Kraft 2009 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243

|

|

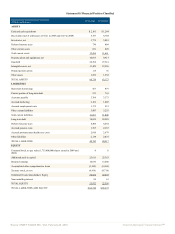

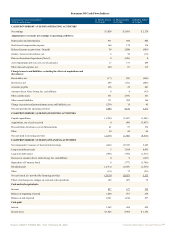

Statement Of Cash Flows Indirect

Statement Of Cash Flows Indirect

(USD $) (in Millions)

12 Months Ended

12/31/2009

12 Months Ended

12/31/2008

12 Months Ended

12/31/2007

CASH PROVIDED BY / (USED IN) OPERATING ACTIVITIES

Net earnings $ 3,028 $ 2,893 $ 2,724

Adjustments to reconcile net earnings to operating cash flows:

Depreciation and amortization 931 986 886

Stock-based compensation expense 164 178 136

Deferred income tax provision / (benefit) 38 (208) (389)

(Gains) / losses on divestitures, net 6 92 (14)

Gain on discontinued operations (Note 2) 0 (926) 0

Asset impairment and exit costs, net of cash paid 17 731 209

Other non-cash expense, net 269 87 115

Change in assets and liabilities, excluding the effects of acquisitions and

divestitures:

Receivables, net (17) (39) (268)

Inventories, net 299 (151) (404)

Accounts payable 126 29 241

Amounts due to Altria Group, Inc. and affiliates 0 0 (93)

Other current assets 351 (535) 161

Other current liabilities 111 985 186

Change in pension and postretirement assets and liabilities, net (239) 19 81

Net cash provided by operating activities 5,084 4,141 3,571

CASH PROVIDED BY / (USED IN) INVESTING ACTIVITIES

Capital expenditures (1,330) (1,367) (1,241)

Acquisitions, net of cash received 0 (99) (7,437)

Proceeds from divestitures, net of disbursements 41 97 216

Other 50 49 46

Net cash used in investing activities (1,239) (1,320) (8,416)

CASH PROVIDED BY / (USED IN) FINANCING ACTIVITIES

Net (repayment) / issuance of short-term borrowings (446) (5,912) 5,649

Long-term debt proceeds 3 7,018 6,495

Long-term debt repaid (968) (795) (1,472)

Decrease in amounts due to Altria Group, Inc. and affiliates 0 0 (149)

Repurchase of Common Stock 0 (777) (3,708)

Dividends paid (1,712) (1,663) (1,638)

Other (10) 72 (56)

Net cash (used in) / provided by financing activities (3,133) (2,057) 5,121

Effect of exchange rate changes on cash and cash equivalents 145 (87) 52

Cash and cash equivalents:

Increase 857 677 328

Balance at beginning of period 1,244 567 239

Balance at end of period 2,101 1,244 567

Cash paid:

Interest 1,262 968 628

Income taxes $ 1,025 $ 964 $ 1,366

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠