IHOP 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

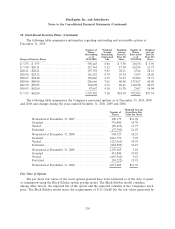

18. Stock-Based Incentive Plans (Continued)

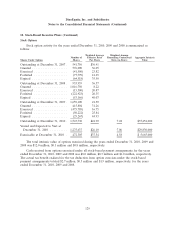

The following table summarizes information regarding outstanding and exercisable options at

December 31, 2010:

Number of Weighted Weighted Number of Weighted

Shares Average Average Shares Average

Outstanding Remaining Exercise Exercisable Exercise

as of Contractual Price Per as of Price Per

Range of Exercise Prices 12/31/2010 Life Share 12/31/2010 Share

$ 5.55 - $ 5.55 ....................... 505,445 8.04 $ 5.50 20,476 $ 5.50

$ 5.90 - $28.11 ....................... 117,364 5.13 17.30 69,234 21.73

$28.21 - $28.21 ....................... 197,352 9.03 28.21 2,364 28.21

$28.80 - $29.32 ....................... 156,152 8.74 29.24 3,833 28.80

$30.67 - $38.88 ....................... 138,066 4.75 34.25 95,066 35.71

$40.00 - $40.00 ....................... 206,666 7.01 40.00 133,167 40.00

$46.70 - $50.85 ....................... 154,698 4.76 48.41 140,198 48.27

$50.93 - $62.00 ....................... 47,967 9.18 51.78 7,967 56.04

$ 5.55 - $62.00 ....................... 1,523,710 7.28 $24.90 472,305 $37.54

The following table summarizes the Company’s nonvested options as of December 31, 2010, 2009

and 2008 and changes during the years ended December 31, 2010, 2009 and 2008:

Weighted Average

Number of Grant-Date Fair

Shares Value Per Share

Nonvested at December 31, 2007 ................. 100,175 $11.96

Granted .................................... 576,000 18.70

Vested ..................................... (89,653) 11.77

Forfeited ................................... (77,799) 21.07

Nonvested at December 31, 2008 ................. 508,723 18.23

Granted .................................... 1,016,750 5.03

Vested ..................................... (123,365) 19.95

Forfeited ................................... (222,923) 10.19

Nonvested at December 31, 2009 ................. 1,179,185 7.10

Granted .................................... 415,804 19.85

Vested ..................................... (493,362) 9.43

Forfeited ................................... (50,222) 15.91

Nonvested at December 31, 2010 ................. 1,051,405 $11.76

Fair Value of Options

The per share fair values of the stock options granted have been estimated as of the date of grant

or assumption using the Black-Scholes option pricing model. The Black-Scholes model considers,

among other factors, the expected life of the option and the expected volatility of the Company’s stock

price. The Black-Scholes model meets the requirements of U.S. GAAP but the fair values generated by

130