IHOP 2010 Annual Report Download - page 87

Download and view the complete annual report

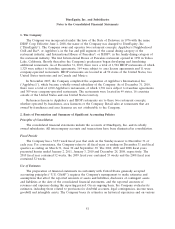

Please find page 87 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Level 2 inputs include quoted prices for similar assets and liabilities in active markets, quoted

prices for identical or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable for the asset or liability (i.e., interest rates, yield curves, etc.),

and inputs that are derived principally from or corroborated by observable market data by

correlation or other means (market corroborated inputs).

• Level 3 includes unobservable inputs that reflect our assumptions about the assumptions that

market participants would use in pricing the asset or liability. We develop these inputs based on

the best information available, including our own data.

For more information on the financial instruments the Company measures at fair value, see

Note 11, Fair Value Measurements, of Notes to the Consolidated Financial Statements.

Leases

Our restaurants are located on (i) sites owned by us, (ii) sites leased by us from third parties and

(iii) sites owned or leased by franchisees. At the inception of the lease, each property is evaluated to

determine whether the lease will be accounted for as an operating or capital lease in accordance with

the provisions of U.S. GAAP governing the accounting for leases.

The lease term used for straight-line rent expense is calculated from the date we obtain possession

of the leased premises through the lease termination date. Prior to January 2, 2006, we capitalized rent

expense from possession date through construction completion and reported the related asset in

property and equipment. Capitalized rent was amortized through depreciation and amortization

expense over the estimated useful life of the related assets limited to the lease term. Straight-line rent

recorded during the preopening period (construction completion through restaurant open date) was

recorded as expense. Commencing January 2, 2006, we expense rent from possession date through

restaurant open date. Once a restaurant opens for business, we record straight-line rent over the lease

term plus contingent rent to the extent it exceeded the minimum rent obligation per the lease

agreement. We use a consistent lease term when calculating depreciation of leasehold improvements,

when determining straight-line rent expense and when determining classification of our leases as either

operating or capital.

There is potential for variability in the rent holiday period, which begins on the possession date

and ends on the restaurant open date, during which no cash rent payments are typically due under the

terms of the lease. Factors that may affect the length of the rent holiday period generally relate to

construction related delays. Extension of the rent holiday period due to delays in restaurant opening

will result in greater preopening rent expense recognized during the rent holiday period and lesser

occupancy expense during the rest of the lease term (post-opening).

For leases that contain rent escalations, we record the total rent payable during the lease term, as

determined above, on the straight-line basis over the term of the lease (including the rent holiday

period beginning upon our possession of the premises), and record the difference between the

minimum rents paid and the straight-line rent as a lease obligation. Certain leases contain provisions

that require additional rental payments based upon restaurant sales volume (‘‘contingent rent’’).

Contingent rentals are accrued each period as the liabilities are incurred, in addition to the straight-line

rent expense noted above.

Certain of our lease agreements contain tenant improvement allowances. For purposes of

recognizing incentives, we amortize the incentives over the shorter of the estimated useful life or lease

term. For tenant improvement allowances, we also record a deferred rent liability or an obligation in

our non-current liabilities on the consolidated balance sheets.

Management makes judgments regarding the probable term for each restaurant property lease,

which can impact the classification and accounting for a lease as capital or operating, the rent holiday

71