IHOP 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IHOP’s domestic system-wide same-restaurant sales for the year ended December 31, 2010 were

essentially flat compared with the prior year. While domestic system-wide same-restaurant sales

increased in the third and fourth quarters in contrast to decreases in the first and second quarters, we

do not believe this constitutes a discernable trend.

Fifty-Three Week Fiscal Year

Our fiscal year ends on the Sunday nearest to December 31 of each year. As a result, every five or

six years our fiscal year contains 53 calendar weeks. Fiscal 2010 and 2008 each contained 52 weeks,

whereas fiscal 2009 contained 53 weeks. The estimated impact on fiscal 2010 of the 53rd week in fiscal

2009 was an increase in 2009 revenue of $30.2 million, an increase in segment profit of $13.2 million

and an increase in income before income taxes of $10.6 million. While certain expenses increased in

direct relationship to additional revenue from the 53rd week, other costs (for example, depreciation

and other fixed costs) are recorded on a calendar month basis. Therefore, the impact of the additional

week is not necessarily indicative of a typical relationship of expenses to revenues measured over a

longer period of comparison, such as a fiscal month or a fiscal quarter.

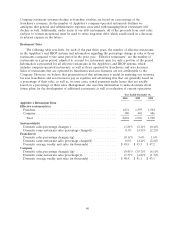

Significant Gains and Charges

There were several significant gains and charges that affect the comparisons of fiscal year 2010

results with previously reported periods, as presented in the following table:

Year ended December 31,

2010 2009 2008

(In millions)

Impairment and closure charges ................... $ 3.5 $105.1 $240.6

Loss (gain) on extinguishment of debt and temporary

equity ..................................... 107.0 (45.7) (15.2)

(Gain) loss on disposition of assets ................. (13.6) (6.9) 0.3

Each transaction is discussed in further detail under paragraphs captioned with those descriptions

elsewhere in Item 7. While impairment and closure charges in 2010 were significantly lower than in the

two previous years, our fixed and intangible assets (including goodwill) must be assessed continually for

indicators of impairment. Given the uncertainty as to future economic and other assumptions used in

assessing impairments, it is possible that significant impairment charges may occur in future periods.

Prior to the October 2010 Refinancing, our debt traded at less than its carrying value such that early

retirement by purchases on the open market resulted in significant gains. The fair value of our current

debt instruments is currently greater than its carrying value (see Note 12 of Notes to the Consolidated

Financial Statements). Therefore, while we may dedicate a portion of excess cash flow towards early

debt retirement, we do not anticipate recognizing gains on the extinguishment of debt.

Financial Statement Effect of Franchising Company-Operated Restaurants

As of December 31, 2010, we have franchised 193 Applebee’s company-operated restaurants since

the second quarter of 2008 and have signed agreements to franchise an additional 66 restaurants. The

sale of 36 restaurants in the St. Louis market closed in January 2011 and the sale of 29 of the 30

Washington, D.C. restaurants closed in February 2011 the sale of the one remaining Washington, D.C.

restaurant is expected to close before the end of the second fiscal quarter of 2011. We are planning to

franchise a significant majority of the remaining 243 company-operated Applebee’s over the next

several years. As the number of company-operated restaurants declines, the amount of Company

restaurant revenues and Company restaurant expenses in future periods will decline significantly

compared to amounts reported in previous periods. Franchise royalty revenues and expenses will likely

increase as company-operated restaurants are franchised, although not in the same magnitude as the

39