IHOP 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

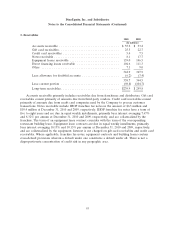

3. Receivables (Continued)

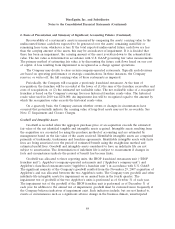

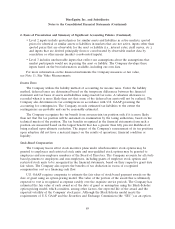

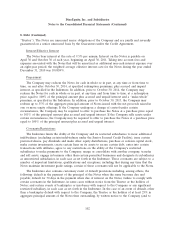

The following table summarizes the activity in the allowance for doubtful accounts:

Allowance for Doubtful Accounts (In million)

Balance at December 31, 2007 ............................... $3.0

Provision ............................................. 1.3

Charge-offs ............................................ (1.6)

Recoveries ............................................ 0.2

Balance at December 31, 2008 ............................... 2.9

Provision ............................................. 1.7

Charge-offs ............................................ (1.3)

Recoveries ............................................ 0.1

Balance at December 31, 2009 ............................... 3.4

Provision ............................................. 3.4

Charge-offs ............................................ (0.8)

Recoveries ............................................ 0.2

Balance at December 31, 2010 ............................... $6.2

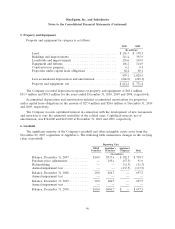

4. Assets Held For Sale

The Company classifies assets as held for sale and ceases the depreciation of the assets when there

is a plan for disposal of the assets and those assets meet the held for sale criteria as defined in

U.S. GAAP. Reacquired franchises, property and equipment and other assets held for sale are

accounted for on the specific identification basis.

Reacquired franchises

For reacquired franchises, the Company records the franchise and equipment at the lower of

(1) the sum of the franchise receivables and costs of reacquisition, or (2) the estimated net realizable

value at the reacquisition date. Pending the sale of such franchise, the carrying value is amortized

ratably over the remaining life of the asset or lease, and the estimated net realizable value is evaluated

in conjunction with our impairment evaluation of long-lived assets. There was $332,000 in reacquired

franchises and equipment included in assets held for sale at December 31, 2010 and $469,000 at

December 31, 2009.

Property and equipment

At December 31, 2009, assets held for sale primarily consisted of four parcels of land previously

intended for future restaurant development, four parcels of land on which Applebee’s franchised

restaurants are situated, the net assets of one Applebee’s restaurant expected to be sold, property and

equipment from one previously closed Applebee’s restaurant and one IHOP restaurant held for

refranchising.

94