificant to Kraft Foods.

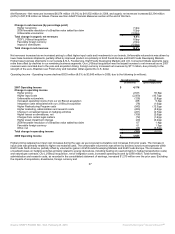

Other Divestitures:

In 2009, we received $41 million in net proceeds and recorded pre-tax losses of $6 million on the divestitures of our Balance bar operations in the

U.S., a juice operation in Brazil and a plant in Spain. We recorded after-tax gains of $58 million, or $0.04 per diluted share, on these divestitures,

primarily due to the differing book and tax bases of our Balance bar operations.

In 2008, we received $153 million in net proceeds, and recorded pre-tax losses of $92 million on divestitures, primarily related to a Nordic and

Baltic snacks operation and four operations in Spain. We recorded after-tax losses of $64 million, or $0.04 per diluted share, on these divestitures.

Included in the 2008 divestitures were the following, which were a condition of the EU Commission’s approval of our LU Biscuit acquisition:

• We divested a biscuit operation in Spain. From this divestiture, we received $86 million in net proceeds and recorded pre-tax losses of

$74 million.

• We divested another biscuit operation in Spain and a trademark in Hungary that we had previously acquired as part of the LU Biscuit

acquisition. As such, the impacts of these divestitures were reflected as adjustments to the purchase price allocations.

In 2007, we received $216 million in net proceeds and recorded pre-tax gains of $14 million on the divestitures of our hot cereal assets and

trademarks, our sugar confectionery assets in Romania and related trademarks and our flavored water and juice brand assets and related

trademarks, including Veryfine and Fruit2O. We recorded an after-tax loss of $5 million on these divestitures to reflect the differing book and tax

bases of our hot cereal assets and trademarks divestiture.

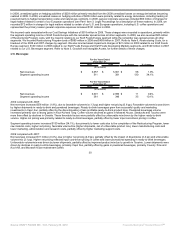

The aggregate operating results of the divestitures discussed above, other than the divestiture of the Post cereals business, were not material to

our financial statements in any of the periods presented. Refer to Note 16, Segment Reporting, for details of the gains and losses on divestitures

by segment. The net impacts to segment operating income from gains and losses on divestitures, along with resulting asset impairment charges,

are summarized in the table with the Asset Impairment Charges section below.

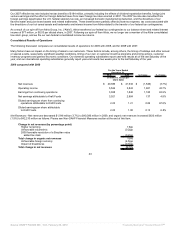

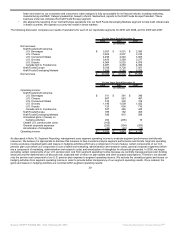

Asset Impairment Charges

In 2009, we recorded aggregate asset impairment charges of $21 million, or $0.01 per diluted share. During our 2009 review of goodwill and

non-amortizable intangible assets, we recorded a $12 million charge for the impairment of intangible assets in the Netherlands. In addition, during

2009, we recorded a $9 million asset impairment charge to write off an investment in Norway. We recorded the aggregate asset impairment

charges within asset impairment and exit costs.

21

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠