IHOP 2010 Annual Report Download - page 98

Download and view the complete annual report

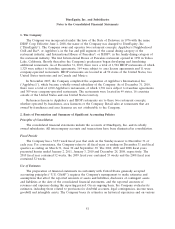

Please find page 98 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

other assumptions that are believed to be reasonable under the circumstances. Actual results could

differ from those estimates.

Concentration of Credit Risk

The Company’s cash, cash equivalents, receivables and investments are potentially subject to

concentration of credit risk. Cash, cash equivalents and investments are placed with financial

institutions that management believes are creditworthy. The Company does not believe that it is

exposed to any significant credit risk on cash and cash equivalents. At times, cash and cash equivalent

balances may be in excess of FDIC insurance limits.

Receivables are derived from revenues earned from franchisees and distributors located primarily

in the United States. The Company is subject to a concentration of credit risk with respect to

Applebee’s franchisee receivables. As of December 31, 2010, Applebee’s franchisees operated 1,553

Applebee’s restaurants in the United States (which comprised 83% of the total Applebee’s restaurants

in the United States). Of those restaurants, the nine largest Applebee’s franchisees owned 851

restaurants, representing 55% of all franchised Applebee’s restaurants in the United States. Receivables

from all Applebee’s franchisees totaled $27.0 million at December 31, 2010.

The Company maintains an allowance for doubtful accounts based upon our historical experience

taking into account current economic conditions.

Cash and Cash Equivalents

The Company considers all highly liquid investment securities with remaining maturities at the date

of purchase of three months or less to be cash equivalents. These cash equivalents are stated at cost

which approximates market value.

Restricted Assets

Restricted Cash

The Company entered into three separate securitization transactions in 2007. The proceeds

received from these transactions primarily were used to fund the acquisition of Applebee’s and to fund

certain cash accounts as required by the indentures and other agreements related to the securitization

transactions (‘‘Securitization Agreements’’). These cash accounts were to be used only for the purposes

specified in the Securitization Agreements. The Company presented these cash accounts as restricted

cash in both the current and non-current asset sections of the consolidated balance sheets while

borrowings subject to the indentures were outstanding. All obligations under the indentures were

satisfied and discharged on October 19, 2010 (see Note 8), including the maintenance of restricted cash

accounts. Restricted cash balances as of December 31, 2010 relate primarily to certain advertising

funds.

Other Restricted Assets

The Company has restricted assets related to its captive insurance subsidiary which are included in

non-current assets in the consolidated balance sheets. The captive insurance subsidiary was formed to

provide insurance coverage to Applebee’s and its franchisees. These restricted assets are primarily

investments, use of which is restricted to the payment of insurance claims.

82