Kraft 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Morningstar® Document Research℠

FORM 10-K

KRAFT FOODS INC - KFT

Filed: February 25, 2010 (period: December 31, 2009)

Annual report which provides a comprehensive overview of the company for the past year

Table of contents

-

Page 1

Morningstar Document Research ® ℠FORM 10-K KRAFT FOODS INC - KFT Filed: February 25, 2010 (period: December 31, 2009) Annual report which provides a comprehensive overview of the company for the past year -

Page 2

... FORM 10-K [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2009 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 COMMISSION FILE NUMBER 1-16483 Kraft Foods Inc. (Exact name... -

Page 3

... Accounting Policies Commodity Trends Liquidity Off-Balance Sheet Arrangements and Aggregate Contractual Obligations Equity and Dividends Quantitative and Qualitative Disclosures about Market Risk Financial Statements and Supplementary Data Consolidated Statements of Earnings for the years ended... -

Page 4

..., U.S. Cheese, U.S. Convenient Meals, U.S. Grocery, U.S. Snacks, Canada & North America Foodservice, Kraft Foods Europe (formerly known as European Union) and Kraft Foods Developing Markets. In January 2009, we began implementing changes to our operating structure based on our Organizing For Growth... -

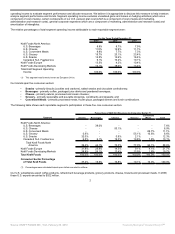

Page 5

... segment were: For the Years Ended December 31, 2008 2007 Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice (1) Kraft Foods Europe Kraft Foods Developing Markets Total Kraft Segment Operating Income (1) This segment was... -

Page 6

...N.A. Foodservice business sells primarily branded products including Maxwell House coffee, Oreo cookies, A.1. steak sauce, and a broad array of Kraft sauces, dressings and cheeses. 3 U.S. Convenient Meals Convenient Meals: U.S. Grocery Grocery: Convenient Meals: U.S. Snacks Snacks: Cheese: Canada... -

Page 7

... the closing price of $29.58 for a share of Kraft Foods Common Stock on January 15, 2010 and an exchange rate of $1.63 per £1.00) and valued the entire issued share capital of Cadbury at £11.9 billion (approximately $19.4 billion) on January 15, 2010, the last trading day before the publication of... -

Page 8

... reflected as discontinued operations on the consolidated statement of earnings. The exchange was expected to be tax-free to participating shareholders for U.S. federal income tax purposes. In this split-off transaction, approximately 46.1 million shares of Kraft Foods Common Stock were tendered for... -

Page 9

..., distributors, convenience stores, gasoline stations, drug stores, value stores and other retail food outlets. In general, the retail trade for food products is consolidating. Food products are distributed through distribution centers, satellite warehouses, company-operated and public cold-storage... -

Page 10

... coffee T-Discs and Tazo teas T-Discs for use in our Tassimo hot beverage system; Capri Sun packaged juice drinks for sale in the U.S. and Canada; Taco Bell Home Originals Mexican style food products for sale in U.S. grocery stores; and California Pizza Kitchen frozen pizzas for sale in U.S. grocery... -

Page 11

... Officer Executive Vice President, Operations and Business Services Executive Vice President and President, Kraft Foods Europe Executive Vice President, Corporate and Legal Affairs and General Counsel Executive Vice President and President, Kraft Foods International Executive Vice President, Global... -

Page 12

... appointed as Executive Vice President, Operations and Business Services effective January 1, 2008. Prior to that, he served as Executive Vice President, Global Business Services and Strategy, as Senior Vice President of Business Process Simplification and as Corporate Controller for Kraft Foods. He... -

Page 13

..., Kraft Foods Inc., Three Lakes Drive, Northfield, IL 60093. Certain of these materials may also be found in our proxy statement relating to our 2010 Annual Meeting of Shareholders. Available Information Our Internet address is www.kraftfoodscompany.com. Our Annual Reports on Form 10-K, Quarterly... -

Page 14

... products or shift our product mix to our lower margin offerings. If we are not able to maintain or improve our brand image or value proposition, it could have a material effect on our market share and our profitability. We may also need to increase spending on marketing, advertising and new product... -

Page 15

... reduce future reported earnings, potential loss of customers or key employees of acquired businesses, and indemnities and potential disputes with the buyers or sellers. Any of these activities could affect our product sales, financial condition and results of operations. 12 Source: KRAFT FOODS INC... -

Page 16

... in the equity markets or interest rates could substantially increase our pension costs and have a negative impact on our operating results and profitability. At the end of 2009, the projected benefit obligation of our defined benefit pension plans was $10.6 billion and assets were $8.9 billion... -

Page 17

... will have a material effect on our financial results. Item 4. Submission of Matters to a Vote of Security Holders. No matters were submitted to a vote of security holders during the fourth quarter of 2009. 14 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 18

... the cumulative total return on our Common Stock with the cumulative total return of the S&P 500 Index and the performance peer group index. The graph shows total shareholder return assuming $100 was invested on December 31, 2004 and dividends were reinvested on a quarterly basis. Date Kraft Foods... -

Page 19

... exercise options, and who used shares to pay the related taxes for grants of restricted and deferred stock that vested. Accordingly, these are non-cash transactions. Total Number of Shares Average Price Paid per Share October 1-31, 2009 November 1-30, 2009 December 1-31, 2009 For the Quarter Ended... -

Page 20

... Total assets Long-term debt Total debt Total long-term liabilities Total Kraft Foods Shareholders' Equity Total Equity Book value per common share outstanding Market price per Common Stock share - high / low Closing price of Common Stock at year end Price / earnings ratio at year end - Basic Price... -

Page 21

... financial statements and related notes contained in Item 8 of this Annual Report on Form 10-K. Description of the Company We manufacture and market packaged food products, including snacks, beverages, cheese, convenient meals and various packaged grocery products, in approximately 160 countries... -

Page 22

... the closing price of $29.58 for a share of Kraft Foods Common Stock on January 15, 2010 and an exchange rate of $1.63 per £1.00) and valued the entire issued share capital of Cadbury at £11.9 billion (approximately $19.4 billion) on January 15, 2010, the last trading day before the publication of... -

Page 23

... reflected as discontinued operations on the consolidated statement of earnings. The exchange was expected to be tax-free to participating shareholders for U.S. federal income tax purposes. In this split-off transaction, approximately 46.1 million shares of Kraft Foods Common Stock were tendered for... -

Page 24

...'s contribution to net earnings would have been insignificant to Kraft Foods. Other Divestitures: In 2009, we received $41 million in net proceeds and recorded pre-tax losses of $6 million on the divestitures of our Balance bar operations in the U.S., a juice operation in Brazil and a plant in Spain... -

Page 25

... 31, 2008 (in millions) 2009 Gains / (losses) & asset impairment charges on divestitures, net: 2007 Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice (1) Kraft Foods Europe Kraft Foods Developing Markets Total net impact... -

Page 26

... jurisdictions and the divestiture of our Balance bar operations in the U.S. Our 2008 effective tax rate included net tax benefits of $222 million from discrete tax events. Of the total net tax benefits, approximately $50 million related to fourth quarter corrections of state, federal and foreign... -

Page 27

... balance sheet and related interest income of $77 million, or $0.03 per diluted share, in 2007. Following our spin-off from Altria, we no longer are a member of the Altria consolidated tax return group, and we file our own federal consolidated income tax returns. Consolidated Results of Operations... -

Page 28

... 43.7% $ 5,524 Higher pricing reflected the carryover impact of 2008 pricing actions, as we recovered some of our cumulative cost increases from prior years. The favorable volume/mix was driven by strong contributions from Kraft Foods Developing Markets and U.S. Convenient Meals. The decrease in... -

Page 29

... shares outstanding Change in net earnings from continuing operations 2008 gain on the split-off of our Post cereals business Decreased earnings from discontinued operations Change in net earnings from discontinued operations Total change in net earnings attributable to Kraft Foods 2009 Net Earnings... -

Page 30

... Europe and Kraft Foods Developing Markets. Higher base business shipments in our Canada & N.A. Foodservice, Kraft Foods Developing Markets and U.S. Convenient Meals segments were more than offset by declines in our remaining business segments. Our LU Biscuit acquisition was the largest increase... -

Page 31

..., U.S. Cheese, U.S. Convenient Meals, U.S. Grocery, U.S. Snacks, Canada & N.A. Foodservice, Kraft Foods Europe (formerly known as European Union) and Kraft Foods Developing Markets. Effective January 2009, we began implementing changes to our operating structure based on our Organizing For Growth... -

Page 32

... Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Unrealized gains / (losses) on hedging activities Certain U.S. pension plan costs General corporate expenses Amortization of intangibles Operating income For the Years... -

Page 33

... by improved product mix due to growth in Tassimo. Lower shipments were driven by declines in ready-to-drink beverages, primarily Capri Sun, partially offset by gains in powdered beverages, primarily Country Time and Kool-Aid, and Maxwell House mainstream coffee. 30 Source: KRAFT FOODS INC, 10... -

Page 34

.../mix, higher manufacturing costs and higher marketing, administration and research costs. U.S. Convenient Meals For the Years Ended December 31, 2009 2008 (in millions) $ change % change Net revenues Segment operating income $ 4,496 510 $ 4,240 339 $ 256 171 6.0% 50.4% For the Years Ended... -

Page 35

...offset by higher marketing support costs and higher marketing, administration and research costs. Frozen Pizza Divestiture - On January 4, 2010, we entered into an agreement to sell the assets of our Frozen Pizza business to Nestlé for total consideration of $3.7 billion. The sale, which is subject... -

Page 36

...of Handi-Snacks ready-to-eat desserts, as well as lower shipments in pourable and spoonable salad dressings, Jell-O ready-to-eat-desserts, barbecue sauce and Cool Whip whipped topping, which were partially offset by growth in Kraft macaroni and cheese dinners. Segment operating income increased $137... -

Page 37

... and research costs, a 2007 gain on the divestiture of our hot cereal assets and trademarks and the impact of divestitures. These unfavorable variances were partially offset by higher net pricing and lower marketing support costs. Canada & N.A. Foodservice For the Years Ended December 31, 2009 2008... -

Page 38

... Program costs and higher marketing support costs. Kraft Foods Europe For the Years Ended December 31, 2009 2008 (in millions) $ change % change Net revenues Segment operating income $ 8,768 785 $ 9,728 182 $ (960) 603 (9.9%) 100.0+% For the Years Ended December 31, 2008 2007 (in millions... -

Page 39

... provides readers of our financial statements greater transparency to the total costs of our Kraft Foods Europe Reorganization. Kraft Foods Developing Markets For the Years Ended December 31, 2009 2008 (in millions) $ change % change Net revenues Segment operating income $ 7,956 936 $ 8,248... -

Page 40

... well as the accounting policies we used to prepare our consolidated financial statements. Principles of Consolidation: The consolidated financial statements include Kraft Foods, as well as our wholly owned and majority owned subsidiaries. Our domestic operating subsidiaries report year-end results... -

Page 41

... of discounted cash flows that is based on our annual strategic planning process. Estimating the fair value of individual reporting units requires us to make assumptions and estimates regarding our future plans, industry and economic conditions. For our reporting units within our Kraft Foods North... -

Page 42

... our product mix to our lower margin offerings. If we are not able to maintain or improve our brand image or value proposition, it could have a material effect on our market share and our profitability. As we primarily use a forecasted discounted cash flow model based on segment operating income... -

Page 43

... actions. Employee Benefit Plans: In September 2006, new guidance was issued surrounding employers' accounting for defined benefit pension and other postretirement plans. The new guidance required us to measure plan assets and benefit obligations as of the balance sheet date beginning in 2008... -

Page 44

... pension plans. We determine our expected rate of return on plan assets from the plan assets' historical long-term investment performance, current asset allocation and estimates of future long-term returns by asset class. We attempt to 41 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered... -

Page 45

...rate of return on plan assets on pension costs Effect of change in discount rate on postretirement health care costs $ (59) (30) (9) $ 59 $ 30 9 (24) (18) (1) $ 26 18 1 Financial Instruments: As we operate globally, we use certain financial instruments to manage our foreign currency exchange... -

Page 46

... own federal consolidated income tax returns. In July 2006, new guidance was issued which addressed accounting for the uncertainty in income taxes. We adopted the guidance effective January 1, 2007. The guidance clarified when tax benefits should be recorded in the financial statements and provided... -

Page 47

... pension plans in May and December 2009. Operating cash flows increased in 2008 from 2007 primarily due to increased earnings and working capital improvements (mainly from lower income tax payments and lower inventory levels), partially offset by increased interest paid. The increase in operating... -

Page 48

... billion in dividend payments, $777 million in Common Stock share repurchases and $795 million in repayments of long-term debt securities, primarily related to debt that matured on October 1, 2008, partially offset by $6.9 billion in proceeds from our long-term debt offerings. The net cash provided... -

Page 49

...-average term of our outstanding long-term debt was 8.4 years. On February 8, 2010, we issued $9.5 billion of senior unsecured notes at a weighted-average effective rate of 5.364% and are using the net proceeds ($9,379 million) to finance the Cadbury acquisition and for general corporate purposes... -

Page 50

... at December 31, 2009, and does not reflect the impacts of our recent acquisition and divestiture activity. Payments Due Total 2010 2011-12 (in millions) 2013-14 2015 and Thereafter Long-term debt (2) Interest expense (3) Capital leases (4) Operating leases (5) Purchase obligations: Inventory and... -

Page 51

...We paid $32.085 per share, which was the average of the high and the low price of Kraft Foods Common Stock as reported on the NYSE on March 1, 2007. This repurchase was in accordance with our spin-off agreement with Altria. Stock Plans: At our 2009 annual meeting, our shareholders approved the Kraft... -

Page 52

... upon the number of Altria stock awards outstanding at the time of our spin-off, we granted stock options for 24.2 million shares of Common Stock at a weighted-average price of $15.75. The options expire between 2007 and 49 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 53

... intangibles related to the acquisition. Over the long-term, the combined company is targeting EPS growth of 9 to 11 percent. Our results will also be affected by the sale of the assets of our Frozen Pizza business, which is expected to close in the first quarter of 2010. We also expect earnings to... -

Page 54

...way that this limitation can be addressed is by using free cash flow in combination with our U.S. GAAP reported net cash provided by operating activities. Free cash flow is an internal, supplemental measure of our performance. Our management uses free cash flow as the primary cash flow metric in the... -

Page 55

...; our long-term strategy; our intent to acquire the remaining Cadbury ordinary shares; our accounting for the sale of our Frozen Pizza business as a discontinued operation in the first quarter of 2010; our continuing expectation that the exchange with our shareholders related to the split-off of... -

Page 56

... issues, Food and Drug Administration or other regulatory actions or delays, unanticipated expenses such as litigation or legal settlement expenses, a shift in our product mix to lower margin offerings, risks from operating globally, our failure to successfully integrate the Cadbury business and tax... -

Page 57

...losses in fair value or earnings to be incurred by Kraft Foods, nor does it consider the effect of favorable changes in market rates. We cannot predict actual future movements in such market rates and do not present these VAR results to be indicative of future movements in such market rates or to be... -

Page 58

... 8. Financial Statements and Supplementary Data. Kraft Foods Inc. and Subsidiaries Consolidated Statements of Earnings for the years ended December 31, (in millions of dollars, except per share data) 2009 2008 2007 Net revenues Cost of sales Gross profit Marketing, administration and research costs... -

Page 59

... liabilities Long-term debt Deferred income taxes Accrued pension costs Accrued postretirement health care costs Other liabilities TOTAL LIABILITIES Contingencies (Note 13) EQUITY Common Stock, no par value (1,735,000,000 shares issued in 2009 and 2008) Additional paid-in capital Retained earnings... -

Page 60

... Consolidated Statements of Equity (in millions of dollars, except per share data) Kraft Foods Shareholders' Equity Accumulated Other Comprehensive Common Stock Balances at January 1, 2007 Comprehensive earnings: Net earnings Other comprehensive earnings, net of income taxes Total comprehensive... -

Page 61

... proceeds Long-term debt repaid Decrease in amounts due to Altria Group, Inc. and affiliates Repurchase of Common Stock Dividends paid Other Net cash (used in) / provided by financing activities Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents: Increase Balance... -

Page 62

... a tax-free transaction. Effective as of the close of business on March 30, 2007, all Kraft Foods shares owned by Altria were distributed to Altria's stockholders, and our separation from Altria was completed. Principles of Consolidation: The consolidated financial statements include Kraft Foods, as... -

Page 63

... line items within the statements of earnings were affected by the change in accounting policy: For the Year Ended December 31, 2009 As Computed under LIFO As Reported under Average Cost (in millions, except per share data) Favorable / (Unfavorable) Cost of sales Provision for income taxes Earnings... -

Page 64

... 0.08 The following line items within the balance sheets were affected by the change in accounting policy: December 31, 2009 As Reported under Average Cost (in millions) As Computed under LIFO Favorable / (Unfavorable) Inventories, net Deferred income tax asset Retained earnings $ 3,718 752 14... -

Page 65

... cash flows of those operations. For our reporting units within our Kraft Foods Developing Markets geographic unit, we used a risk-rated discount rate of 10.5%. Insurance and Self-Insurance: We use a combination of insurance and self-insurance for a number of risks, including workers' compensation... -

Page 66

... actions. Employee Benefit Plans: In September 2006, new guidance was issued surrounding employers' accounting for defined benefit pension and other postretirement plans. The new guidance required us to measure plan assets and benefit obligations as of the balance sheet date beginning in 2008... -

Page 67

... balance sheets as either current assets or current liabilities. Cash flows from hedging instruments are classified in the same manner as the affected hedged item in the consolidated statements of cash flows. Commodity cash flow hedges - We are exposed to price risk related to forecasted purchases... -

Page 68

... of the Altria consolidated tax return group. We file our own federal consolidated income tax returns. As a result of the spin-off, Altria transferred our federal tax contingencies to our balance sheet and related interest income of $77 million in 2007. Additionally, during 2007, Altria paid us $305... -

Page 69

...of the change in other current assets within the net cash provided by operating activities section of the consolidated statement of cash flows. In July 2006, new guidance was issued which addressed accounting for the uncertainty in income taxes. We adopted the guidance effective January 1, 2007. The... -

Page 70

... the closing price of $29.58 for a share of Kraft Foods Common Stock on January 15, 2010 and an exchange rate of $1.63 per £1.00) and valued the entire issued share capital of Cadbury at £11.9 billion (approximately $19.4 billion) on January 15, 2010, the last trading day before the publication of... -

Page 71

... reflected as discontinued operations on the consolidated statement of earnings. The exchange was expected to be tax-free to participating shareholders for U.S. federal income tax purposes. In this split-off transaction, approximately 46.1 million shares of Kraft Foods Common Stock were tendered for... -

Page 72

... of the Post cereals business, were not material to our financial statements in any of the periods presented. Refer to Note 16, Segment Reporting, for details of the gains and losses on divestitures by segment. 69 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 73

... Intangible Assets: At December 31, 2009 and 2008, goodwill by reportable segment was: 2009 (in millions) 2008 Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice (1) Kraft Foods Europe Kraft Foods Developing Markets Total... -

Page 74

...-amortizable intangible assets consist principally of brand names purchased through our acquisitions of Nabisco Holdings Corp., LU Biscuit and the Spanish and Portuguese operations of United Biscuits. Amortizable intangible assets consist primarily of trademark licenses, customer-related intangibles... -

Page 75

... to sell a cheese plant in Australia. In anticipation of divesting the juice operation in Brazil, we recorded an asset impairment charge of $13 million in the fourth quarter of 2008. The charge primarily included the write-off of associated intangible assets of $8 million and property, plant and... -

Page 76

...category management and value chain model was completed in 2009 for our Chocolate, Coffee and Cheese categories. Significant progress was made in 2009 related to the integration of our Europe Biscuits business, and we expect the integration to be completed by mid-2010. The European Principal Company... -

Page 77

... activity for the years ended December 31, 2009 and 2008 was: Asset Write-downs (in millions) Severance Other Total Liability balance, January 1, 2008 Charges Cash (spent) / received Charges against assets Currency Liability balance, December 31, 2008 Reversal of charges Cash (spent) / received... -

Page 78

... operating income as follows: For the Year Ended December 31, 2008 Restructuring Implementation Costs Costs (in millions) Total Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing... -

Page 79

... outstanding commercial paper. The general terms of the $500 million notes are: $500 million total principal notes due February 19, 2014 at a fixed, annual interest rate of 6.750%. Interest is payable semiannually, and began on February 19, 2009. 76 Source: KRAFT FOODS INC, 10-K, February 25, 2010... -

Page 80

... (effective rate 11.32%), $200 million face amount, due 2011 Other foreign currency obligations Capital leases and other Total long-term debt Less current portion of long term debt Long-term debt As of December 31, 2009, aggregate maturities of long-term debt were (in millions): 2010 2011 2012 2013... -

Page 81

...spin-off, Altria converted all of its Class B shares of Kraft Foods common stock into Class A shares of Kraft Foods common stock. Following our spin-off, we only have Class A common stock outstanding. There were no Class B common shares or preferred shares issued and outstanding at December 31, 2009... -

Page 82

... $32.085 per share, which was the average of the high and the low price of Kraft Foods Common Stock as reported on the NYSE on March 1, 2007. This repurchase was in accordance with our Altria spin-off agreement. 79 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 83

...), net of income taxes: Currency translation adjustments Amortization of experience losses and prior service costs Settlement losses Net actuarial loss arising during period Change in fair value of cash flow hedges Total other comprehensive earnings Balances at December 31, 2009 Note 10. Stock Plans... -

Page 84

...our stated dividend policy. Stock option activity for the year ended December 31, 2009 was: WeightedAverage Exercise Price Average Remaining Contractual Term Aggregate Intrinsic Value Shares Subject to Option Balance at January 1, 2009 Options granted Options exercised Options cancelled Balance at... -

Page 85

...January 2007, we issued 5.2 million shares of restricted and deferred stock to eligible employees as part of our annual equity program, and the market value per restricted or deferred share was $34.655 on the date of grant. 82 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 86

... by the value of projected forfeitures. Based upon the number of Altria stock awards outstanding upon our spin-off, we granted stock options for 24.2 million shares of Kraft Foods Common Stock at a weighted-average price of $15.75. The options expire between 2007 and 2012. In addition, we issued... -

Page 87

... our consolidated balance sheets at December 31, 2009 and 2008 as follows: 2009 (in millions) 2008 Prepaid pension assets Other accrued liabilities Accrued pension costs $ $ 84 115 (53) (1,765) (1,703) $ $ 56 (29) (2,367) (2,340) Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 88

... rate of return on plan assets from the plan assets' historical long-term investment performance, current asset allocation and estimates of future long-term returns by asset class. Components of Net Pension Cost: Net pension cost consisted of the following for the years ended December 31, 2009, 2008... -

Page 89

... would use in pricing the assets, based on the best information available, such as investment manager pricing for limited partnerships using company financial statements, relevant valuation multiples and discounted cash flow analyses. 86 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 90

... future benefit payments from our pension plans at December 31, 2009 were: U.S. Plans Non-U.S. Plans (in millions) 2010 2011 2012 2013 2014 2015-2019 $ 473 453 443 450 440 2,557 $ 246 246 253 256 260 1,419 Other Costs: We sponsor and contribute to employee savings plans. These plans cover... -

Page 91

...Year-end discount rates for our U.S. and Canadian plans were developed from a model portfolio of high quality, fixed-income debt instruments with durations that match the expected future cash flows of the benefit obligations. Changes in our U.S. and Canadian discount rates were primarily the result... -

Page 92

...years ended December 31: 2009 U.S. Plans 2008 2007 2009 Canadian Plans 2008 2007 Discount rate Health care cost trend rate 6.10% 7.00% 6.10% 7.50% 5.90% 8.00% 7.60% 9.00% 5.80% 9.00% 5.00% 8.50% Future Benefit Payments: Our estimated future benefit payments for our postretirement health care... -

Page 93

... discount rate of 6.5% in 2009 and 7.1% in 2008, an assumed ultimate annual turnover rate of 0.5% in 2009 and 2008, assumed compensation cost increases of 4.0% in 2009 and 2008, and assumed benefits as defined in the respective plans. Postemployment costs arising from actions that offer employees... -

Page 94

... 31, 2009 were determined using: Quoted Prices in Active Markets for Total Fair Value Identical Assets (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) (in millions) Foreign exchange contracts Commodity contracts Interest rate contracts Total... -

Page 95

... effect of cash flow hedges for the year ended December 31, 2009 was: Gain / (Loss) Recognized in OCI (Gain) / Loss Reclassified from AOCI into Earnings (in millions) Foreign exchange contracts intercompany loans Foreign exchange contracts forecasted transactions Commodity contracts Interest rate... -

Page 96

Fair Value Hedges: The effect of fair value hedges for the year ended December 31, 2009 was: Gain / (Loss) Recognized in Income on Derivatives Gain / (Loss) Recognized in Income on Borrowings (in millions) Interest rate contracts $ 7 $ (7) We include the gain or loss on hedged long-term debt ... -

Page 97

...million in 2008 and $433 million in 2007. As of December 31, 2009, minimum rental commitments under non-cancelable operating leases in effect at year-end were (in millions): 2010 2011 2012 2013 2014 Thereafter $ 306 243 185 103 76 212 94 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 98

... for the years ended December 31, 2009, 2008 and 2007: 2009 2008 (in millions) 2007 Earnings from continuing operations before income taxes: United States Outside United States Total Provision for income taxes: United States federal: Current Deferred State and local: Current Deferred Total United... -

Page 99

...income tax rate on pre-tax earnings differed from the U.S. federal statutory rate for the following reasons for the years ended December 31, 2009, 2008 and 2007: 2009 2008 2007 U.S. federal statutory rate Increase / (decrease) resulting from: State and local income taxes, net of federal tax benefit... -

Page 100

..., 2009 and 2008: 2009 2008 (in millions) Deferred income tax assets: Accrued postretirement and post employment benefits Accrued pension costs Other Total deferred income tax assets Valuation allowance Net deferred income tax assets Deferred income tax liabilities: Trade names Property, plant and... -

Page 101

...food products, including snacks, beverages, cheese, convenient meals and various packaged grocery products. We manage and report operating results through three geographic units: Kraft Foods North America, Kraft Foods Europe and Kraft Foods Developing Markets. We manage the operations of Kraft Foods... -

Page 102

... Accounting Policies. Segment data were: For the Years Ended December 31, 2008 2007 (in millions) 2009 Net revenues: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets... -

Page 103

... the Years Ended December 31, 2008 (in millions) 2007 Earnings from continuing operations before income taxes: Operating income: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing... -

Page 104

...financial instrument balances. For the Years Ended December 31, 2008 (in millions) 2009 2007 Depreciation expense: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Total... -

Page 105

... of Canada & N.A. Foodservice, Kraft Foods Europe and Kraft Foods Developing Markets into sector components, were: For the Year Ended December 31, 2009 Kraft Foods Kraft Foods Developing Europe Markets (in millions) Kraft Foods North America Total Snacks Beverages Cheese Grocery Convenient Meals... -

Page 106

... data: Basic EPS attributable to Kraft Foods: Continuing operations Discontinued operations Net earnings attributable to Kraft Foods Diluted EPS attributable to Kraft Foods: Continuing operations Discontinued operations Net earnings attributable to Kraft Foods Dividends declared Market price - high... -

Page 107

... Accordingly, the sum of the quarterly EPS amounts may not equal the total for the year. During the fourth quarter of 2008, we increased our gain on discontinued operations by $77 million to correct for a deferred tax liability related to the split-off of the Post cereals business. As such, our gain... -

Page 108

... in our internal control over financial reporting during the quarter ended December 31, 2009, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. 105 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 109

... registered public accounting firm, who audited and reported on the consolidated financial statements included in this report, has audited our internal control over financial reporting as of December 31, 2009. February 16, 2010 106 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 110

... Public Accounting Firm To the Board of Directors and Shareholders of Kraft Foods Inc.: In our opinion, the consolidated balance sheets and the related consolidated statements of earnings, of equity and of cash flows appearing in Item 8 present fairly, in all material respects, the financial... -

Page 111

... Management and Related Stockholder Matters. The number of shares to be issued upon exercise or vesting of awards issued under, and the number of shares remaining available for future issuance under, our equity compensation plans at December 31, 2009 were: Equity Compensation Plan Information Number... -

Page 112

...the Registrant's Current Report on Form 8-K filed with the SEC on December 22, 2009). The Registrant agrees to furnish copies of any instruments defining the rights of holders of long-term debt of the Registrant and its consolidated subsidiaries that does not exceed 10 percent of the total assets of... -

Page 113

... Statement on Form S-1/A filed with the SEC on May 2, 2001).+ Form of Employee Grantor Trust Enrollment Agreement (incorporated by reference to Exhibit 10.26 to the Annual Report on Form 10-K of Altria Group, Inc. for the year ended December 31, 1995).+ Kraft Foods Inc. 2006 Stock Compensation Plan... -

Page 114

... Report on Form 10-K for the fiscal year ended December 31, 2009, formatted in XBRL (eXtensible Business Reporting Language): (i) the Consolidated Statements of Earnings, (ii) the Consolidated Statements of Equity, (iii) the Consolidated Balance Sheets, (iv) the Consolidated Statements of Cash Flows... -

Page 115

...duly authorized. KRAFT FOODS INC. By: /s/ TIMOTHY R. MCLEVISH (Timothy R. McLevish, Executive Vice President and Chief Financial Officer) Date: February 25, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 116

... of Directors and Shareholders of Kraft Foods Inc.: Our audits of the consolidated financial statements and of the effectiveness of internal control over financial reporting referred to in our report dated February 16, 2010 appearing in the 2009 Annual Report on Form 10-K of Kraft Foods Inc. also... -

Page 117

Kraft Foods Inc. and Subsidiaries Valuation and Qualifying Accounts for the years ended December 31, 2009, 2008 and 2007 (in millions) Col. A Col. B Balance at Description Beginning of Period Charged to Costs and Expenses Col. C Additions Col. D Charged to Other Accounts (a) Deductions (b) Col. E ... -

Page 118

... City time) on the second Business Day"; (c) Section 2.09(a) is amended by deleting the phrase "upon at least three Business Day's notice" appearing in such section and replacing it with "upon at least two Business Day's notice"; and 1 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 119

...a manually executed counterpart hereof. Section 5. Applicable Law. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE SUBSTANTIVE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO CHOICE OF LAW DOCTRINES. Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 120

... Agreement or any other provision of the Credit Agreement or any document related thereto, all of which are ratified and affirmed in all respects and shall continue in full force and effect. [SIGNATURE PAGES FOLLOW] Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 121

... BRANCH, as a Lender By: /s/ T. Hallaways Name: T. Hallaways Title: Vice President By: /s/ M. Naulls Name: M. Naulls Title: A. Vice President Amendment No. 2 to Acquisition and Refinancing Bridge Credit Agreement Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 122

... /s/ Jay Cahll Name: Jay Cahll Title: Director By: THE ROYAL BANK OF SCOTLAND PLC, as a Lender By: /s/ Tracy Rahn Name: Tracy Rahn Title: Vice President Amendment No. 2 to Acquisition and Refinancing Bridge Credit Agreement Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 123

... Renaud-Franick Falce Name: Renaud-Franick Falce Title: Managing Director /s/ Scott Tricarico Name: Scott Tricarico Title: Vice President Amendment No. 2 to Acquisition and Refinancing Bridge Credit Agreement By: Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 124

... Name: Francesco Di Mario Title: FVP, Credit Manager /s/ John J. Michalisin Name: John J. Michalisin Title: First Vice President Amendment No. 2 to Acquisition and Refinancing Bridge Credit Agreement By: Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research... -

Page 125

... Title: Authorized Signatory THE BANK OF NOVA SCOTIA, as a Lender By: /s/ Paula Czach Name: Paula Czach Title: Director and Execution Head Amendment No. 2 to Acquisition and Refinancing Bridge Credit Agreement Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 126

..., as a Lender By: /s/ Padraig Matthews Name: Padraig Matthews Title: Vice President /s/ Sean Hassett Name: Sean Hassett Title: Director Amendment No. 2 to Acquisition and Refinancing Bridge Credit Agreement By: Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 127

... of the Company's businesses and increases in shareholder value. For purposes of the Plan, the following terms are defined as set forth below: (a) (b) "Annual Incentive Award" means an Incentive Award made pursuant to Section 5(a)(vi) with a Performance Cycle of one year or less. "Awards... -

Page 128

... operating profit less the cost of capital. "Exchange Act" means the Securities Exchange Act of 1934, as amended from time to time, and any successor thereto. "Fair Market Value" means, as of any given date, the mean between the highest and lowest reported sales prices of the Common Stock on the New... -

Page 129

... operating margins, productivity ratios, share price (including, but not limited to, growth measures and total shareholder return), cost control, margins, operating efficiency, market share, customer satisfaction or employee satisfaction, working capital, management development, succession planning... -

Page 130

...amended from time to time. "Prior Plan" means the Kraft Foods Inc. 2001 Performance Incentive Plan. "Restricted Period" means the period during which an Award may not be sold, assigned, transferred, pledged or otherwise encumbered. "Restricted Stock" means an Award of shares of Common Stock pursuant... -

Page 131

... or other taxes or as payment for the exercise or conversion price of an Award under the Plan will be deemed distributed for purposes of determining the maximum number of shares remaining available for delivery under the Plan. 5 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 132

... In the event of any merger, share exchange, reorganization, consolidation, recapitalization, reclassification, distribution, stock dividend, stock split, reverse stock split, split-up, spin-off, issuance of rights or warrants or other similar transaction or event affecting the Common Stock in any... -

Page 133

... payment of any outstanding Awards in cash, including, but not limited to, payment of cash in lieu of any fractional Awards, provided that any such payment shall be exempt from or comply with the requirements of Section 409A of the Code. 7 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered... -

Page 134

... Stock Option. The term of each Stock Option shall be set forth in the Award agreement, but no Stock Option shall be exercisable more than ten years after the grant date. The grant price per share of Common Stock purchasable under a Stock Option shall not be less than 100% of the Fair Market Value... -

Page 135

...are performance-based Awards that are expressed in U.S. currency or Common Stock or any combination thereof. Incentive Awards shall either be Annual Incentive Awards or Long-Term Incentive Awards. 9 (iv) (v) (vi) Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 136

...,000 shares. The total amount of any Annual Incentive Award awarded to any Participant with respect to any Performance Cycle, taking into account the cash and the Fair Market Value of any Common Stock payable with respect to such Award, shall not exceed $10,000,000. The total amount of any Long-Term... -

Page 137

... (if any) of the value of the consideration that would be received in such Change in Control by the holders of the securities of Kraft Foods Inc. relating to such Awards over the exercise or purchase price (if any) for such Awards. If and to the extent that (A) outstanding Awards are assumed or... -

Page 138

... following events: (i) Acquisition of 20% or more of the outstanding voting securities of the Company by another entity or group; excluding, however, the following: (A) (B) (C) (ii) any acquisition by the Company or any of its Affiliates; any acquisition by an employee benefit plan or related trust... -

Page 139

... may be issued under the Plan, (iii) would materially modify the requirements for participation in the Plan or (iv) must otherwise be approved by the shareholders of the Company in order to comply with applicable law or the rules of the New York Stock Exchange or, if the shares of Common Stock are... -

Page 140

... or event described in Section 4(b) of the Plan, the terms of outstanding Awards may not be amended to reduce the exercise price of outstanding Stock Options or the base price of outstanding SARs, or cancel outstanding Stock Options or SARs in exchange for cash, other Awards or Stock Options or... -

Page 141

...unfunded" status of the Plan. Section 13. General Provisions. (a) The Committee may require each person acquiring shares of Common Stock pursuant to an Award to represent to and agree with the Company in writing that such person is acquiring the shares without a view to the distribution thereof. The... -

Page 142

... the Fair Market Value of the shares of Common Stock to be withheld and delivered pursuant to this Section 13(d) to satisfy applicable withholding taxes in connection with the benefit exceed the minimum amount of taxes required to be withheld. The obligations of the Company under the Plan shall be... -

Page 143

...The Plan was approved by stockholders and became effective on May 20, 2009. No Awards shall be made after May 20, 2019, provided that any Awards granted prior to that date may extend beyond it. 17 (h) (i) Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research... -

Page 144

... 2005 PERFORMANCE INCENTIVE PLAN RESTRICTED STOCK AGREEMENT FOR KRAFT FOODS COMMON STOCK KRAFT FOODS INC., a Virginia corporation (the "Company"), hereby grants to the employee (the "Employee") named in the Award Statement (the "Award Statement") attached hereto, as of the date set forth in the... -

Page 145

... the Fair Market Value of the Common Stock received in payment of vested Restricted Shares on the date as of which the amount giving rise to the withholding requirement first became includible in the gross income of the Employee under applicable tax laws. If the Employee is covered by a Company tax... -

Page 146

..., end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for any member of the Kraft Foods Group; 3 Source: KRAFT FOODS INC, 10-K, February 25, 2010... -

Page 147

... in the Plan, or the Employees' acquisition or sale of the underlying shares of Common Stock; (m) the Employee is hereby advised to consult with the Employee's own personal tax, legal and financial advisors regarding the Employee's participation in the Plan before taking any action related to the... -

Page 148

...In the event of any merger, share exchange, reorganization, consolidation, recapitalization, reclassification, distribution, stock dividend, stock split, reverse stock split, split-up, spin-off, issuance of rights or warrants or other similar transaction or event affecting the Common Stock after the... -

Page 149

... order to comply with local law or facilitate the administration of the Plan, and to require the Employee to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing. IN WITNESS WHEREOF, this Restricted Stock Agreement has been duly executed as of KRAFT FOODS... -

Page 150

... the Kraft Foods Inc. Amended and Restated 2005 Performance Incentive Plan (the "Plan") a non-qualified stock option (the "Option"). The Option entitles the Optionee to exercise up to the aggregate number of shares set forth in the Award Statement (the "Option Shares") of the Company's Common Stock... -

Page 151

... this Option unless it has received payment in a form acceptable to the Company for all applicable Tax-Related Items, as well as amounts due the Company as "theoretical taxes" pursuant to the then-current international assignment and tax equalization policies and procedures of the Kraft Foods Group... -

Page 152

...In the event of any merger, share exchange, reorganization, consolidation, recapitalization, reclassification, distribution, stock dividend, stock split, reverse stock split, split-up, spin-off, issuance of rights or warrants or other similar transaction or event affecting the Common Stock after the... -

Page 153

...any severance, resignation, termination, redundancy, dismissal, end of service payments, bonuses, long-service awards, pension or retirement benefits or similar payments and in no event should be considered as compensation for, or relating in any way to, past services for the Company or the Employer... -

Page 154

... Kraft Foods Group, or under an employment contract with any member of the Kraft Foods Group, on or after the date specified as normal retirement age in the pension plan or employment contract, if any, under which the Optionee is at that time accruing pension benefits for his or her current service... -

Page 155

IN WITNESS WHEREOF, this Non-Qualified US Stock Option Award Agreement has been granted as of KRAFT FOODS INC. By: Carol J. Ward Vice President and Corporate Secretary 6 . Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠-

Page 156

Exhibit 10.16 KRAFT FOODS INC. CHANGE IN CONTROL PLAN ADOPTED: APRIL FOR KEY EXECUTIVES AMENDED: DECEMBER 24, 2007 31, 2009 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠-

Page 157

... following events: (A) Acquisition of 20% or more of the outstanding voting securities of the Company by another entity or group; excluding, however, the following: (1) any acquisition by the Company or any of its Affiliates; (2) any acquisition by an employee benefit plan or related trust sponsored... -

Page 158

..., directly or indirectly, more than 50% of the combined voting power of the outstanding securities entitled to vote generally in the election of directors (or similar persons) of the entity purchasing or acquiring the Company's assets in substantially the same proportions relative to each other as... -

Page 159

... of this Plan shall not be considered a Participant for the purposes of this Plan. 4 Long-Term Incentive Plan Award Target Net After-Tax Benefit Non-Competition Agreement Non-Solicitation Agreement Non-U.S. Executive Participant Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 160

Payment Any payment or distribution in the nature of compensation (within the meaning of Section 280G (b) (2) of the Code) to or for the benefit of the Participant, whether paid or payable pursuant to this Plan or otherwise. The Kraft Foods Inc. Change in Control Plan for Key Executives, as set ... -

Page 161

...annual incentive or long-term incentive opportunity as in effect immediately prior to the Change in Control; the Employer requiring the Participant to be based at any office or location other than any other location which does not extend the Participant's home to work location commute as of the time... -

Page 162

(b) Terminations which DO NOT give rise to Separation Benefits under this Plan. Notwithstanding Section 3.2(a), if a Participant's employment is terminated for Cause or Disability (as those terms are defined below) or as a result of the Participant's death, or the Participant terminates his or her ... -

Page 163

...) of any payments made to the Participant under the laws of his or her designated home country or any program or policy of the Employer in such country on account of the Participant's termination of employment. 8 (b) Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 164

...the terms and conditions of the Company's outplacement services policy as in effect immediately prior to the Change in Control, but in no event shall such outplacement services continue for more than two years after the calendar year in which the Participant terminates employment. The Employer shall... -

Page 165

... under the applicable Company non-qualified defined benefit pension plan, the Company shall credit the Participant with two (or in the case of a Participant who served as Chairman and Chief Executive Officer immediately prior to the Change in Control, three) additional years of service and shall... -

Page 166

... the benefit of the Participant. Reimbursements and payments made with regard to any Underpayment shall be made no later than December 31 of the year next following the year in which the related Excise Taxes are remitted. 11 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 167

...contest shall be limited to issues with respect to which a Gross-Up Payment would be payable hereunder and the Participant shall be entitled to settle or contest, as the case may be, any other issue raised by the Internal Revenue Service or any other taxing authority. 12 Source: KRAFT FOODS INC, 10... -

Page 168

... amount of any payment or value of any benefits hereunder be reduced by any compensation or benefits earned by a Participant as a result of employment by another employer, except as specifically provided under Section 3.3. 13 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 169

..., legal representatives and assigns) agreement to execute a general release in the form and substance to be provided by Employer, releasing the Employer, its affiliated companies and their officers, directors, agents and employees from any claims or causes of action of any kind that the Participant... -

Page 170

... The term "Company," as used in this Plan, shall mean the Company as hereinbefore defined and any successor or assignee to the business or assets which by reason hereof becomes bound by this Plan. 5. Duration, Amendment and Termination 5.1. Duration. This Plan shall remain in effect until terminated... -

Page 171

... any liability to any Participant or other person for any taxes, penalties or interest due on amounts paid or payable under the Plan, including taxes, penalties or interest imposed under Section 409A of the Code. 16 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 172

... general funds of the Employer and no special or separate fund shall be established or other segregation of assets made to assure payment. No Participant or other person shall have under any circumstances any interest in any particular property or assets of the Company or its Affiliates as a result... -

Page 173

... policies and arrangements of the Company or its Affiliates providing severance benefits, EXCEPT FOR the 2005 Performance Incentive Plan. IN WITNESS WHEREOF, the Company has caused this Plan to be executed by its duly authorized officer effective as of the Effective Date set forth above. KRAFT FOODS... -

Page 174

... of President Kraft Foods North America. The Letter is amended in the following respects, effective November 23, 2009: 1. The following new sentence is added at the end of the third paragraph of the Section entitled Other Benefits relating to severance arrangements in the event of involuntary... -

Page 175

... company based on matters covered by section 409A of the Code. Please signify your agreement with the terms of this amendment by signing this letter and returning it to my attention before November 27, 2009. Sincerely yours, /s/ David Pendleton David Pendleton Vice President Compensation Kraft Foods... -

Page 176

EXHIBIT 12.1 Kraft Foods Inc. and Subsidiaries Computation of Ratios of Earnings to Fixed Charges (in millions of dollars) Years Ended December 31, 2008 2007 2006 2009 2005 Earnings from continuing operations before income taxes Add / (Deduct): Equity in net earnings of less than 50% owned ... -

Page 177

Exhibit 21.1 Company Name State of Incorporation Country of Incorporation 152999 Canada Inc. 3072440 Nova Scotia Company AB Kraft Foods Lietuva Abades B.V. Aberdare Developments Limited Aberdare Two Developments Limited AGF Kanto, Inc. AGF SP, Inc. AGF Suzuka, Inc. Ajinomoto General Foods, Inc. ... -

Page 178

..., S.L. Kraft Canada Inc. Kraft Food Ingredients Corp. Kraft Foods (Australia) Limited Kraft Foods (Bahrain) W.L.L. Kraft Foods (Beijing) Company Limited Kraft Foods (China) Company Limited Kraft Foods (Malaysia) Sdn Bhd Kraft Foods (New Zealand) Limited Kraft Foods (Philippines), Inc. Kraft Foods... -

Page 179

...Production Holdings BVBA Kraft Foods Belgium Services BVBA Kraft Foods Biscuit Brands Kuan LLC Kraft Foods Biscuits Holdings CV Kraft Foods Bolivia S.A. Kraft Foods Brasil do Nordeste Ltda. Kraft Foods Brasil S.A. Kraft Foods Bulgaria AD Kraft Foods Caribbean Sales Corp. Kraft Foods CEEMA GmbH Kraft... -

Page 180

...Business Services Centre, s.r.o. Kraft Foods Finance Europe AG Kraft Foods Financing Luxembourg S.a.r.l. Kraft Foods France Biscuit S.A.S. Kraft Foods France Intellectual Property SAS Kraft Foods France SAS Kraft Foods Galletas S.A. Kraft Foods Global Brands LLC Kraft Foods Global Brands, Inc. Kraft... -

Page 181

... Lda. Kraft Foods Postres, S.A. Kraft Foods Production Holdings BVBA Kraft Foods Production Holdings Maatschap Kraft Foods R & D, Inc. Kraft Foods Romania SA Kraft Foods Sales Co., Ltd. Kraft Foods Schweiz GmbH Kraft Foods Schweiz Holding GmbH Kraft Foods Schweiz Production GmbH Kraft Foods Services... -

Page 182

...Sirketi Kraft Guangtong Food Company, Limited Kraft Holding, S. de R.L. de C.V. Kraft Insurance (Ireland) Limited Kraft Jacobs Suchard (Australia) Pty. Ltd. Kraft Jacobs Suchard la Vosgienne Kraft Malaysia Sdn Bhd Kraft New Services, Inc. Kraft Pizza Company Kraft Reinsurance (Ireland) Limited Kraft... -

Page 183

...Limited Nabisco Inversiones S.R.L. Nabisco Philippines, Inc. Nabisco Royal Argentina LLC Nabisco Taiwan Corporation NISA Holdings LLC NSA Holdings, L.L.C. OAO "UNITED BAKERS - Pskov" OAO Bolshevik OMFC Service Company ONKO Grossroesterei G.m.b.H. OOO Kraft Foods Rus OOO Kraft Foods Sales & Marketing... -

Page 184

... Limited Delaware Oregon New Jersey Delaware Delaware Tunisia Czech Republic Singapore Singapore Brazil Switzerland Colombia United States Venezuela United States United Kingdom United States United States China United States Jamaica China Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered... -

Page 185

...the financial statements, financial statement schedule and the effectiveness of internal control over financial reporting, which appear in this Annual Report on Form 10-K. /s/ PricewaterhouseCoopers LLP Chicago, Illinois February 25, 2010 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 186

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act... -

Page 187

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act... -

Page 188

... Foods' Annual Report on Form 10-K fairly presents in all material respects Kraft Foods' financial condition and results of operations. /s/ TIMOTHY R. MCLEVISH Timothy R. McLevish Executive Vice President and Chief Financial Officer February 25, 2010 A signed original of these written statements... -

Page 189

... Per Share Data) 12 Months Ended 12/31/2009 12 Months Ended 12/31/2008 12 Months Ended 12/31/2007 Net revenues Cost of sales Gross profit Marketing, administration and research costs Asset impairment and exit costs (Gains) / losses on divestitures, net Amortization of intangibles Operating income... -

Page 190

... liabilities Total current liabilities Long-term debt Deferred income taxes Accrued pension costs Accrued postretirement health care costs Other liabilities TOTAL LIABILITIES EQUITY Common Stock, no par value (1,735,000,000 shares issued in 2009 and 2008) Additional paid-in capital Retained earnings... -

Page 191

...Of Financial Position Classified (Parenthetical) (USD $) (in Millions except Share Data) 12/31/2009 12/31/2008 Receivables, allowances Common Stock, no par value Common Stock, shares issued $ 121 $0 $ 129 $0 1,735,000,0001,735,000,000 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 192

...of income taxes Total comprehensive earnings /(losses) Exercise of stock options and issuance of other stock awards Cash dividends declared ($1.16 per share in 2009, $1.12 per share in 2008 and $1.04 per share in 2007) Dividends paid on noncontrolling interest and other activities Ending Balances at... -

Page 193

...) Statement Of Shareholders Equity And Other Comprehensive Income (Parenthetical) (USD $) 12 Months Ended 12/31/2009 12 Months Ended 12/31/2008 12 Months Ended 12/31/2007 Cash dividends declared, per share $ 1.16 $ 1.12 $ 1.04 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 194

... proceeds Long-term debt repaid Decrease in amounts due to Altria Group, Inc. and affiliates Repurchase of Common Stock Dividends paid Other Net cash (used in) / provided by financing activities Effect of exchange rate changes on cash and cash equivalents Cash and cash equivalents: Increase Balance... -

Page 195

... a tax-free transaction. Effective as of the close of business on March 30, 2007, all Kraft Foods shares owned by Altria were distributed to Altria's stockholders, and our separation from Altria was completed. Principles of Consolidation: The consolidated financial statements include Kraft Foods, as... -

Page 196

... line items within the statements of earnings were affected by the change in accounting policy: For the Year Ended December 31, 2009 As Reported under Average Cost (in millions, except per share data) As Computed under LIFO Favorable / (Unfavorable) Cost of sales $ Provision for income taxes... -

Page 197

... Discontinued operations Net earnings attributable to Kraft Foods $ 1.22 $ 0.69 1.21 $ 0.69 1.90 $ (0.01) (0.01) $ 1.91 $ As Computed under LIFO For the Year Ended December 31, 2007 As Reported under Average Cost (in millions, except per share data) Favorable / (Unfavorable) Cost of sales... -

Page 198

... actions. Employee Benefit Plans: In September 2006, new guidance was issued surrounding employers' accounting for defined benefit pension and other postretirement plans. The new guidance required us to measure plan assets and benefit obligations as of the balance sheet date beginning in 2008... -

Page 199

... benefit plans cover most salaried and certain hourly employees. The cost of these plans is charged to expense over the working life of the covered employees. Financial Instruments: As we operate globally, we use certain financial instruments to manage our foreign currency exchange rate... -

Page 200

... of the Altria consolidated tax return group. We file our own federal consolidated income tax returns. As a result of the spin-off, Altria transferred our federal tax contingencies to our balance sheet and related interest income of $77 million in 2007. Additionally, during 2007, Altria paid us $305... -

Page 201

...of the change in other current assets within the net cash provided by operating activities section of the consolidated statement of cash flows. In July 2006, new guidance was issued which addressed accounting for the uncertainty in income taxes. We adopted the guidance effective January 1, 2007. The... -

Page 202

... the closing price of $29.58 for a share of Kraft Foods Common Stock on January 15, 2010 and an exchange rate of $1.63 per £1.00) and valued the entire issued share capital of Cadbury at £11.9 billion (approximately $19.4 billion) on January 15, 2010, the last trading day before the publication of... -

Page 203

... reflected as discontinued operations on the consolidated statement of earnings. The exchange was expected to be tax-free to participating shareholders for U.S. federal income tax purposes. In this split-off transaction, approximately 46.1 million shares of Kraft Foods Common Stock were tendered for... -

Page 204

... of the Post cereals business, were not material to our financial statements in any of the periods presented. Refer to Note 16, Segment Reporting, for details of the gains and losses on divestitures by segment. Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 205

...$) 12 Months Ended 12/31/2009 Inventories: Note 3. Inventories: Inventories at December 31, 2009 and 2008 were: 2009 (in millions) 2008 Raw materials $ Finished product Inventories, net $ 1,410 2,365 3,775 $ 1,568 2,313 $ 3,881 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 206

...492 4,231 13,872 828 19,423 (8,730) 10,693 $ $ 462 3,913 12,590 850 17,815 (7,898) 9,917 Refer to Note 5, Goodwill and Intangible Assets, for asset impairment charges taken against property, plant and equipment. Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 207

... 31, 2009 and 2008, goodwill by reportable segment was: 2009 (in millions) 2008 Goodwill and Intangible Assets: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods (1) Europe Kraft Foods Developing Markets Total... -

Page 208

... to sell a cheese plant in Australia. In anticipation of divesting the juice operation in Brazil, we recorded an asset impairment charge of $13 million in the fourth quarter of 2008. The charge primarily included the write-off of associated intangible assets of $8 million and property, plant and... -

Page 209

...category management and value chain model was completed in 2009 for our Chocolate, Coffee and Cheese categories. Significant progress was made in 2009 related to the integration of our Europe Biscuits business, and we expect the integration to be completed by mid-2010. The European Principal Company... -

Page 210

... operating income as follows: For the Year Ended December 31, 2008 Restructuring Implementation Costs Costs (in millions) Total Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing... -

Page 211

U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Total - continuing operations Discontinued operations Total $ 25 17 50 108 38 320 12 332 $ 7 15 2 44 12 127 127 $ 32 32 52 152 50 447 12 459 Source: KRAFT FOODS INC, 10-K, February 25, 2010 ... -

Page 212

...Average Year-End Rate Amount Outstanding (in millions) 2008 Average Year-End Rate Commercial paper Bank loans Total short-term borrowings $ $ 262 191 453 0.5% $ 10.5% $ 606 291 897 2.6% 13.0% The fair values of our short-term borrowings at December 31, 2009 and 2008, based upon current market... -

Page 213

... 18,024 $ 15,130 3,970 182 11 61 19,354 (765) 18,589 $ $ As of December 31, 2009, aggregate maturities of long-term debt were (in millions): 2010 2011 2012 2013 2014 Thereafter $ 513 2,014 4,373 1,556 506 9,640 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 214

... discount. On November 12, 2009, we repaid $750 million in notes, and on October 1, 2008, we repaid $700 million in notes. These repayments were primarily financed from commercial paper issuances. Fair Value: The aggregate fair value of our long-term debt, based on quoted prices in active markets... -

Page 215

.... We paid $32.085 per share, which was the average of the high and the low price of Kraft Foods Common Stock as reported on the NYSE on March 1, 2007. This repurchase was in accordance with our Altria spin-off agreement. Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar... -

Page 216

... earnings / (losses), net of income taxes: Currency translation adjustments Amortization of experience losses and prior service costs Settlement losses Net actuarial loss arising during period Change in fair value of cash flow hedges Total other comprehensive losses Balances at December 31, 2008... -

Page 217

... earnings / (losses), net of income taxes: Currency translation adjustments Amortization of experience losses and prior service costs Settlement losses Net actuarial loss arising during period Change in fair value of cash flow hedges Total other comprehensive earnings Balances at December 31, 2009... -

Page 218

...our stated dividend policy. Stock option activity for the year ended December 31, 2009 was: WeightedAverage Exercise Price Average Remaining Contractual Term Aggregate Intrinsic Value Shares Subject to Option Balance at January 1, 2009 Options granted Options exercised Options cancelled Balance at... -

Page 219

... by the value of projected forfeitures. Based upon the number of Altria stock awards outstanding upon our spin-off, we granted stock options for 24.2 million shares of Kraft Foods Common Stock at a weighted-average price of $15.75. The options expire between 2007 and 2012. In addition, we issued... -

Page 220

... and the fair value of plan assets at December 31, 2009 and 2008 were: 2009 U.S. Plans 2008 Non-U.S. Plans 2009 2008 (in millions) Projected benefit obligation $ 4,666 $ 6,133 $ 3,703 $ 1,740 Powered by Morningstar® Document Research℠Source: KRAFT FOODS INC, 10-K, February 25, 2010 -

Page 221

... rate of return on plan assets from the plan assets' historical long-term investment performance, current asset allocation and estimates of future long-term returns by asset class. Components of Net Pension Cost: Net pension cost consisted of the following for the years ended December 31, 2009, 2008... -

Page 222

... determine our postretirement benefit obligations at December 31: 2009 U.S. Plans 2008 Canadian Plans 2009 2008 Discount rate Health care cost trend rate assumed 5.70% 7.00% 6.10% 7.00% 5.25% 9.00% 7.60% 9.00% Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document... -

Page 223

...Year-end discount rates for our U.S. and Canadian plans were developed from a model portfolio of high quality, fixed-income debt instruments with durations that match the expected future cash flows of the benefit obligations. Changes in our U.S. and Canadian discount rates were primarily the result... -

Page 224

... discount rate of 6.5% in 2009 and 7.1% in 2008, an assumed ultimate annual turnover rate of 0.5% in 2009 and 2008, assumed compensation cost increases of 4.0% in 2009 and 2008, and assumed benefits as defined in the respective plans. Postemployment costs arising from actions that offer employees... -

Page 225

...(Level 3) Total Fair Value Foreign exchange contracts Commodity contracts Interest rate contracts Total derivatives $ $ (148) 20 153 25 $ $ - $ 11 11 $ (148) $ 8 153 13 $ 1 1 Cash Flow Hedges: Cash flow hedges affected accumulated other comprehensive earnings / (losses), net of income taxes... -

Page 226

... Hedges: The effect of fair value hedges for the year ended December 31, 2009 was: Gain / (Loss) Recognized in Income on Derivatives Gain / (Loss) Recognized in Income on Borrowings (in millions) Interest rate contracts $ 7 $ (7) We include the gain or loss on hedged long-term debt and the... -

Page 227

...Foreign exchange contracts intercompany loans Foreign exchange contracts forecasted transactions Commodity contracts Interest rate contracts Net investment hedge - euro notes $ 1,376 631 1,832 2,350 4,081 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research... -

Page 228

...505 million in 2008 and $433 million in 2007. As of December 31, 2009, minimum rental commitments under non-cancelable operating leases in effect at year-end were (in millions): 2010 2011 2012 2013 2014 Thereafter $ 306 243 185 103 76 212 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by... -

Page 229

... for the years ended December 31, 2009, 2008 and 2007: 2009 2008 (in millions) 2007 Earnings from continuing operations before income taxes: United States Outside United States Total Provision for income taxes: United States federal: Current Deferred State and local: Current Deferred Total United... -

Page 230

... 2008 35.0% 2.8% (1.4%) (5.2%) (1.0%) 30.2% Deferred income tax assets: Accrued postretirement and post employment benefits Accrued pension costs Other Total deferred income tax assets Valuation allowance Net deferred income tax assets Deferred income tax liabilities: Trade names Property, plant... -

Page 231

... Years Ended December 31, 2008 (in millions, except per share data) 2009 2007 Earnings from continuing operations Earnings and gain from discontinued operations, net of income taxes Net earnings Noncontrolling interest Net earnings attributable to Kraft Foods Weighted-average shares for basic EPS... -

Page 232

... Accounting Policies. Segment data were: For the Years Ended December 31, 2008 (in millions) 2009 2007 Net revenues: Kraft Foods North America: U.S. Beverages U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets... -

Page 233

... in segment operating income as follows: For the Years Ended December 31, 2008 (in millions) 2009 2007 Kraft Foods North America: U.S. Beverages $ U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe Kraft Foods Developing Markets Gains / (losses... -

Page 234

... pension assets and derivative financial instrument balances. For the Years Ended December 31, 2008 (in millions) 2009 2007 Depreciation expense: Kraft Foods North America: U.S. Beverages $ U.S. Cheese U.S. Convenient Meals U.S. Grocery U.S. Snacks Canada & N.A. Foodservice Kraft Foods Europe... -

Page 235

... 8,248 $ $ 15,910 8,215 7,462 4,172 6,173 41,932 Kraft Foods North America For the Year Ended December 31, 2007 Kraft Foods Kraft Foods Developing Europe Markets (in millions) Total Snacks Beverages Cheese Grocery Convenient Meals Total net revenues $ $ 5,704 3,499 5,199 3,138 5,336 22,876... -

Page 236

... Quarterly Financial Data (Unaudited): (USD $) 12 Months Ended 12/31/2009 Quarterly Financial Data (Unaudited): Note 17. Quarterly Financial Data (Unaudited): First 2009 Quarters Second Third (in millions, except per share data) Fourth Net revenues Gross profit Earnings from continuing operations... -

Page 237

... Accordingly, the sum of the quarterly EPS amounts may not equal the total for the year. During the fourth quarter of 2008, we increased our gain on discontinued operations by $77 million to correct for a deferred tax liability related to the split-off of the Post cereals business. As such, our gain... -

Page 238

... Ended 12/31/2009 Subsequent Events: Note 18. Subsequent Events: We evaluated subsequent events through February 16, 2010 and included all accounting and disclosure requirements related to subsequent events in our financial statements. Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered... -

Page 239

... and Qualifying Accounts Valuation and Qualifying Accounts (USD $) 12 Months Ended 12/31/2009 Valuation and Qualifying Accounts Kraft Foods Inc. and Subsidiaries Valuation and Qualifying Accounts for the years ended December 31, 2009, 2008 and 2007 (in millions) Col. A Col. B Balance at Beginning... -

Page 240

Document Information Document Information (USD $) 12 Months Ended 12/31/2009 Document Type Amendment Flag Document Period End Date 10-K false 2009-12-31 Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠-

Page 241

...29/2010 06/30/2009 Trading Symbol Entity Registrant Name Entity Central Index Key Current Fiscal Year End Date Entity Well-known Seasoned Issuer Entity Current Reporting Status Entity Voluntary Filers Entity Filer Category Entity Common Stock, Shares Outstanding Entity Public Float KFT KRAFT FOODS... -

Page 242

Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Research℠-

Page 243

_____ Created by Morningstar® Document Researchâ„ http://documentresearch.morningstar.com Source: KRAFT FOODS INC, 10-K, February 25, 2010 Powered by Morningstar® Document Researchâ„