IHOP 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional new restaurants committed, optioned or pending. The strong existing franchisee base

accounts for over 90% of these future obligations. In addition, we may take steps to consolidate and

rehabilitate existing markets if we believe that doing so is advisable in order to fully realize

development potential.

In a challenging economic environment and a highly competitive family dining category, there can

be no assurance that the strategies described above, when implemented, will achieve the intended

results within the time frame anticipated.

Significant Known Events, Trends or Uncertainties Impacting or Expected to Impact Comparisons of

Reported or Future Results

Refinancing of Indebtedness

In October 2010, we effected a series of transactions that culminated in the refinancing of our

remaining $1.6 billion of securitized indebtedness (the ‘‘October 2010 Refinancing’’) and the

redemption of our Series A Perpetual Preferred Stock (‘‘Series A Stock’’), both of which had been

issued to finance our 2007 acquisition of Applebee’s. The October 2010 Refinancing replaced

securitized debt that had an anticipated repayment date of 2012 with a $900 million Senior Secured

Credit Facility due in 2017 and $825 million of Senior Notes due in 2018. The redemption of the

Series A Stock eliminated high-coupon dividend payments on the Series A Stock that were not

deductible for tax purposes. In February 2011, we entered into an amendment that reduces the interest

rate pricing for borrowings under our Senior Secured Credit Facility. These transactions are discussed

in further detail under ‘‘Liquidity and Capital Resources’’ below.

Current Economic Conditions

While published economic data suggests both personal disposable income and consumer

confidence improved during 2010, we believe the countervailing effects of high levels of unemployment

and home foreclosures in addition to lower overall valuations for residential real estate will continue to

put pressure on consumer spending. A continued decline or lack of growth in disposable income for

discretionary spending could cause our customers to change historic purchasing behavior and choose

lower-cost dining options or alternatives to dining out. These factors could have an adverse effect on

our business, results of operations and financial condition.

Sales Trends

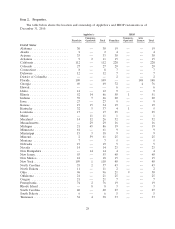

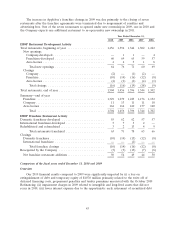

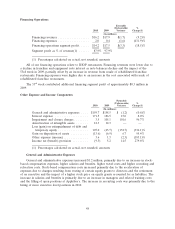

Domestic Same-Restaurant Percentage Sales Change

2009 2010

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Applebee’s

Quarter ............. (3.0)% (4.3)% (6.5)% (4.5)% (2.7)% (1.6)% 3.3% 2.9%

YTD............... (3.0)% (3.6)% (4.5)% (4.5)% (2.7)% (2.2)% (0.5)% 0.3%

IHOP

Quarter ............. 2.0% (0.6)% (1.1)% (3.1)% (0.4)% (1.0)% 0.1% 1.1%

YTD............... 2.0% 0.7% 0.2% (0.8)% (0.4)% (0.7)% (0.4)% 0.0%

Applebee’s domestic system-wide same-restaurant sales increased 2.9% and 0.3% for the fourth

quarter and year ended December 31, 2010, respectively. This marked the first year of positive

same-restaurant sales subsequent to the November 2007 acquisition of Applebee’s. Further, this was the

fifth consecutive quarter in which either the decline in same-restaurant sales was less than the decline

in the preceding quarter or, as was the case in the third and fourth quarters of 2010, reflected an

increase in same-restaurant sales. In light of the potential impact of economic uncertainties on

discretionary consumer spending, there can be no assurance that the trend of improvement and overall

positive performance will continue.

38