IHOP 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

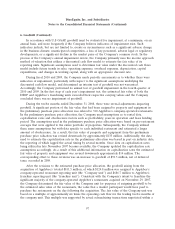

8. Debt (Continued)

‘‘Trustee’’). The Notes are unsecured senior obligations of the Company and are jointly and severally

guaranteed on a senior unsecured basis by the Guarantors under the Credit Agreement.

Interest/Effective Interest

The Notes bear interest at the rate of 9.5% per annum. Interest on the Notes is payable on

April 30 and October 30 of each year, beginning on April 30, 2011. Taking into account fees and

expenses associated with the Notes that will be amortized as additional non-cash interest expense over

an eight-year period, the weighted average effective interest rate for the Notes during the year ended

December 31, 2010 was 10.0834%.

Prepayment

The Company may redeem the Notes for cash in whole or in part, at any time or from time to

time, on and after October 30, 2014, at specified redemption premiums, plus accrued and unpaid

interest, as specified in the Indenture. In addition, prior to October 30, 2014, the Company may

redeem the Notes for cash in whole or in part, at any time and from time to time, at a redemption

price equal to 100% of the principal amount plus accrued and unpaid interest and a ‘‘make-whole’’

premium, as specified in the Indenture. In addition, prior to October 30, 2013, the Company may

redeem up to 35% of the aggregate principal amount of Notes issued with the net proceeds raised in

one or more equity offerings. If the Company undergoes a change of control under certain

circumstances, the Company may be required to offer to purchase the Notes at a purchase price equal

to 101% of the principal amount plus accrued and unpaid interest. If the Company sells assets under

certain circumstances, the Company may be required to offer to purchase the Notes at a purchase price

equal to 100% of the principal amount plus accrued and unpaid interest.

Covenants/Restrictions

The Indenture limits the ability of the Company and its restricted subsidiaries to incur additional

indebtedness (excluding certain indebtedness under the Senior Secured Credit Facility), issue certain

preferred shares, pay dividends and make other equity distributions, purchase or redeem capital stock,

make certain investments, create certain liens on its assets to secure certain debt, enter into certain

transactions with affiliates, agree to any restrictions on the ability of the Company’s restricted

subsidiaries to make payments to the Company, merge or consolidate with another company, transfer

and sell assets, engage in business other than certain permitted businesses and designate its subsidiaries

as unrestricted subsidiaries, in each case as set forth in the Indenture. These covenants are subject to a

number of important limitations, qualifications and exceptions, including that during any time that the

Notes maintain investment grade ratings, certain of these covenants will not be applicable to the Notes.

The Indenture also contains customary event of default provisions including, among others, the

following: default in the payment of the principal of the Notes when the same becomes due and

payable; default for 30 days in the payment when due of interest on the Notes; failure to comply with

certain covenants in the Indenture, in some cases without notice from the Trustee or the holders of

Notes; and certain events of bankruptcy or insolvency with respect to the Company or any significant

restricted subsidiary, in each case as set forth in the Indenture. In the case of an event of default, other

than a bankruptcy default with respect to the Company, the Trustee or the holders of at least 25% in

aggregate principal amount of the Notes then outstanding, by written notice to the Company (and to

102